( 経済学、リンク::::::::::)

ジョン・ロー、カンティロン、ナイト他、経済表or循環図

http://nam-students.blogspot.com/2015/09/blog-post_31.html(本頁) カンティロン効果 https://nam-students.blogspot.com/2019/05/blog-post_21.html フランク・ナイト1921 https://freeassociations2020.blogspot.com/2020/07/grown-revolutionary-socialism-may-be.html https://ja.wikipedia.org/wiki/%E3%83%95%E3%83%A9%E3%83%B3%E3%82%AF%E3%83%BB%E3%83%8A%E3%82%A4%E3%83%88 市場主義のたそがれ 新自由主義の光と影 (中公新書) Kindle版 2009根井雅弘 (著)

https://www.amazon.co.jp/dp/B00LMB0KFQ/ ナイトが紹介、考察されている

サミュエルソンからマンキューへ:経済循環図考

http://nam-students.blogspot.com/2015/09/blog-post_23.html

NAMs出版プロジェクト: サミュエルソン 国民所得にかんする循環的流れの図

http://nam-students.blogspot.jp/2015/09/blog-post_25.html

NAMs出版プロジェクト: マンキューマクロよりhttp://nam-students.blogspot.jp/2015/09/blog-post_21.html AD-AS曲線(『らくらくマクロ経済学入門』より)

http://nam-students.blogspot.jp/2015/09/ad-as.html NAMs出版プロジェクト: フロー循環図

http://nam-students.blogspot.jp/2015/08/blog-post_38.html

ナイト 経済組織1933原著kindle (後述) https://www.amazon.co.jp/dp/B087JB15VC/

https://ja.wikipedia.org/wiki/%E3%83%95%E3%83%A9%E3%83%B3%E3%82%AF%E3%83%BB%E3%83%8A%E3%82%A4%E3%83%88

http://nam-students.blogspot.com/2015/09/blog-post_31.html(本頁)

https://www.amazon.co.jp/dp/B00LMB0KFQ/ ナイトが紹介、考察されている

サミュエルソンからマンキューへ:経済循環図考

http://nam-students.blogspot.com/2015/09/blog-post_23.html

NAMs出版プロジェクト: サミュエルソン 国民所得にかんする循環的流れの図

http://nam-students.blogspot.jp/2015/09/blog-post_25.html

NAMs出版プロジェクト: マンキューマクロより

http://nam-students.blogspot.jp/2015/09/ad-as.html

http://nam-students.blogspot.jp/2015/08/blog-post_38.html

The Economic Organization (English Edition) Kindle版

略歴

立場

- ナイトはアルフレッド・マーシャルの経済学を継承し、道徳哲学に裏付けられた自由主義と自由企業制度の改革と社会進歩の考えを深化した。このためか、ミルトン・フリードマンやジョージ・スティグラー、ロナルド・コースなどシカゴ学派の第2世代と呼ばれる経済学者を育てたものの、自由競争に全幅の信頼を置くフリードマンらとは違い政府による政策的な介入をある程度は是認する立場を取っている。

業績

- ナイトの経済学における最大の業績は、著書『Risk, Uncertainty and Profit(危険・不確実性および利潤)』である。ナイトは確率によって予測できる「リスク」と、確率的事象ではない「不確実性」とを明確に区別し、「ナイトの不確実性」と呼ばれる概念を構築した。

- ナイトは、不確定な状況を3つのタイプに分類した。

- 第1のタイプは「先験的確率」である。これは例えば「2つのサイコロを同時に投げるとき、目の和が7になる確率」というように、数学的な組み合わせ理論に基づく確率である。

- 第2のタイプは「統計的確率」である。これは例えば男女別・年齢別の「平均余命」のように、経験データに基づく確率である。

- そして第3のタイプは「推定」である。このタイプの最大の特徴は、第1や第2のタイプと異なり、確率形成の基礎となるべき状態の特定と分類が不可能なことである。さらに、推定の基礎となる状況が1回限りで特異であり、大数の法則が成立しない。ナイトは推定の良き例証として企業の意思決定を挙げている。企業が直面する不確定状況は、数学的な先験的確率でもなく、経験的な統計的確率でもない、先験的にも統計的にも確率を与えることができない推定であると主張した。

- そしてナイトは完全競争の下では不確実性を排除することはできないと主張し、その不確実性に対処する経営者への報酬として、利潤を基礎付けた。

人物像

- ナイトの授業を受講し、後に同僚となったジョージ・スティグラーは以下のようにナイトを表現した。

- タバコを吸うときは、爪楊枝を刺してひげを焦がすまで吸いきろうとする。

- ある時、「今から話す理論が分からない学生は経済学部を辞めろ!」と勢いよく叫んだ。しかし、その10分後、「自分もようやく2年前にこの理論が理解できたんだ」とつぶやく。

- ナイトの講義を取った学生は、ナイトのあっちへ行ったりこっちへ行ったりの授業を、1年目はノートを取ろうと悪戦苦闘する。2年目以降はそんなことをせずに、1年目の学生が悪戦苦闘しながらノートを取るのを見て笑う。

- だが、彼は学生からも、学内の教師たちからも尊敬された。「ほかの誰にも見たことが無いほど、真実に対する無条件の奉仕の精神を人々に感じさせた」。」[1]

- アメリカが広島、長崎に原子爆弾を落としたことは人類の犯した最悪の罪であると糾弾し、また広島の原爆で両親を失った少女を養女としていた。[2]

- モンペルラン・ソサイエティーの活動などにおけるミルトン・フリードマン、ジョージ・スティグラーの目に余る言動に対し、ナイトは彼らに、ナイトのところで勉強し、論文を書いたと言うことを禁止する、という破門宣言をした。[3]

