https://t.co/BWOpQd9mNC pic.twitter.com/7Q9JOHPW9c

— slowslow2772 (@slowslow2772) March 29, 2023

https://twitter.com/slowslow2772/status/1640964901811404800?s=61&t=TKsS0bD7pJEzj4Xb7VDEDQ

| ||||||||||||||||||||||||

http://nam-students.blogspot.jp/2015/10/q.html

トービン「国際為替取引税」(『人間開発報告書1994』より)

http://nam-students.blogspot.jp/2016/02/1994.html

http://nam-students.blogspot.jp/2015/12/irving-fisher-stamp-scrip-1933-2016331.html

https://twitter.com/slowslow2772/status/1640956153713795072?s=61&t=TKsS0bD7pJEzj4Xb7VDEDQ

https://freeassociations2020.blogspot.com/2022/08/jfk-vs-military-atlantic.html

tobin 1963 万年筆マネー

https://nam-students.blogspot.com/2019/06/tobin1963.html

ケネディ暗殺

https://freeassociations2020.blogspot.com/2022/02/55-20181116.html

ハミルトンhttps://t.co/K49aHKz0gF

— luminous woman (@_luminous_woman) March 13, 2021

リンカーンhttps://t.co/wASvZ0jgSE

ルーズベルト 1944

A Job Guarantee Costs Far Less Than Unemploymenthttps://t.co/QkQm1MTzPM

Tobin on JFK 1962https://t.co/FtZC1u8qEX pic.twitter.com/tjU44ZlaN7

| 地域通貨花子1 (@TiikituukaHana) |

|

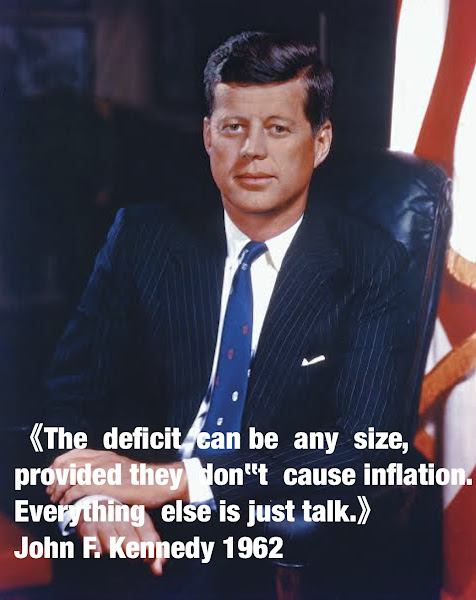

ケネディはMMTerだった

『誰がケインズを殺したか?』4,参照 JFK'S SPEECH AT YALE UNIVERSITY (JUNE 11, 1962) youtu.be/PznXIiGe9rI?t=… MMTer(=戦争をしなくても完全雇用は可能と考える人々)であるがゆえにリンドン・ジョンソンに暗殺された。 | |

ケネディ大統領とノーベル賞受賞経済学者トービンの会話

ケネディ「債務対GDPの比率に経済学的な上限はありま会話か?政府債務は過度に増やしてはいけないといわれますけど、実際はないですよね。そうでしょう?じゃあ何が上限になるんですか?」

トービン「唯一の上限はインフレです」

ケネディ「そうですよね!財政赤字も政府債務も、本来はどんな規模でもいい、インフレにならない限りは。それ以外はタワゴトですよ」

● John F. Kennedy 1962

《The deficit can be any size, the debt can be any size, provided they don't cause inflation. Everything else is just talk.》

from James Tobin's testimony

p.276

ケネディ「財政赤字も政府債務も、本来はどんな規模でもいい、インフレにならない限りは。それ以外はタワゴトですよ」

ジェームズ・トービンの証言より

(生涯で約120)

『生きているケネディ』は断片紹介で全訳ではない。

Transcript of President John F. Kennedy’s address at Medical Care for the Aged rally, New York, 20 May 1962

The problem, however, is more complicated, because they do not comprehend what we’re trying to do. We do not cover doctor’s bills here. We do not affect the freedom of choice–you can go to any doctor you want, you work out your arrangements with him–what we’re talking about here is hospital bills–and that’s an entirely different matter. And I hope that, one by one, the doctors of the United States will take the extraordinary step of not merely reading the journals and the publications of the AMA–because I do not recognize the bill when I hear those descriptions–but, instead,… instead to write to Secretary Renikoff in Washington, or to me–and you know where I live–or to Senator Anderson, or to Congressman King if you are a doctor or opposed to this bill and get a concise explanation and the bill, and read it.

