The Debt-Deflation Theory of Great Depressions Author(s): Irving Fisher Source: Econometrica, Vol. 1, No. 4 (Oct., 1933), pp. 337-357 Published by: The Econometric Society Stable URL: http://www.jstor.org/stable/1907327 Accessed: 25/03/2010 23:29

337:

THE DEBT-DEFLATION THEORY

OF GREAT DEPRESSIONS

BY IRVING FISHER

INTRODUCTORY

IN Booms and Depressions, I have developed, theoretically and sta- tistically, what may be called a debt-deflation theory of great depres- sions. In the preface, I stated that the results "seem largely new," I spoke thus cautiously because of my unfamiliarity with the vast literature on the subject. Since the book was published its special con- clusions have been widely accepted and, so far as I know, no one has yet found them anticipated by previous writers, though several, in- cluding myself, have zealously sought to find such anticipations. Two of the best-read authorities in this field assure me that those conclu- sions are, in the words of one of them, "both new and important." Partly to specify what some of these special conclusions are which are believed to be new and partly to fit them into the conclusions of other students in this field, I am offering this paper as embodying, in brief, my present "creed" on the whole subject of so-called "cycle theory." My "creed" consists of 49 "articles" some of which are old and some new. I say "creed" because, for brevity, it is purposely ex- pressed dogmatically and without proof. But it is not a creed in the sense that my faith in it does not rest on evidence and that I am not ready to modify it on presentation of new evidence. On the contrary, it is quite tentative. It may serve as a challenge to others and as raw material to help them work out a better product. Meanwhile the following is a list of my 49 tentative conclusions.

"CYCLE THEORY" IN GENERAL

1. The economic system contains innumerable variables-quantities of "goods" (physical wealth, property rights, and services), the prices of these goods, and their values (the quantities multiplied by the prices). Changes in any or all of this vast array of variables may be due to many causes. Only in imagination can all of these variables re- main constant and be kept in equilibrium by the balanced forces of human desires, as manifested through "supply and demand."

2. Economic theory includes a study both of (a) such imaginary, ideal equilibrium-which may be stable or unstable-and (b) dis- equilibrium. The former is economic statics; the latter, economic dy- namics. So-called cycle theory is merely one part of the study of eco- nomic dis-equilibrium.

3. The study of dis-equilibrium may proceed in either of two ways.

338:

We may take as our unit for study an actual historical case of great dis-equilibrium, such as, say, the panic of 1873; or we may take as our unit for study any constituent tendency, such as, say, deflation, and discover its general laws, relations to, and combinations with, other tendencies. The former study revolves around events, or facts; the latter, around tendencies. The former is primarily economic history; the latter is primarily economic science. Both sorts of studies are prop- er and important. Each helps the other. The panic of 1873 can only be understood in the light of the various tendencies involved-defla- tion and other; and deflation can only be understood in the light of the various historical manifestations-1873 and other.

4. The old and apparently still persistent notion of "the" business cycle, as a single, simple, self-generating cycle (analogous to that of a pendulum swinging under influence of the single force of gravity) and as actually realized historically in regularly recurring crises, is a myth. Instead of one force there are many forces. Specifically, instead of one cycle, there are many co-existing cycles, constantly aggravating or neutralizing each other, as well as co-existing with many non-cyclical forces. In other words, while a cycle, conceived as a fact, or historical event, is non-existent, there are always innumerable cycles, long and short, big and little, conceived as tendentcies (as well as numerous non- cyclical tendencies), any historical event being the resultant of all the tendencies then at work. Any one cycle, however perfect and like a sine curve it may tend to be, is sure to be interfered with by other tend- encies.

5. The innumerable tendencies making mostly for economic dis-equi- librium may roughly be classified under three groups: (a) growth or trend tendencies, which are steady; (b) haphazard disturbances, which are unsteady; (c) cyclical tendencies, which are unsteady but steadily repeated.

6. There are two sorts of cyclical tendencies. One is "forced" or im- posed on the economic mechanism from outside. Such is the yearly rhythm; also the daily rhythm. Both the yearly and the daily rhythm are imposed on us by astronomical forces from outside the economic organization; and there may be others such as from sun spots or transits of Venus. Other examples of "forced" cycles are the monthly and week- ly rhythms imposed on us by custom and religion. The second sort of cyclical tendency is the "free" cycle, not forced from outside, but self-generating, operating analogously to a pen- dulum or wave motion.