日本語訳著書

脚注

参考文献

- 竹森俊平『1997年―世界を変えた金融危機』朝日新聞社、2007年10月12日。ISBN 978-4-02-273174-6

【土地所有者】

↗︎ \

借地料(地代) 商品購入の

支払いのための ための紙幣

紙幣 \

/ ↘︎

【借地農業者】 ←食品購入の -【製造業セクター

ための紙幣 の労働者】

http://www.eonet.ne.jp/~

《貨幣に必要な性質に、可分割性、すなわち損失を伴わず分割できることを挙げたのは、ローが最初とされている。》

The Avalon Project : Money and Trade Considered

http://avalon.law.yale.edu/

西洋経済古書収集ーカンティロン,『商業試論』

http://www.eonet.ne.jp/~カンティロン『商業試論』。1756刊第二刷(初版は1755年刊)。

《 地主は1年分の収入を限度として紙幣を発行し、働きたいと思っている製造業労働者を雇用し、その労働の対価としてこれを彼らに与える。借地農は穀物等の財貨を製造業労働者に与え、この紙幣を受領する。そして、地主は地代をこの紙幣で受け取る。貨幣は出発点に一巡したことになる。もし、労働者消費が少なく、貨幣全部が使われない時は、貨幣価値が上昇し、農民も地代を支払えなくなるので、地主はより一層の紙幣を発行する。このことは、大陸から失業者を引き寄せ、より大きな消費を生み出すとする。

マーフィー(元々カンティロンの研究家である)のように、ローの「孤島モデル」に、カンティロンの三つの地代論、すなわちカンティロンの「経済表」の原型を見ることも可能であろう。そうなれば、「かれ(カンティロン:引用者)こそ経済表を描いた最初の人であった。」(シュンペーターの言葉)という栄誉、はローに優先権を譲ることになるだろう。》

参考:

中川辰洋 『ジョン・ローの実像と虚像 18世紀経済思想の再検討』 日本経済評論社、2011年

吉田啓一 『ジョン・ローの研究 附・「貨幣と商業」全訳』 泉文堂、1968年

Antoin E. Murphy, John Law Economiste et homme d'Etat, Brussels, Peter Lang, 2007, 447pp, Book, PUBLISHED.

This paper aims to demonstrate that John Law has a prior claim to both Richard Cantillon and François Quesnay as the originator of the circular flow of income and expenditure. Law's use of an island model in chapter VII of Money and Trade (1705) shows the circular flow process amongst three socio-economic groupings-landlords, farmers and manufacturing workers.

ジョン・ロー (John Law) - Cruel.org

ジョン・ロー (1705) は ダヴァンザティの「交換価値」と「利用価値」のちがいを拡張して、 その有名な「水とダイヤモンド」パラドックスを導入した。つまり、利用価値の高い水は 交換価値がなく、ダイヤモンドはものすごい交換価値を持つけれど、利用価値は ほとんど ...

ジョン・ロー - Wikipedia

ジョン・ロー(仏: John Law de Lauriston, 1671年4月21日 - 1729年5月21日)は、 スコットランド出身の経済思想家、実業家、財政家で ... アムステルダム時代に ジェームズ2世の息子ジェームズ・フランシ...

十八世紀の銀行券論 ― ジョン・ローとジェームズ・ステュアート ― 古谷 豊 ...

(Adobe PDF)

この立場はジョン・ローとジェームズ・ステュアートの二人によって代表される。 ... ローは フランスで活躍する前に、1705 年に母国スコットランドで議会に銀行設立の提案 ... ットランド向けに書いた「1705 年土地貨幣造幣局法案」の銀行案と『貨幣と商業』の議論 .

紙幣の父 ジョン・ロー (1) -重商主義の時代 ( その他経済 ...

有名な財政家たるジョン・ローも挙げられる(『貨幣および貿易考察』1705年 John Law, Money and Trade considered,1705)。なるほど彼の労作は土地を担保とした紙幣 という当時しばしば発表された計画の通俗化に捧げられたものに過ぎ ...

やさしい経済学・危機・先人に学ぶ:ジョン・ロー - 一橋大学経済研究所

(Adobe PDF)

ジョン・ローは、経済に関する著作はあるが、基本的には政策起業家とでも呼ぶべ. き 財政家で、 ... 起業家を評価し、その意味でジョン・ローを高く買っている。 .... ローが 1705 年に書いた『貨幣および商業に関する考察』では土地を担保にした貨.

西洋経済古書収集ージョン・ロー,『貨幣と商業』

ジョン・ロー『貨幣と商業に関する考察ならびに国民に貨幣を供給するための提案』。 1760年刊。 ..... 中村の本(1996)によると、本書は1705年エディンバラで初版、1720年 に仏訳版、同年ロンドンでニ度刷られ、1750年と、1760年版がグラスゴウの同書肆で 発行 ...

ーーーーーー

☆

リチャード・カンティロン - Wikipedia

リチャード・カンティロン(Richard Cantillon、? - 1734年)は、フランスの銀行家、実業家 、経済思想家。 詳しい出自は不明だが、スペイン系のアイルランド人商人の息子として 1680年から1690年の間に生まれたと言われている。その後フランスへ渡り、 ...