All these arguments were made against Social Security at the time of Franklin Roosevelt–they’re made today–the mail pours in. And at least half the mail which I receive in the White House on this issue and others is wholly misinformed. Last week, I got 1500 letters on a revenue measure; 1494 opposed, and six for. And at least half of those letters were completely misinformed about the details of what they wrote. And why is that so? Because there are so many busy men in Washington who write–some organizations have six, seven, and eight hundred people, spreading mail across the country, asking doctors and others to write in and tell your Congressmen you’re opposed to it. The mail pours in to the White House, in to the Congress and Senators’ offices. Congressmen and Senators feel people are opposed to it. Then they read a Gallup poll which says 75% of the people are in favor of it–and they say, ‘What has happened to my mail?’

The point of the matter is, that this meeting and the others indicate that the people of the United States recognize, one by one, thousand by thousand, million by million, that this is a problem… which is… solution is long overdue. And this year, I believe–or certainly as inevitably as the tide comes in, next year–this bill is going to pass.

And then I read that this bill will sap the individual self-reliance of Americans. I can’t imagine anything worse–or anything better to sap someone’s self-reliance than to be sick, alone, broke, or to have saved for a lifetime and put it out in a week, two weeks, a month, two months…

I’ve visited twice today–yesterday, and once today, a hospital, with doctors [unintelligible] for a long time–to visit my father. It isn’t easy. It isn’t easy. He can pay his bills! But, otherwise, I would be–and I’m not as well off as he is.

But, uh… what happens to him and to others when they put their life savings in in a short time? So I must say that I believe we stand about in good company today, in halls such as this, where your predecessors, where Dave Devinsky himself actually stood, where another former President stood and fought this issue out of Social Security against the same charges.

I understand that there’s going to be a program against this bill in which an English physician is going to come and talk about how bad their plans are. May be! But he oughta talk about it in England! Because his plan–his plan and what they do in England is entirely different. In England the entire cost of medicine for people of all ages, all of it–doctors, choice of doctors, hospitals, from the time you’re born till the time you die–are included in a government program. But what we’re talking about is entirely different. And I hope that while he’s here, he and Dr. Spock and others who have joined us will come to see what we’re trying to do. The fact of the matter is, what we are now talking about doing, most of the countries of Europe did years ago–the British did it 30 years ago. We are behind every country nearly in Europe in this matter of medical care for our citizens.

And then those who say that this should be left to private effort. In those hospitals in New Jersey where the doctors said they wouldn’t treat anyone who paid their hospital bills through Social Security–those hospitals and every other new hospital, the American people, all of us, contribute one half, or two thirds for every new hospital, the national government. We pay 55% of all new research done. We help young men become doctors. We are concerned with the progress of this country, and those who say that what we are now talking about spoils our great pioneer heritage should remember that the West was settled with two great actions by the national government: one, in President Lincoln’s administration, when he gave a homestead to everyone who went West, and in 1862 he set aside government property to build our land grant colleges. This cooperation–between and alert and progressive citizenry and a progressive government, is what has made this country great–and we shall continue as long as we have the opportunity to do so.

And then there are those who say, well, what if you die before you’re 65? Well, then you really don’t care–we have no guarantees. But what we are talking about is, our people are living a long time, their housing in inadequate, in many cases their rehabilitation is inadequate. We’ve got great unfinished business in this country. And while this bill does not solve our problems in this area, I do not believe it is a valid argument to say, 'This bill isn’t going to do the job.’ It will not–but–it will do part of it. Our housing bill last year for the elderly–that won’t do the job, but it will begin. When we retain workers, that won’t take care of unemployment chronically in some areas–but it’s a start. We aren’t able overnight to solve all the problems this country faces–but is that any reason to say, let’s not even try? That’s what we’re going to do today–we are trying. We are trying.

上記は、

14:30

Still in the area of fiscal policy, let me say a word about deficits. The myth persists that Federal deficits create inflation and budget surpluses prevent it. Yet sizeable budget surpluses after the war did not prevent inflation, and persistent deficits for the last several years have not upset our basic price stability. Obviously deficits are sometimes dangerous--and so are surpluses. But honest assessment plainly requires a more sophisticated view than the old and automatic cliche that deficits automatically bring inflation.

それでも財政政策の分野では、赤字について一言申し上げます。 神話は、連邦赤字がインフレを生み出し、予算の黒字がそれを防ぐと主張し続けています。 しかし、戦後の巨額の財政黒字はインフレを防いでおらず、過去数年間の持続的な財政赤字は基本的な物価の安定を妨げませんでした。 明らかに赤字は時には危険であり、黒字もそうです。 しかし、正直な評価には、赤字が自動的にインフレをもたらすという従来の自動決まり文句よりも洗練された見解が明らかに必要です。

Commencement Address at Yale University.