7. It is the "free" type of cycle which is apparently uppermost in the minds of most people when they talk of "the" business cycle. The yearly cycle, though it more nearly approaches a perfect cycle than

339:

any other, is seldom thought of as a cycle at all but referred to as 'seasonal variation."

8. There may be equilibrium which, though stable, is so delicately poised that, after departure from it beyond certain limits, instability ensues, just as, at first, a stick may bend under strain, ready all the time to bend back, until a certain point is reached, when it breaks. This simile probably applies when a debtor gets "broke,"or when the breaking of many debtors constitutes a "crash," after which there is no coming back to the original equilibrium. To take another simile, such a disaster is somewhat like the "capsizing" of a ship which, under ordinary conditions, is always near stable equilibrium but which, after being tipped beyond a certain angle, has no longer this tendency to return to equilibrium, but, instead, a tendency to depart further from it.

9. We may tentatively assume that, ordinarily and within wide limits, all, or almost all, economic variables tend, in a general way, to- ward a stable equilibrium. In our classroom expositions of supply and demand curves, we very properly assume that if the price, say, of sugar is above the point at which supply and demand are equal, it tends to fall; and if below, to rise.

10. Under such assumptions, and taking account of "economic fric- tion," which is always present, it follows that, unless some outside force intervenes, any "free" oscillations about equilibrium must tend progressively to grow smaller and smaller, just as a rocking chair set in motion tends to stop. That is, while "forced" cycles, such as season- al, tend to continue unabated in amplitude, ordinary "free" cycles tend to cease, giving way to equilibrium.

11. But the exact equilibrium thus sought is seldom reached and never long maintained. New disturbances are, humanly speaking, sure to occur, so that, in actual fact, any variable is almost always above or below the ideal equilibrium. For example, coffee in Brazil may be over-produced, that is, may be more than it would have been if the producers had known in ad- vance that it could not have been sold at a profit. Or there may be a shortage in the cotton crop. Or factory, or commercial inventories may be under or over the equilibrium point. Theoretically there may be-in fact, at most times there must be- over- or under-production, over- or under-consumption, over- or under- spending, over- or under-saving, over- or under-investment, and over or under everything else. It is as absurd to assume that, for any long period of time, the variables in the economic organization, or any part of them, will "stay put," in perfect equilibrium, as to assume that the Atlantic Ocean can ever be without a wave.

12. The important variables which may, and ordinarily do, stand

340:

above or below equilibrium are: (a) capital items, such as homes, fac- tories, ships, productive capacity generally, inventories, gold, money, credits, and debts; (b) income items, such as real income, volume of trade, shares traded; (c) price items, such as prices of securities, com- modities, interest.

13. There may even be a general over-production and in either of two senses: (a) there may be, in general, at a particular point of time, over-large inventories or stocks on hand, or (b) there may be, in gen- eral, during a particular period of time, an over-rapid flow of produc- tion. The classical notion that over-production can only be relative as between different products is erroneous. Aside from the abundance or scarcity of particular products, relative to each other, production as a whole is relative to human desires and aversions, and can as a whole overshoot or undershoot the equilibrium mark. In fact, except for brief moments, there must always be some de- gree of general over-production or general under-production and in both senses-stock and flow.

14. But, in practice, general over-production, as popularly imagined, has never, so far as I can discover, been a chief cause of great dis-equi- librium. The reason, or a reason, for the common notion of over-pro- duction is mistaking too little money for too much goods.

15. While any deviation from equilibrium of any economic variable theoretically may, and doubtless in practice does, set up some sort of oscillations, the important question is: Which of them have been suf- ficiently great disturbers to afford any substantial explanation of the great booms and depressions of history? 16. I am not sufficiently familiar with the long detailed history of these disturbances, nor with the colossal literature concerning their al- leged explanations, to have reached any definitive conclusions as to the relative importance of all the influences at work. I am eager to learn from others.

17. According to my present opinion, which is purely tentative, there is some grain of truth in most of the alleged explanations commonly offered, but this grain is often small. Any of them may suffice to ex- plain small disturbances, but all of them put together have probably been inadequate to explain big disturbances.