カンティロンは、『商業試論』で土地はすべての物産と商品の素材であり、労働はその形式であると述べ、生産物の価値は詰まるところ土地の価値に還元する、とフランソワ・ケネーに先立って重農主義を主張した。その一方で、現金の増加はそれに比例した一国の消費の増大をひき起こし、それがしだいに価格の高騰を生むと、乗数効果による貨幣流通量のコントロールの必要性についても言及し、それを元に重商主義の主張の一つである貿易差額主義を支持している。

カンティロンの主張は、価値論において重農主義的であるものの、本来的な価値と市場における価格との乖離にも着目し、その乖離を利潤機会として追求する存在として企業者の存在を定義している。そして、企業者と顧客が市場で「掛け合い」をすることで、市場における均衡状態が実現すると結論付けている。

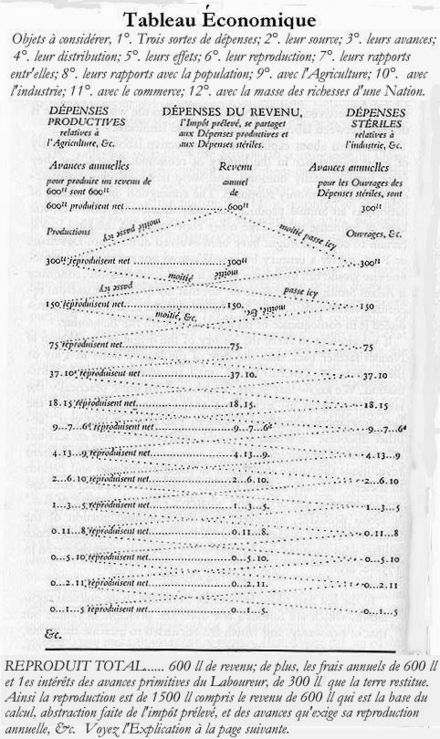

Representation of Cantillon's primitive circular flow model[5]

Cantillon 2010, p. 66

One of the earliest ideas on the circular flow was explained in the work of 18th century Irish-French economist Richard Cantillon,[2] who was influenced by prior economists, especially William Petty.[6] Cantillon described the concept in his 1730 Essay on the Nature of Trade in General, in chapter 11, entitled "The Par or Relation between the Value of Land and Labor" to chapter 13, entitled "The Circulation and Exchange of Goods and Merchandise, as well as their Production, are Carried On in Europe by Entrepreneurs, and at a Risk." Thornton eds. (2010) further explained: …

【地主】

2/6↗︎ ↘︎2/6

1/6

【借地農】 → 【都市の企業家】

3/6は実物で ←

とどまる 3/6

(矢印は貨幣の流れ。カンティロンが暗に批判したジョン・ローの発想1705と似ている。賃労働者と職人はこの図では略されている。)

以上に、地主の主導による経済循環の流れが描かれている。この構図(米田昇平による図式を左にあげる(注5)3)が、カンティロンの「経済表」(注6)4といわれるものである。「カンティヨンこそ初めてこの循環の流れを具体的且つ明示的となし、また経済生活の鳥瞰図をわれわれに示した最初の人であった。いい換えると、かれこそ経済表(tableu éonomique)を描いた最初の人であった。・・・経済表の「発明」に関するカンティヨンの優先性は、全くなんらの疑いをも差しはさみえないものである」(シュンペーター, 1956, p.462-3)。

- R.カンティロン 津田内匠訳 『商業試論』 名古屋大学出版会、1992

- 津田内匠 「解説 カンティロン ― 企業者とディリジスムの経済学」1992年 (津田訳『商業試論』 収録)

- 米田昇平 「リチャード・カンティロン -地主と企業者― 」2005年a (坂本達哉編『黎明期の経済学 経済思想第3巻』 日本経済評論社、2005年 所収)

- シュンペーター 東畑精一訳 『経済分析の歴史 2』 岩波書店、1956年

(注6)「わが国において、しばしば「カンティロンの『経済表』ということが言われる。」(渡辺, 2000, p.284)として、堀経夫『経済学史要論 上』1936、平瀬巳之吉『経済学の古典と近代』1954の使用例があげられている。日本ではかなり古くから使われてきたのである。

ーーーーー

フランク・ナイト - Wikipedia

フランク・ハインマン・ナイト(Frank Hyneman Knight, 1885年11月7日 - 1972年4月15 日)は、20世紀前半に活躍したアメリカの経済学者。ジェイコブ・ヴァイナー、ヘンリー・ シモンズとともにシカゴ学派の創設者である。1950年アメリカ経済学会会長。

- ナイトはアルフレッド・マーシャルの経済学を継承し、道徳哲学に

裏付けられた自由主義と自由企業制度の改革と社会進歩の考えを深 化した。このためか、ミルトン・フリードマンやジョージ・ スティグラー、ロナルド・コースなどシカゴ学派の第2世代と呼ば れる経済学者を育てたものの、 自由競争に全幅の信頼を置くフリードマンらとは違い政府による政 策的な介入をある程度は是認する立場を取っている。

Frank Knight - Wikiquote

https://en.wikiquote.org/wiki/Frank_Knight

Frank Hyneman Knight (November 7, 1885 – April 15, 1972) was an American economist who spent most of his career at the University of Chicago, where he became one of the founders of the Chicago school. Nobel laureates Milton Friedman,George Stigler and James M. Buchanan were all students of Knight at Chicago. Ronald Coase said that Knight, without teaching him, was a major influence on his thinking.

- [We may view the] economic organization as a system of prize relations. Seen in the large, free enterprise is an organization of production and distribution in which individuals or family units get their real income, their "living," by selling productive power for money to "business units" or "enterprises", and buying with the money income thus obtained the direct goods and services which they consume. This view, it will be remembered, ignores for the sake of simplicity the fact that an appreciable fraction of the productive power in use at any time is not really employed in satisfying current wants but to make provision for increased want-satisfaction in the future; it treats society as it would be, or would tend to become, with progress absent, or in a “static” state.

- Frank Knight. The Economic Organization, 1933. p.59-60; on the circular-flow of income and the circular-flow diagram.