President Griswold, members of the faculty, graduates and their families, ladies and gentlemen:

Let me begin by expressing my appreciation for the very deep honor that you have conferred upon me. As General de Gaulle occasionally acknowledges America to be the daughter of Europe, so I am pleased to come to Yale, the daughter of Harvard. It might be said now that I have the best of both worlds, a Harvard education and a Yale degree.

I am particularly glad to become a Yale man because as I think about my troubles, I find that a lot of them have come from other Yale men. Among businessmen, I have had a minor disagreement with Roger Blough, of the law school class of 1931, and I have had some complaints, too, from my friend Henry ford, of the class of 1940. In journalism I seem to have a difference with John Hay Whitney, of the class of 1926—and sometimes I also displease Henry Luce of the class of 1920, not to mention also William F. Buckley, Jr., of the class of 1950. I even have some trouble with my Yale advisers. I get along with them, but I am not always sure how they get along with each other.

I have the warmest feelings for Chester Bowles of the class of 1924, and for Dean Acheson of the class of 1915, and my assistant, McGeorge Bundy, of the class of 1940. But I am not 100 percent sure that these three wise and experienced Yale men wholly agree with each other on every issue.

So this administration which aims at peaceful cooperation among all Americans has been the victim of a certain natural pugnacity developed in this city among Yale men. Now that I, too, am a Yale man, it is time for peace. Last week at West Point, in the historic tradition of that Academy, I availed myself of the powers of Commander in Chief to remit all sentences of offending cadets. In that same spirit, and in the historic tradition of Yale, let me now offer to smoke the clay pipe of friendship with all of my brother Ells, and I hope that they may be friends not only with me but even with each other.

In any event, I am very glad to be here and as a new member of the club, I have been checking to see what earlier links existed between the institution of the Presidency and Yale. I found that a member of the class of 1878, William Howard Taft, served one term in the White House as preparation for becoming a member of this faculty. And a graduate of 1804, John C. Calhoun, regarded the Vice Presidency, quite naturally, as too lowly a status for a Yale alumnus—and became the only man in history to ever resign that office.

Calhoun in 1804 and Taft in 1878 graduated into a world very different from ours today. They and their contemporaries spent entire careers stretching over 40 years in grappling with a few dramatic issues on which the Nation was sharply and emotionally divided, issues that occupied the attention of a generation at a time: the national bank, the disposal of the public lands, nullification or union, freedom or slavery, gold or silver. Today these old sweeping issues very largely have disappeared. The central domestic issues of our time are more subtle and less simple. They relate not to basic clashes of philosophy or ideology but to ways and means of reaching common goals—to research for sophisticated solutions to complex and obstinate issues. The world of Calhoun, the world of Taft had its own hard problems and notable challenges. But its problems are not our problems. Their age is not our age. As every past generation has had to disenthrall itself from an inheritance of truisms and stereotypes, so in our own time we must move on from the reassuring repetition of stale phrases to a new, difficult, but essential confrontation with reality.

For the great enemy of the truth is very often not the lie—deliberate, contrived, and dishonest—but the myth—persistent, persuasive, and unrealistic. Too often we hold fast to the clichés of our forebears. We subject all facts to a prefabricated set of interpretations. We enjoy the comfort of opinion without the discomfort of thought.

Mythology distracts us everywhere—in government as in business, in politics as in economics, in foreign affairs as in domestic affairs. But today I want to particularly consider the myth and reality in our national economy. In recent months many have come to feel, as I do, that the dialog between the parties—between business and government, between the government and the public—is clogged by illusion and platitude and fails to reflect the true realities of contemporary American society.

I speak of these matters here at Yale because of the self-evident truth that a great university is always enlisted against the spread of illusion and on the side of reality. No one has said it more clearly than your President Griswold: "Liberal learning is both a safeguard against false ideas of freedom and a source of true ones." Your role as university men, whatever your calling, will be to increase each new generation's grasp of its duties.

There are three great areas of our domestic affairs in which, today, there is a danger that illusion may prevent effective action. They are, first, the question of the size and the shape of government's responsibilities; second, the question of public fiscal policy; and third, the matter of confidence, business confidence or public confidence, or simply confidence in America. I want to talk about all three, and I want to talk about them carefully and dispassionately—and I emphasize that I am concerned here not with political debate but with finding ways to separate false problems from real ones.

If a contest in angry argument were forced upon it, no administration could shrink from response, and history does not suggest that American Presidents are totally without resources in an engagement forced upon them because of hostility in one sector of society. But in the wider national interest, we need not partisan wrangling but common concentration on common problems. I come here to this distinguished university to ask you to join in this great task.