18. In particular, as explanations of the so-called business cycle, or cycles, when these are really serious, I doubt the adequacy of over- production, under-consumption, over-capacity, price-dislocation, mal- adjustment between agricultural and industrial prices, over-confidence, over-investment, over-saving, over-spending, and the discrepancy be- tween saving and investment.

19. I venture the opinion, subject to correction on submission of

341:

future evidence, that, in the great booms and depressions, each of the above-named factors has played a subordinate r6le as compared with two dominant factors, namely over-indebtedness to start with and de- flation following soon after; also that where any of the other factors do become conspicuous, they are often merely effects or symptoms of these two. In short, the big bad actors are debt disturbances and price- level disturbances. While quite ready to change my opinion, I have, at present, a strong conviction that these two economic maladies, the debt disease and the price-level disease (or dollar disease), are, in the great booms and de- pressions, more important causes than all others put together.

20. Some of the other and usually minor factors often derive some importance when combined with one or both of the two dominant fac- tors. Thus over-investment and over-speculation are often important; but they would have far less serious results were they not conducted with borrowed money. That is, over-indebtedness may lend importance to over-investment or to over-speculation. The same is true as to over-confidence. I fancy that over-confidence seldom does any great harm except when, as, and if, it beguiles its vic- tims into debt. Another example is the mal-adjustment between agricultural and industrial prices, which can be shown to be a result of a change in the general price level.

21. Disturbances in these two factors-debt and the purchasing pow- er of the monetary unit-will set up serious disturbances in all, or near- ly all, other economic variables. On the other hand, if debt and de- flation are absent, other disturbances are powerless to bring on crises comparable in severity to those of 1837, 1873, or 1929-33.

THE ROLES OF DEBT AND DEFLATION

22. No exhaustive list can be given of the secondary variables af- fected by the two primary ones, debt and deflation; but they include especially seven, making in all at least nine variables, as follows: debts, circulating media, their velocity of circulation, price levels, net worths, profits, trade, business confidence, interest rates.

23. The chief interrelations between the nine chief factors may be de- rived deductively, assuming, to start with, that general economic equi- librium is disturbed by only the one factor of over-indebtedness, and, in particular, assuming that there is no other influence, whether ac- cidental or designed, tending to affect the price level.

24. Assuming, accordingly, that, at some point of time, a state of over-indebtedness exists, this will tend to lead to liquidation, through

342:

the alarm either of debtors or creditors or both. Then we may deduce the following chain of consequences in nine links: (1) Debt liquidation leads to distress selling and to (2) Contraction of deposit currency, as bank loans are paid off, and to a slowing down of velocity of circula- tion. This contraction of deposits and of their velocity, precipitated by distress selling, causes (3) A fall in the level of prices, in other words, a swelling of the dollar. Assuming, as above stated, that this fall of prices is not interfered with by reflation or otherwise, there must be (4) A still greater fall in the net worths of business, precipitating bank- ruptcies and (5) A like fall in profits, which in a "capitalistic," that is, a private-profit society, leads the concerns which are running at a loss to make (6) A reduction in output, in trade and in employment of labor. These losses, bankruptcies, and unemployment, lead to (7) Pes- simism and loss of confidence, which in turn lead to (8) Hoarding and slowing down still more the velocity of circulation. The above eight changes cause (9) Complicated disturbances in the rates of interest, in particular, a fall in the nominal, or money, rates and a rise in the real, or commodity, rates of interest. Evidently debt and deflation go far toward explaining a great mass of phenomena in a very simple logical way.

25. The above chain of causes, consisting of nine links, includes only a few of the interrelations between the nine factors. There are other demonstrable interrelations, both rational and empirical, and doubtless still others which cannot, yet, at least, be formulated at all.' There must also be many indirect relations involving variables not in- cluded among the nine groups.

26. One of the most important of such interrelations (and probably too little stressed in my Booms and Depressions) is the direct effect of lessened money, deposits, and their velocity, in curtailing trade, as evidenced by the fact that trade has been revived locally by emergency money without any raising of the price level.