- Quotes about Knight

- Hayek greatly praised Knight on several occasions. In 1951, he grouped Knight, with Ludwig von Mises and Edwin Cannan, as one of three primary transmitters of classical liberalism during the 1920s and 1930s. Even more significantly, Hayek wrote in the beginning of the “Acknowledgments and Notes” section of The Constitution of Liberty: “If I had regarded it as my task to acknowledge all indebtedness and to notice all agreements, these notes would have been studded with references to the work of Ludwig von Mises, Frank H. Knight, and Edwin Cannan.” Hayek referred to Knight eight times inThe Constitution of Liberty.

Notwithstanding Hayek’s praise and references to him, Knight ripped the book in a 1967 review.- Alan Ebenstein, Hayek's Journey: The Mind of Friedrich Hayek (2003), Ch. 13. The Chicago School of Economics and Milton Friedman

- Knight's monograph The Economic Organization (1933) was prepared in the mid-1920s while Knight was at the University of Iowa and was later duplicated for student use at Chicago... It contains the elements of theory that helped to establish for Chicago its pre-eminence in neoclassical economics. While, according to Buchanan, there was little in the monograph that was wholly original, its value was in its emphasis on key points, its clarification of ambiguous concepts and notions, and its integrated approach to the economy as a social organization. According to Buchanan, several generations of undergraduate students at Chicago obtained their vision of the totality of the economic process only after encountering Knight (and Simons).

- Ross B. Emmett. The Elgar Companion to The Chicago School of Economics, 2008. p. 238

Circular flow of income - Wikiquote

https://en.wikiquote.org/wiki/Circular_flow_of_income- Knight is the first to use the circular- flow diagram as a means of explaining the way in which the interaction of individuals and businesses in goods and factor markets simultaneously solve all the functions required for effective social organization (Knight 1951, pp. 61–6). Prices provide a measure of the social importance of goods and services (albeit ‘not a true index of social importance according to any recognized ethical standard’), ensure that productive resources are allocated to the production of goods and services which place the highest value on them, and simultaneously distribute income across the productive resources accordingly. ‘The principal connection between the price system and social progress’, meanwhile, ‘is mediated by the phenomenon of interest on capital’ (pp. 63–5).

- Ross B. Emmett. The Elgar Companion to The Chicago School of Economics, 2008. p.54

- Knight’s wheel of wealth emphasizes the circular flow of income in the economy as money is exchanged for factor services and final goods at successive stages in the production process. His emphasis on equalization of returns at the margin implicitly made his model an equilibrium one. And Knight’s approach contrasts with Carl Menger’s emphasis on the demand for final goods determining the prices of factors of production. Knight stressed instead the importance of opportunity cost, a characteristic feature of both Chicago economics and the Virginia School of Political Economy.

ーーー

競争の倫理 フランク・ナイト論文選 (シリーズ・現代思想と自由主義論)

http://books.rakuten.co.jp/rb/6080456/

フランク・H.ナイト

- 発売日: 2009年05月

- 著者/編集: フランク・H.ナイト, 高哲男

- 出版社: ミネルヴァ書房

- サイズ: 全集・双書

- ページ数: 281,

- ISBNコード: 9784623053452

【内容情報】(「BOOK」データベース

シカゴ学派の総帥ナイトは、ケインズやハイエクと並ぶ二十世紀を代表する経済学者でありながら、その思想と文体の晦渋さゆえに忘却の淵に曝されてきた。本書は、アメリカ経済学界の「大いなる暗闇」の核心を明らかにする論文選。

【目次】(「BOOK」データベースより)

第1章 競争の倫理/第2章 集産主義体制における限界原理経済学の位置/第3章 景気循環、利子および貨幣ー方法論的アプローチ/第4章 民主主義の意味ーその政治的・経済的構造と理念/第5章 現代文明における宗教と倫理/第6章 自由主義社会の病弊/第7章 自由放任主義ーその賛否/解説 フランク・ナイトの複眼(黒木亮)-思索の多面性と重層性

(経済組織1933は未所収)

ーーーーー

黒木亮論文より

http://jshet.net/docs/journal/

4) サミュエルソンがナイトから受けた影響,

第1章 競争の倫理/第2章 集産主義体制における限界原理経済学の位置/第3章 景気循環、利子および貨幣ー方法論的アプローチ/第4章 民主主義の意味ーその政治的・経済的構造と理念/第5章 現代文明における宗教と倫理/第6章 自由主義社会の病弊/第7章 自由放任主義ーその賛否/解説 フランク・ナイトの複眼(黒木亮)-思索の多面性と重層性

(経済組織1933は未所収)

ーーーーー

黒木亮論文より

http://jshet.net/docs/journal/

4) サミュエルソンがナイトから受けた影響,

Emmett, Ross B. 2009. Frank Knight and the Chicago School in American Econmics. London and New York: Routledge.―, ed. 2010. The Elgar Companion to the Chicago School of Economics. Cheltenham, UK and Northampton, MA, USA: Edward Elgar.

Patinkin, Don. 1973. Frank Knight as a Teacher. American Economic Review 63 (5): 787―810. 季刊現代経済編集室訳「教師としてのフランク・ナイト(I)(II)」 『季刊現代経済』15: 212―24, 17: 188201.-. 1981. Essays On and In the Chicago Tradition. Durham, NC: Duke Univ. Press. ☆

☆パティンキンによればサミュエルソンはナイトから影響を受けたという(季刊現代経済#15)。

Frank Knight. The Economic Organization, 1933 diagram - Yahoo!検索

http://search.yahoo.co.jp/In Search of the" Wheel of Wealth": On the Origins of Frank Knight's ...