27. In actual chronology, the order of the nine events is somewhat different from the above "logical" order, and there are reactions and repeated effects. As stated in Appendix I of Booms and Depressions: The following table of our nine factors, occurring and recurring (together with distress selling), gives a fairly typical, though still inadequate, picture of the

1 Many of these interrelations have been shown statistically, and by many writers. Some, which I have so shown and which fit in with the debt-deflation theory, are: that price-change, after a distributed lag, causes, or is followed by, corresponding fluctuations in the volume of trade , employment, bankruptcies, and rate of interest. The results as to price-change and unemployment are con- tained in Charts II and III, pp. 352-3. See references at the end of this article; also footnote 2, page 345, regarding the charts.

343:

cross-currents of a depression in the approximate order in which it is believed they usually occur. (The first occurrence of each factor and its sub-divisions is indicated by italics. The figures in parenthesis show the sequence in the original exposition.)

I. (7) Mild Gloom and Shock to Confidence (8) Slightly Reduced Velocity of Circulation (1) Debt Liquidation

II. (9) Money Interest on Safe Loans Falls (9) But Money Interest on Unsafe Loans Rises

III. (2) Distress Selling (7) More Gloom (3) Fall in Security Prices (1) More Liquidation (3) Fall in Commodity Prices

IV. (9) Real Interest Rises; REAL DEBTS INCREASE (7) More Pessimism and Distrust (1) More Liquidation (2) More Distress Selling (8) More Reduction in Velocity

V. (2) More Distress Selling (2) Contraction of Deposit Currency (3) Further Dollar Enlargement

VI. (4) Reduction in Net Worth (4) Increase in Bankruptcies (7) More Pessimism and Distrust (8) More Slowing in Velocity (1) More Liquidation

VII. (5) Decrease in Profits (5) Increase in Losses (7) Increase in Pessimism (8) Slower Velocity (1) More Liquidation (6) Reduction in Volume of Stock Trading

VI I I. (6) Decrease in Construction (6) Reduction in Output (6) Reduction in Trade (6) Unemployment (7) More Pessimism

IX. (8) Hoarding

X. (8) Runs on Banks (8) Banks Curtailing Loans for Self-Protection (8) Banks Selling Investments (8) Bank Failures (7) Distrust Grows (8) More Hoarding (1) More Liquidation (2) More Distress Selling (3) Further Dollar Enlargement

344:

As has been stated, this order (or any order, for that matter) can be only ap- proximate and subject to variations at different times and places. It represents my present guess as to how, if not too much interfered with, the nine factors selected for explicit study in this book are likely in most cases to fall in line. But, as has also been stated, the idea of a single-line succession is itself inade- quate, for while Factor (1) acts on (2), for instance, it also acts directly on (7), so that we really need a picture of subdividing streams or, better, an interacting network in which each factor may be pictured as influencing and being influenced by many or all of the others. Paragraph 24 above gives a logical, and paragraph 27 a chronolog- ical, order of the chief variables put out of joint in a depression when once started by over-indebtedness.

28. But it should be noted that, except for the first and last in the "logical" list, namely debt and interest on debts, all the fluctuations listed come about through a fall of prices.

29. When over-indebtedness stands alone, that is, does not lead to a fall of prices, in other words, when its tendency to do so is counter- acted by inflationary forces (whether by accident or design), the re- sulting "cycle" will be far milder and far more regular.

30. Likewise, when a deflation occurs from other than debt causes and without any great volume of debt, the resulting evils are much less. It is the combination of both-the debt disease coming first, then precipitating the dollar disease-which works the greatest havoc.

31. The two diseases act and react on each other. Pathologists are now discovering that a pair of diseases are sometimes worse than either or than the mere sum of both, so to speak. And we all know that a minor disease may lead to a major one. Just as a bad cold leads to pneumonia, so over-indebtedness leads to deflation.

32. And, vice versa, deflation caused by the debt reacts on the debt. Each dollar of debt still unpaid becomes a bigger dollar, and if the over-indebtedness with which we started was great enough, the liqui- dation of debts cannot keep up with the fall of prices which it causes. In that case, the liquidation defeats itself. While it diminishes the number of dollars owed, it may not do so as fas,, as it increases the value of each dollar owed. Then, the very effort of intdividuals to lessen their burden of debts increases it, because of the mass effect of the stampede to liquidate in swelling each dollar owed. Then we have the great para- dox which, I submit, is the chief secret of most, if not all, great de- pressions: The more the debtors pay, the more they owe. The more the economic boat tips, the more it tends to tip. It is not tending to right itself, but is capsizing.

33. But if the over-indebtedness is not sufficiently great to make liquidation thus defeat itself, the situation is different and simpler. It is then more analogous to stable equilibrium; the more the boat

345:

rocks the more it will tend to right itself. In that case, we have a truer example of a cycle. 34. In the "capsizing" type in particular, the worst of it is that real incomes are so rapidly and progressively reduced. Idle men and idle machines spell lessened production and lessened real income, the cen- tral factor in all economic science. Incidentally this under-production occurs at the very time that there is the illusion of over-production.

35. In this rapid survey, I have not discussed what constitutes over- indebtedness. Suffice it here to note that (a) over-indebtedness is al- ways relative to other items, including national wealth and income and the gold supply, which last is specially important, as evidenced by the recent researches of Warren and Pearson; and (b) it is not a mere one-dimensional magnitude to be measured simply by the num- ber of dollars owed. It must also take account of the distribution in time of the sums coming due. Debts due at once are more embarras- sing than debts due years hence; and those payable at the option of the creditor, than those payable at the convenience of the debtor. Thus debt embarrassment is great for call loans and for early maturities. For practical purposes, we may roughly measure the total national debt embarrassment by taking the total sum currently due, say within the current year, including rent, taxes, interest, installments, sinking fund requirements, maturities and any other definite or rigid commit- ments for payment on principal.

ILLUSTRATED BY THE DEPRESSION OF 1929-332

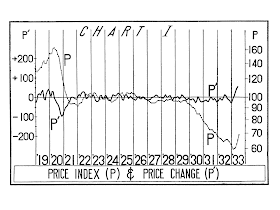

36. The depression out of which we are now (I trust) emerging is an example of a debt-deflation depression of the most serious sort. The 2 Note the charts, pp. 352-7: Chart I shows: (1) the price level (P) and (2) its percentage rate of rise or fall (P'). When the last named is lagged with the lag distributed according to a probability curve so that the various P"s overlap and cumulate we get P', as in Charts II and III.

351:

CHARTS

The following eight charts are all on the "ratio scale" excepting Charts II, III, V, VI, and curve P' of Chart I. The particular ratio scale used is indicated in each case. It will be noted that in Charts VII and VIII all curves have a common ratio scale, as indicated by the inset at the right in both charts, except "Brokers' Loans" in Chart VII and "Failures Num- bers," "Failures Liabilities," and "Shares Traded" in Chart VIII, which four curves have another, "reduced" i.e., smaller, common scale, as indicated by the inset at the left of Chart VIII. It will be further noted that "Money in Circulation," "Failures Numbers," and "Failures Liabilities" are inverted. The full details of how P' in Charts II and III is derived from P' in Chart I and also how P' in Chart I is derived from P are given in "Our Unstable Dollar and the So-Called Business Cycle," Journal of the American Statistical Association, June, 1925.

This P' is virtually a lagged average of the P"s. Charts II and III show: P' contrasted with employment (E). P' may be con- sidered as what employment would be if controlled entirely by price-change.

Chart IV shows the Swedish official (retail) weekly index number contrasted with the American weekly wholesale and monthly retail indexes.

Chart V shows the estimated internal debt in the United States contrasted with the estimated total money value of wealth. The unshaded extensions of the bars upward show what the 1933 figures would be if enlarged 75 per cent to translate them into 1929 dollars (according to the index number of wholesale commodity prices).

Chart VI shows estimated "fixed" annual charges (actually collected) con- trasted with estimated national income. The unshaded extensions of the bars upward show what the 1932 figures would be if enlarged 56 per cent to translate them into 1929 dollars. Charts VII and VIII show the chief available statistics before and after March 4, 1933, grouped in the order indicated in Article 27 above.

346:

debts of 1929 were the greatest known, both nominally and really, up to that time. They were great enough not only to "rock the boat" but to start it capsizing. By March, 1933, liquidation had reduced the debts about 20 per cent, but had increased the dollar about 75 per cent, so that the real debt, that is the debt as measured in terms of commodities, was increased about 40 per cent [(100% - 20%) X (100%+75%) =140%]. Note Chart V.