(Adobe PDF)

of Frank Knight's Circular-Flow Diagram

Amazon.co.jp: Economic Organization: Frank Knight: 洋書

Amazon.co.jp: Economic Organization: Frank Knight: 洋書. ... Economic Organization (英語) ハードカバー – 1933/6 ... of the price mechanism in market organization is illustrated neatly by Knight's "wheel of wealth"-the circular flow diagram most ...

ーーーーー

30% 70%

資本収入 労働収入

不労所得 個人収入

融資

流通

投資

工業製品への支出

家賃、地代 原料への支出

政府へ、税金

William T. Foster, "The circuit flow of money." The American Economic Review(1922): 460-473.

William Trufant Foster - Wikipedia, the free encyclopedia

https://en.wikipedia.org/wiki/

This paper aims to demonstrate that John Law has a prior claim to both Richard Cantillon and François Quesnay as the originator of the circular flow of income and expenditure. Law's use of an island model in chapter VII of Money and Trade (1705) shows the circular flow process amongst three socio-economic groupings-landlords, farmers and manufacturing workers.

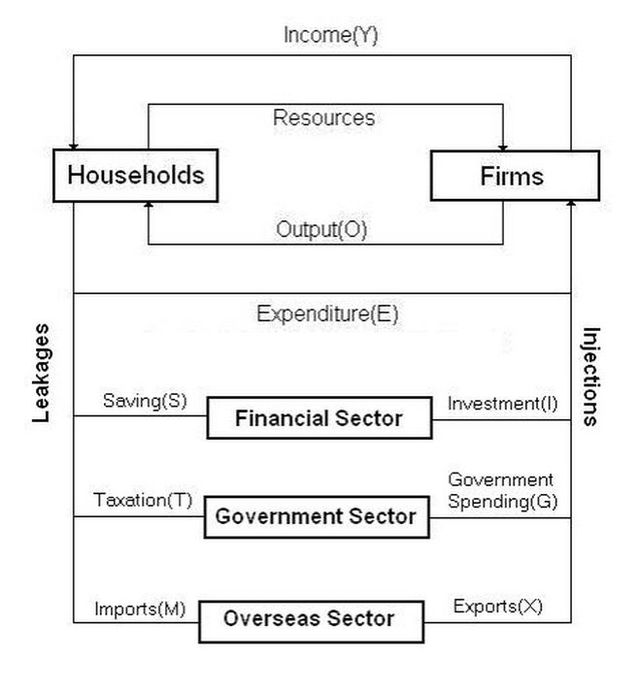

Basic diagram of the circular flow of income. The functioning of the free-market economic system is represented with firmsand households and interaction back and forth.[1]

The circular flow of income or circular flow is a model of theeconomy in which the major exchanges are represented as flows ofmoney, goods and services, etc. between economic agents. The flows of money and goods exchanges in a closed circuit and correspond in value, but run in the opposite direction. The circular flow analysis is the basis of national accounts and hence of macroeconomics.

The idea of the circular flow was already present in the work of Richard Cantillon.[2] François Quesnay developed and visualized this concept in the so called Tableau économique.[3] Important developments of Quesnay's tableau were Karl Marx' reproduction schemes in the second volume of Capital: Critique of Political Economy, and John Maynard Keynes' General Theory of Employment, Interest and Money.Richard Stone further developed the concept for the United Nations(UN) and the Organisation for Economic Co-operation and Development to the system, which is now used internationally.

Overview

The circular flow of income is a concept for better understanding of the economy as a whole and for example the National Income and Product Accounts (NIPAs). In its most basic form it considers a simple economy consisting solely of businessesand individuals, and can be represented in a so called "circular flow diagram." In this simple economy, individuals provide the labor that enables businesses to produce goods and services. These activities are represented by the green lines in the diagram.[4]

Alternatively, one can think of these transactions in terms of the monetary flows that occur. Businesses provide individuals with income (in the form of compensation) in exchange for their labor. That income is, in turn, spent on the goods and services businesses produce. These activities are represented by the blue lines in the diagram above.[4]

The circular flow diagram illustrates the interdependence of the “flows,” or activities, that occur in the economy, such as theproduction of goods and services (or the “output” of the economy) and the income generated from that production. The circular flow also illustrates the equality between the income earned from production and the value of goods and services produced.[4]

Of course, the total economy is much more complicated than the illustration above. An economy involves interactions between not only individuals and businesses, but also Federal, state, and local governments and residents of the rest of the world. Also not shown in this simple illustration of the economy are other aspects of economic activity such as investment incapital (produced—or fixed—assets such as structures, equipment, research and development, and software), flows of financial capital (such as stocks, bonds, and bank deposits), and the contributions of these flows to the accumulation of fixed assets.[4]

History

Cantillon

One of the earliest ideas on the circular flow was explained in the work of 18th century Irish-French economist Richard Cantillon,[2] who was influenced by prior economists, especially William Petty.[6] Cantillon described the concept in his 1730 Essay on the Nature of Trade in General, in chapter 11, entitled "The Par or Relation between the Value of Land and Labor" to chapter 13, entitled "The Circulation and Exchange of Goods and Merchandise, as well as their Production, are Carried On in Europe by Entrepreneurs, and at a Risk." Thornton eds. (2010) further explained:

- Cantillon develops a circular-flow model of the economy that shows the distribution of farm production between property owners, farmers, and workers. Farm production is exchanged for the goods and services produced in the cities by entrepreneurs and artisans. While the property owners are “independent,” the model demonstrates the mutual interdependence between all the classes of people that Adam Smith dubbed the “invisible hand” in The Theory of Moral Sentiments (1759).[7]

Cantillon distinguished at least five types of economic agents: property owners, farmers, entrepreneurs, labors and artisans, as expressed in the contemporary diagram of the Cantillon’s Circular Flow Economy.[5]

Quesnay

François Quesnay further developed these concepts, and was the first to visualize these interactions over time in the so called Tableau économique.[3] Quesnay believed that trade and industry were not sources of wealth, and instead in his 1758 book Tableau économique (Economic Table) argued that agricultural surpluses, by flowing through the economy in the form of rent, wages, and purchases were the real economic movers, for two reasons.