37. Unless some counteracting cause comes along to prevent the fall in the price level, such a depression as that of 1929-33 (namely when the more the debtors pay the more they owe) tends to continue, going deeper, in a vicious spiral, for many years. There is then no tendency of the boat to stop tipping until it has capsized. Ultimately, of course, but only after almost universal bankruptcy, the indebted- ness must cease to grow greater and begin to grow less. Then comes re- covery and a tendency for a new boom-depression sequence. This is the so-called "natural" way out of a depression, via needless and cruel bankruptcy, unemployment, and starvation.

38. On the other hand, if the foregoing analysis is correct, it is al- ways economically possible to stop or prevent such a depression sim- ply by reflating the price level up to the average level at which out- standing debts were contracted by existing debtors and assumed by existing creditors, and then maintaining that level unchanged. That the price level is controllable is not only claimed by monetary theorists but has recently been evidenced by two great events: (1) Sweden has now for nearly two years maintained a stable price level, practically always within 2 per cent of the chosen par and usually within 1 per cent. Note Chart IV.

(2) The fact that immediate rever- sal of deflation is easily achieved by the use, or even the prospect of use, of appropriate instrumentalities has just been demonstrated by President Roosevelt. Note Charts VII and VIII. 39. Those who imagine that Roosevelt's avowed reflation is not the cause of our recovery but that we had "reached the bottom anyway" are very much mistaken. At any rate, they have given no evidence, so far as I have seen, that we had reached the bottom. And if they are right, my analysis must be woefully wrong. According to all the evi- dence, under that analysis, debt and deflation, which had wrought havoc up to March 4, 1933, were then stronger than ever and, if let alone, would have wreaked greater wreckage than ever, after March 4. Had no "artificial respiration" been applied, we would soon have seen general bankruptcies of the mortgage guarantee companies, sav- ings banks, life insurance companies, railways, municipalities, and states.

347:

By that time the Federal Government would probably have become unable to pay its bills without resort to the printing press, which would itself have been a very belated and unfortunate case of artifi- cial respiration. If even then our rulers should still have insisted on "leaving recovery to nature" and should still have refused to inflate in any way, should vainly have tried to balance the budget and dis- charge more government employees, to raise taxes, to float, or try to float, more loans, they would soon have ceased to be our rulers. For we would have insolvency of our national government itself, and prob- ably some form of political revolution without waiting for the next legal election. The mid-west farmers had already begun to defy the law.

40. If all this is true, it would be as silly and immoral to "let nature take her course" as for a physician to neglect a case of pneumonia. It would also be a libel on economic science, which has its therapeutics as truly as medical science.

41. If reflation can now so easily and quickly reverse the deadly down-swing of deflation after nearly four years, when it was gathering increased momentum, it would have been still easier, and at any time, to have stopped it earlier. In fact, under President Hoover, recovery was apparently well started by the Federal Reserve open-market pur- chases, which revived prices and business from May to September 1932. The efforts were not kept up and recovery was stopped by va- rious circumstances, including the political "campaign of fear." It would have been still easier to have prevented the depression al- most altogether. In fact, in my opinion, this would have been done had Governor Strong of the Federal Reserve Bank of New York lived, or had his policies been embraced by other banks and the Federal Re- serve Board and pursued consistently after his death.' In that case, there would have been nothing worse than the first crash. We would have had the debt disease, but not the dollar disease-the bad cold but not the pneumonia.

42. If the debt-deflation theory of great depressions is essentially correct, the question of controlling the price level assumes a new im- portance; and those in the drivers' seats-the Federal Reserve Board and the Secretary of the Treasury, or, let us hope, a special stabili- zation commission-will in future be held to a new accountability.

43. Price level control, or dollar control, would not be a panacea. Even with an ideally stable dollar, we would still be exposed to the

3

Eventually, however, in order to have avoided depression, the gold stand- ard would have had to be abandoned or modified (by devaluation); for, with the gold standard as of 1929, the price levels at that time could not have been main- tained indefinitely in the face of: (1) the "scramble for gold" due to the continued extension of the gold standard to include nation after nation; (2) the increasing volume of trade; and (3) the prospective insufficiency of the world gold supply.

348:

debt disease, to the technological-unemployment disease, to over-pro- duction, price-dislocation, over-confidence, and many other minor dis- eases. To find the proper therapy for these diseases will keep econo- mists busy long after we have exterminated the dollar disease.

DEBT STARTERS

44. The over-indebtedness hitherto presupposed must have had its starters. It may be started by many causes, of which the most common appears to be new opportunities to invest at a big prospective profit, as compared with ordinary profits and interest, such as through new in- ventions, new industries, development of new resources, opening of new lands or new markets. Easy money is the great cause of over- borrowing. When an investor thinks he can make over 100 per cent per annum by borrowing at 6 per cent, he will be tempted to borrow, and to invest or speculate with borrowed money. This was a prime cause leading to the over-indebtedness of 1929. Inventions and tech- nological improvements created wonderful investment opportunities, and so caused big debts. Other causes were the left-over war debts, domestic and foreign, public and private, the reconstruction loans to foreigners, and the low interest policy adopted to help England get back on the gold standard in 1925. Each case of over-indebtedness has its own starter or set of starters. The chief starters of the over-indebtedness leading up to the crisis of 1837 were connected with lucrative investment opportunities from de- veloping the West and Southwest in real estate, cotton, canal building (led by the Erie Canal), steamboats, and turnpikes, opening up each side of the Appalachian Mountains to the other. For the over-indebt- edness leading up to the crisis of 1873, the chief starters were the ex- ploitation of railways and of western farms following the Homestead Act. The over-indebtedness leading up to the panic of 1893 was chief- ly relative to the gold base which had become too small, because of the injection of too much silver. But the panic of 1893 seems to have had less of the debt ingredient than in most cases, though deflation played a leading r6le. The starter may, of course, be wholly or in part the pendulum-like back-swing or reaction in recovery from a preceding depression as com- monly assumed by cycle theorists. This, of itself, would tend to leave the next depression smaller than the last. 45. When the starter consists of new opportunities to make unu- sually profitable investments, the bubble of debt tends to be blown bigger and faster than when the starter is great misfortune causing merely non-productive debts. The only notable exception is a great war and even then chiefly because it leads after it is over to productive debts for reconstruction purposes.

349:

46. This is quite different from the common naive opinions of how war results in depression. If the present interpretation is correct, the World War need never have led to a great depression. It is very true that much or most of the inflations could not have been helped because of the exigencies of governmental finance, but the subsequent undue deflations could probably have been avoided entirely. 47. The public psychology of going into debt for gain passes through several more or less distinct phases: (a) the lure of big prospective dividends or gains in income in the remote future; (b) the hope of sell- ing at a profit, and realizing a capital gain in the immediate future; (c)the vogue of reckless promotions, taking advantage of the habituation of the public to great expectations; (d) the development of downright fraud, imposing on a public which had grown credulous and gullible. When it is too late the dupes discover scandals like the Hatry, Krueg- er, and Insull scandals. At least one book has been written to prove that crises are due to frauds of clever promoters. But probably these frauds could never have become so great without the original starters of real opportunities to invest lucratively. There is probably always a very real basis for the "new era" psychology before it runs away with its victims. This was certainly the case before 1929. 48. In summary, we find that: (1) economic changes include steady trends and unsteady occasional disturbances which act as starters for cyclical oscillations of innumerable kinds; (2) among the many oc- casional disturbances, are new opportunities to invest, especially be- cause of new inventions; (3) these, with other causes, sometimes con- spire to lead to a great volume of over-indebtedness; (4) this, in turn, leads to attempts to liquidate; (5) these, in turn, lead (unless counter- acted by reflation) to falling prices or a swelling dollar; (6) the dollar may swell faster than the number of dollars owed shrinks; (7) in that case, liquidation does not really liquidate but actually aggravates the debts, and the depression grows worse instead of better, as indicated by all nine factors; (8) the ways out are either via laissez faire (bank- ruptcy) or scientific medication (reflation), and reflation might just as well have been applied in the first place. 49. The general correctness of the above "debt-deflation theory of great depressions" is, I believe, evidenced by experience in the present and previous great depressions. Future studies by others will doubt- less check up on this opinion. One way is to compare different coun- tries simultaneously. If the "debt-deflation theory" is correct, the in- fectiousness of depressions internationally is chiefly due to a common gold (or other) monetary standard and there should be found little tendency for a depression to pass from a deflating to an inflating, or stabilizing, country.