- First, regulation impedes the flow of income throughout all social classes and therefore economic development.

- Second, taxes on the productive classes such as farmers should be reduced in favor of higher taxes for unproductive classes such as landowners, since their luxurious way of life distorts the income flow.

The model Quesnay created consisted of three economic agents: The "Proprietary" class consisted of only landowners. The "Productive" class consisted of all agricultural laborers. The "Sterile" class is made up of artisans and merchants. The flow of production and/or cash between the three classes started with the Proprietary class because they own the land and they buy from both of the other classes. Quesnay visualised the steps in the process in the Tableau économique.

Marx

In Marxian economics, economic reproduction refers to recurrent (or cyclical) processes[8] by which the initial conditions necessary for economic activity to occur are constantly re-created.[9]

Economic reproduction involves the physical production and distribution of goods and services, the trade (the circulation via exchanges and transactions) of goods and services, and the consumption of goods and services (both productive orintermediate consumption and final consumption).

Karl Marx developed the original insights of Quesnay to model the circulation of capital, money, and commodities in the second volume of Das Kapital to show how the reproduction process that must occur in any type of society can take place in capitalist society by means of the circulation of capital.[10]

Marx distinguishes between "simple reproduction" and "expanded (or enlarged) reproduction".[11] In the former case, noeconomic growth occurs, while in the latter case, more is produced than is needed to maintain the economy at the given level, making economic growth possible. In the capitalist mode of production, the difference is that in the former case, the new surplus value created by wage-labour is spent by the employer on consumption (or hoarded), whereas in the latter case, part of it is reinvested in production.

Further developments

An important development was John Maynard Keynes' 1933 publication of the General Theory of Employment, Interest and Money. Keynes' assistant Richard Stone further developed the concept for the United Nations (UN) and the Organisation for Economic Co-operation and Development to the systems, which is now used internationally.

The first to visualize the modern circular flow of income model was Frank Knight in 1933 publication of The Economic Organization.[12] Knight (1933) explained:

- [we may view the] economic organization as a system of prize relations. Seen in the large, free enterprise is an organization of production and distribution in which individuals or family units get their real income, their "living," by selling productive power for money to "business units" or "enterprises", and buying with the money income thus obtained the direct goods and services which they consume. This view, it will be remembered, ignores for the sake of simplicity the fact that an appreciable fraction of the productive power in use at any time is not really employed in satisfying current wants but to make provision for increased want-satisfaction in the future; it treats society as it would be, or would tend to become, with progress absent, or in a “static” state.[13]

Knight pictured a circulation of money and circulation of economic value between people (individuals, families) and business enterprises as a group,[14] explaining: "The general character of an enterprise system, reduced to its very simplest terms, can be illustrated by a diagram showing the exchange of productive power for consumption goods between individuals and business units, mediated by the circulation of money, and suggesting the familiar figure of the wheel of wealth."[15]

Types of models

Two sector model

In the basic circular flow of income, or two sector circular flow of income model, the state of equilibrium is defined as a situation in which there is no tendency for the levels of income (Y), expenditure (E) and output (O) to change, that is:

Y = E = O

This means that the expenditure of buyers (households) becomes income for sellers (firms). The firms then spend this income on factors of productionsuch as labour, capital and raw materials, "transferring" their income to the factor owners. The factor owners spend this income on goods which leads to a circular flow of income.

This basic circular flow of income model consists of six assumptions:

- The economy consists of two sectors: households and firms.

- Households spend all of their income (Y) on goods and services orconsumption (C). There is no saving (S).

- All output (O) produced by firms is purchased by households through their expenditure (E).

- There is no financial sector.

- There is no government sector.

- There is no foreign sector

Three sector model

It includes household sector, producing sector and government sector. It will study a circular flow income in these sectors excluding rest of the world i.e. closed economy income. Here flows from household sector and producing sector to government sector are in the form of taxes. The income received from the government sector flows to producing and household sector in the form of payments for government purchases of goods and services as well as payment of subsides and transfer payments. Every payment has a receipt in response of it by which aggregate expenditure of an economy becomes identical to aggregate income and makes this circular flow unending.

Four sector model

A modern monetary economy comprises a network of four sector economy these are:

- Household sector

- Firms or Producing sector

- Government sector

- Rest of the world sector.

Each of the above sectors receives some payments from the other in lieu of goods and services which makes a regular flow of goods and physical services. Money facilitates such an exchange smoothly. A residual of each market comes in capital market as saving which inturn is invested in firms and government sector. Technically speaking, so long as lending is equal to the borrowing i.e. leakage is equal to injections, the circular flow will continue indefinitely. However this job is done by financial institutions in the economy.

Five sector model

In the five sector model the economy is divided into five sectors:[16]

- Household sector

- Firms or Producing sector

- Financial sector : banks and non-bank intermediaries who engage in the borrowing (savings from households) and lending of money

- Government sector : consists of the economic activities of local, state and federal governments.

- Rest of the world sector: transforms the model from a closed economy to an open economy.

The five sector model of the circular flow of income is a more realistic representation of the economy. Unlike the two sector model where there are six assumptions the five sector circular flow relaxes all six assumptions. Since the first assumption is relaxed there are three more sectors introduced.

Circular flow of income topics

Leakage and injections

In the five sector model the economy there is leakage and injections

- Leakage means withdrawal from the flow. When households and firms save part of their incomes it constitutes leakage. They may be in form of savings, tax payments, and imports. Leakages reduce the flow of income.

- injections means introduction of income into the flow.When households and firms borrow the savings,they constitute injections.Injections increase the flow of income.Injections can take the forms of (a) investment,(b) government spending and (c) exports.So long as leakages are equal to injections circular flow of income continues indefinitely.Financial institutions or capital market play the role of intermediaries.

Leakage and injections can occur in the financial sector, government sector and overseas sector:

- In the financial sector

In terms of the circular flow of income model the leakage that financial institutions provide in the economy is the option for households to save their money. This is a leakage because the saved money can not be spent in the economy and thus is an idle asset that means not all output will be purchased. The injection that the financial sector provides into the economy is investment (I) into the business/firms sector. An example of a group in the finance sector includes banks such as Westpac or financial institutions such as Suncorp.

- In the government sector

The leakage that the Government sector provides is through the collection of revenue through Taxes (T) that is provided by households and firms to the government. For this reason they are a leakage because it is a leakage out of the current income thus reducing the expenditure on current goods and services. The injection provided by the government sector is Government spending (G) that provides collective services and welfare payments to the community. An example of a tax collected by the government as a leakage is income tax and an injection into the economy can be when the government redistributes this income in the form of welfare payments, that is a form of government spending back into the economy.

- In the overseas sector

The main leakage from this sector are imports (M), which represent spending by residents into the rest of the world. The main injection provided by this sector is the exports of goods and services which generate income for the exporters from overseas residents. An example of the use of the overseas sector is Australia exporting wool to China, China pays the exporter of the wool (the farmer) therefore more money enters the economy thus making it an injection. Another example is China processing the wool into items such as coats and Australia importing the product by paying the Chinese exporter; since the money paying for the coat leaves the economy it is a leakage.

- Summary of leakage and injections

- Table 1 All leakages and injections in five sector model

The state of equilibrium

In terms of the five sector circular flow of income model the state of equilibrium occurs when the total leakages are equal to the total injections that occur in the economy. This can be shown as:

Savings + Taxes + Imports = Investment + Government Spending + Exports

OR

S + T + M = I + G + X.

This can be further illustrated through the fictitious economy of Martinland where:

S + T + M = I + G + X

$100 + $150 + $50 = $50 + $100 + $150

$300 = $300

Therefore since the leakages are equal to the injections the economy is in a stable state of equilibrium. This state can be contrasted to the state of disequilibrium where unlike that of equilibrium the sum of total leakages does not equal the sum of total injections. By giving values to the leakages and injections the circular flow of income can be used to show the state of disequilibrium. Disequilibrium can be shown as:

Therefore it can be shown as one of the below equations where:

Total leakages > Total injections

$150 (S) + $250 (T) + $150 (M) > $75 (I) + $200 (G) + 150 (X)

Or

Total Leakages < Total injections

$50 (S) + $200 (T) + $125 (M) < $75 (I) + $200 (G) + 150 (X)

The effects of disequilibrium vary according to which of the above equations they belong to.

If S + T + M > I + G + X the levels of income, output, expenditure and employment will fall causing a recession or contraction in the overall economic activity. But if S + T + M < I + G + X the levels of income, output, expenditure and employment will rise causing a boom or expansion in economic activity.

To manage this problem, if disequilibrium were to occur in the five sector circular flow of income model, changes in expenditure and output will lead to equilibrium being regained. An example of this is if:

S + T + M > I + G + X the levels of income, expenditure and output will fall causing a contraction or recession in the overall economic activity. As the income falls households will cut down on all leakages such as saving, they will also pay less in taxation and with a lower income they will spend less on imports. This will lead to a fall in the leakages until they equal the injections and a lower level of equilibrium will be the result.

The other equation of disequilibrium, if S + T + M < I + G + X in the five sector model the levels of income, expenditure and output will greatly rise causing a boom in economic activity. As the households income increases there will be a higher opportunity to save therefore saving in the financial sector will increase, taxation for the higher threshold will increase and they will be able to spend more on imports. In this case when the leakages increase they wisituation will be a higher level of equilibrium.

Difference between real flow and money flow

- Real flow is the exchange of goods and services between household and firms whereas money flow is the monetary exchange between two sectors.

- In real flow household sector supplies raw material, land, labour, capital and enterprise to firms and in return firms sector provides finished goods and services to household sector. Whereas in money flow, firm sector gives remuneration in the form of money to household sector a wages and salaries, rent, interest etc.

- Difficulties of barter system for the exchange of goods and factor services between households and firms sector in real flow, whereas no such difficulty or inconvenience arise in money flow.

- When goods and services flow from one sector of the economy to another, it is known as real flow.

Phases or stages of circular flow of income

Production, consumption expenditure and generation of income are the three basic economic activities of an economy that go on endlessly and are titled as circular flow of income. Production gives rise to income, income gives rise to demand for goods and services ; such a demand gives rise to expenditure and expenditure induces for further production. The whole process forms the basis for circular flow of income and related activities- production, income and expenditure are known as phases or stages of circular flow of income.

Significance of study of circular flow of income

The book A General Approach to Macroeconomic Policy [17][citation needed] identifies four possible areas of significance:

- Measurement of National Income - National income is an estimation of aggregation of any of economic activity of the circular flow. It is either the income of all the factors of production or the expenditure of various sectors of economy. However, aggregate amount of each of the activity is identical to each other.

- Knowledge of Interdependence - Circular flow of income signifies the interdependence of each of activity upon one another. If there is no consumption, there will be no demand and expenditure which in fact restricts the amount of production and income.