350:

SOME NEW FEATURES

As stated at the outset, several features of the above analysis are, as far as I know, new. Some of these are too unimportant or self-evi- dent to stress. The one (No. 32 above; also 36) which I do venture to stress most is the theory that when over-indebtedness is so great as to depress prices faster than liquidation, the mass effort to get out of debt sinks us more deeply into debt.4 I would also like to emphasize the whole logical articulation of the nine factors, of which debt and de- flation are the two chief (Nos. 23, 24, and 28, above). I would call attention to new investment opportunities as the important "starter" of over-indebtedness (Nos. 44, 45). Finally, I would emphasize the im- portant corollary, of the debt-deflation theory, that great depressions are curable and preventable through reflation and stabilization (Nos. 38-42).

Yale University

4This interaction between liquidation and deflation did not occur to me until 1931, although, with others, I had since 1909 been stressing the fact that deflation tended toward depression and inflation toward a boom. This debt-deflation theory was first stated in my lectures at Yale in 1931, and first stated publicly before the American Association for the Advancement of Science, on January 1, 1932. It is fully set forth in my Booms and Depressions, 1932, and some special features of my general views on cycle theory in "Business Cycles as Facts or Tendencies" in Economische Opstellen Aangeboden aan Prof. C. A. Verrijn Stuart, Haarlem, 1931. Certain sorts of disequilibrium are discussed in other writings. The role of the lag between real and nominal interest is dis- cussed in The Purchasing Power of Money, Macmillan, New York, 1911; and more fully in The Theory of Interest, Macmillan, New York, 1930, as well as the effects of inequality of foresight. Some statistical verification will be found in "Our Unstable Dollar and the So-called Business Cycle," Journal of the Ameri- can Statistical Association, June, 1925, pp. 179-202, and "The Relation of Em- ployment to the Price Level" (address given before a section of the American Association for the Advancement of Science, Atlantic City, N. J., December 28, 1932, and later published in Stabilization of Employment, edited by Charles F. Roos, The Principia Press, Inc., Bloomingdale, Ind., 1933, pp. 152-159). See Charts 1, 11, III. Some statistical verification will be found in The Stock Market Crash and After, Macmillan, New York, 1930. A selected bibliography of the writings of others is given in Appendix III of Booms and Depressions, Adelphi Company, New York, 1932. This bibliography omitted Veblen's Theory of Business Enterprise, Charles Scribner's Sons, New York, 1904, Chapter vii of which, Professor Wesley C. Mitchell points out, probably comes nearest to the debt-deflation theory. Hawtrey's writings seem the next nearest. Professor Alvin H. Hansen informs me that Professor Paxson, of the American History Department of the University of Wisconsin, in a course on the History of the West some twenty years ago, stressed the debt factor and its relation to deflation. But, so far as I know, no one hitherto has pointed out how debt liquidation defeats itself via deflation nor several other features of the present "creed." If any clear-cut anticipation exists, it can never have been prominently set forth, for even the word "debt" is missing in the indexes of the treatises on the subject.

351:

CHARTS

The following eight charts are all on the "ratio scale" excepting Charts II, III, V, VI, and curve P' of Chart I. The particular ratio scale used is indicated in each case. It will be noted that in Charts VII and VIII all curves have a common ratio scale, as indicated by the inset at the right in both charts, except "Brokers' Loans" in Chart VII and "Failures Num- bers," "Failures Liabilities," and "Shares Traded" in Chart VIII, which four curves have another, "reduced" i.e., smaller, common scale, as indicated by the inset at the left of Chart VIII. It will be further noted that "Money in Circulation," "Failures Numbers," and "Failures Liabilities" are inverted. The full details of how P' in Charts II and III is derived from P' in Chart I and also how P' in Chart I is derived from P are given in "Our Unstable Dollar and the So-Called Business Cycle," Journal of the American Statistical Association, June, 1925.

0 件のコメント:

コメントを投稿