- Unending Nature of Economic Activities - It signifies that production, income and expenditure are of unending nature, therefore, economic activities in an economy can never come to a halt. National income is also bound to rise in future.

- Injections and Leakages

See also

References

- ^ Daraban, Bogdan. "Introducing the Circular Flow Diagram to Business Students." Journal of Education for Business 85.5 (2010): 274-279.

- ^ a b Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." Journal of the History of Economic Thought. 1.1 (1993): 47-62.

- ^ a b Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: Famous Figures and Diagrams in Economics(2010): 221-230. Chapter 23.

- ^ a b c d Measuring the Economy : A Primer on GDP and the National Income and Product Accounts, by Bureau of Economic Analysis (BEA), U.S. Department of Commerce, October 2014.

- ^ a b Cantillon 2010, p. 66

- ^ Aspromourgos, Tony. "'Political economy and the social division of labour: the economics of Sir William Petty." Scottish Journal of Political Economy 33.1 (1986): 28-45.

- ^ Cantillon 2010, p. 69: Abstract of chapter 12.

- ^ In a recurrent process, the same event repeats itself on multiple occasions. In a cyclical process, a sequence of eventsrepeats itself on a regular basis.

- ^ Michel Aglietta, introduction to Aglietta, A theory of capitalist regulation. London: NLB, 1979.

- ^ Karl Marx, Capital, Volume II. Penguin Classics, 1992.

- ^ Karl Marx, Capital, Volume I. Penguin Classics, 1990, chapter 23 and Capital, Volume II. Penguin Classics, 1992, chapter 20 and 21.

- ^ Patinkin, Don (December 1973). "In Search of the" Wheel of Wealth": On the Origins of Frank Knight's Circular-Flow Diagram". The American Economic Review 63 (5): 1037–1046. Retrieved 9 June 2015 – via JSTOR. (registration required (help)).

- ^ Frank Knight. The Economic Organization, 1933. p.59-60

- ^ Knight (1933, p. 61)

- ^ Knight (1933, p. 60)

- ^ Jeremy Buultjens, Excel Preliminary Economics, Pascal Press, 2000. p. 10

- ^ A General Approach to Macroeconomic Policy.

- Attribution

This article incorporates text from Bureau of Economic Analysis. Measuring the Economy : A Primer on GDP and the National Income and Product Accounts, 2014, a publication now in the public domain.

Further reading

- Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: Famous Figures and Diagrams in Economics (2010): 221-230. Chapter 23.

- Richard Cantillon, Chantal Saucier (translation) & Mark Thornton (editor) (2010) [1755]. An Essay on Economic Theory.Auburn, Alabama: Ludwig von Mises Institute. ISBN 0-415-07577-7.

- Daraban, Bogdan. "Introducing the Circular Flow Diagram to Business Students." Journal of Education for Business 85.5 (2010): 274-279.

- Mankiw, Gregory (2011). Principles of Economics, 6th edition. Thomson Europe.

- Marks, Melanie, and Gemma Kotula. "Using the circular flow of income model to teach economics in the middle school classroom." The Social Studies 100.5 (2009): 233-242.

- Lloyd A. Metzler. “Three Lags in the Circular Flow of Income”, in: Income, Employment and Public; essays in honor of Alvin H. Hansen, Lloyd A Metzler; New York, W.W. Norton [1948]. pp. 11-32

- Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." Journal of the History of Economic Thought. 1.1 (1993): 47-62.

- Sloman, John (1999). Economics, 3rd edition. Prentice Economics. Europe: Prentice-Hall. ISBN 0-273-65574-4.

External links

- Circular Flow, The Economic Lowdown Video Series at stlouisfed.org/

Five sector model

-

In the five sector model the economy is divided into five sectors:[16]

- Household sector

- Firms or Producing sector

- Financial sector : banks and non-bank intermediaries who engage in the borrowing (savings from households) and lending of money

- Government sector : consists of the economic activities of local, state and federal governments.

- Rest of the world sector: transforms the model from a closed economy to an open economy.

The five sector model of the circular flow of income is a more realistic representation of the economy. Unlike the two sector model where there are six assumptions the five sector circular flow relaxes all six assumptions. Since the first assumption is relaxed there are three more sectors introduced.- The economy consists of two sectors:households and firms.

- Households spend all of their income (Y) on goods and services or consumption (C). There is no saving (S).

- All output (O) produced by firms is purchased by households through their expenditure (E).

- There is no financial sector.

- There is no government sector.

- There is no foreign sector

http://content.wow.com/wiki/Circular_flow_of_income#cite_ note-10

LEAKAGES INJECTION

Saving (S) Investment (I)

Taxes (T) Government Spending (G)

Imports (M) Exports (X)^ Jeremy Buultjens, Excel Preliminary Economics, Pascal Press, 2000. p. 10

https://commons.m.wikimedia.org/wiki/File:Circulation_in_macroeconomics-fr_es_en.svg

Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: Famous Figures and Diagrams in Economics (2010): 221-230. Chapter 23.

p.222NAMs出版プロジェクト: Famous Figures and Diagrams in Economics (英語)http://nam-students.blogspot.jp/2015/09/famous-figures-and-diagrams-in-economics.html

2 Comments:

Y=C+I+G

C=Y-T-S

S貯蓄、T租税、G政府購入、I投資

I G

S T

経済学のメソドロジー

シリーズ名

叢書ヒストリー・オヴ・アイディアズ ≪再検索≫

著者名等

F.H.ナイト/〔ほか〕著 ≪再検索≫

上山隆大/〔ほか〕訳 ≪再検索≫

出版

平凡社 1988.3

大きさ等

18cm 264p

NDC分類

331.2

件名

経済学-歴史 ≪再検索≫

書誌番号

3-0190275167

コメントを投稿

<< Home