Let us take first the question of the size and shape of government. The myth here is that government is big, and bad—and steadily getting bigger and worse. Obviously this myth has some excuse for existence. It is true that in recent history each new administration has spent much more money than its predecessor. Thus President Roosevelt outspent President Hoover, and with allowances for the special case of the Second World War, President Truman outspent President Roosevelt. Just to prove that this was not a partisan matter, President Eisenhower then outspent President Truman by the handsome figure of $182 billion. It is even possible, some think, that this trend may continue.

But does it follow from this that big government is growing relatively bigger? It does not—for the fact is for the last 15 years, the Federal Government—and also the Federal debt—and also the Federal bureaucracy-have grown less rapidly than the economy as a whole. If we leave defense and space expenditures aside, the Federal Government since the Second World War has expanded less than any other major sector of our national life—less than industry, less than commerce, less than agriculture, less than higher education, and very much less than the noise about big government.

The truth about big government is the truth about any other great activity—it is complex. Certainly it is true that size brings dangers—but it is also true that size can bring benefits. Here at Yale which has contributed so much to our national progress in science and medicine, it may be proper for me to mention one great and little noticed expansion of government which has brought strength to our whole society—the new role of our Federal Government as the major patron of research in science and in medicine. Few people realize that in 1961, in support of all university research in science and medicine, three dollars out of every four came from the Federal Government. I need hardly point out that this has taken place without undue enlargement of Government control—that American scientists remain second to none in their independence and in their individualism.

I am not suggesting that Federal expenditures cannot bring some measure of control. The whole thrust of Federal expenditures in agriculture have been related by purpose and design to control, as a means of dealing with the problems created by our farmers and our growing productivity. Each sector, my point is, of activity must be approached on its own merits and in terms of specific national needs. Generalities in regard to federal expenditures, therefore, can be misleading—each case, science, urban renewal, education, agriculture, natural resources, each case must be determined on its merits if we are to profit from our unrivaled ability to combine the strength of public and private purpose.

Next, let us turn to the problem of our fiscal policy. Here the myths are legion and the truth hard to find. But let me take as a prime example the problem of the Federal budget. We persist in measuring our federal fiscal integrity today by the conventional or administrative budget—with results which would be regarded as absurd in any business firm—in any country of Europe—or in any careful assessment of the reality of our national finances. The administrative budget has sound administrative uses. But for wider purposes it is less helpful. It omits our special trust funds and the effect that they have on our economy; it neglects changes in assets or inventories. It cannot tell a loan from a straight expenditure—and worst of all it cannot distinguish between operating expenditures and long term investments.

This budget, in relation to the great problems of Federal fiscal policy which are basic to our economy in 1962, is not simply irrelevant; it can be actively misleading. And yet there is a mythology that measures all of our national soundness or unsoundness on the single simple basis of this same annual administrative budget. If our Federal budget is to serve not the debate but the country, we must and will find ways of clarifying this area of discourse.

Still in the area of fiscal policy, let me say a word about deficits. The myth persists that Federal deficits create inflation and budget surpluses prevent it. Yet sizeable budget surpluses after the war did not prevent inflation, and persistent deficits for the last several years have not upset our basic price stability. Obviously deficits are sometimes dangerous—and so are surpluses. But honest assessment plainly requires a more sophisticated view than the old and automatic cliché that deficits automatically bring inflation.

There are myths also about our public debt. It is widely supposed that this debt is growing at a dangerously rapid rate. In fact, both the debt per person and the debt as a proportion of our gross national product have declined sharply since the Second World War. In absolute terms the national debt since the end of World War II has increased only 8 percent, while private debt was increasing 305 percent, and the debts of State and local governments—on whom people frequently suggest we should place additional burdens—the debts of State and local governments have increased 378 percent. Moreover, debts, public and private, are neither good nor bad, in and of themselves. Borrowing can lead to over-extension and collapse—but it can also lead to expansion and strength. There is no single, simple slogan in this field that we can trust.

Finally, I come to the problem of confidence. Confidence is a matter of myth and also a matter of truth—and this time let me take the truth of the matter first.

It is true—and of high importance—that the prosperity of this country depends on the assurance that all major elements within it will live up to their responsibilities. If business were to neglect its obligations to the public, if labor were blind to all public responsibility, above all, if government were to abandon its obvious—and statutory—duty of watchful concern for our economic health-if any of these things should happen, then confidence might well be weakened and the danger of stagnation would increase. This is the true issue of confidence.

But there is also the false issue—and its simplest form is the assertion that any and all unfavorable turns of the speculative wheel—however temporary and however plainly speculative in character—are the result of, and I quote, "a lack of confidence in the national administration." This I must tell you, while comforting, is not wholly true. Worse, it obscures the reality-which is also simple. The solid ground of mutual confidence is the necessary partnership of government with all of the sectors of our society in the steady quest for economic progress.

Corporate plans are not based on a political confidence in party leaders but on an economic confidence in the Nation's ability to invest and produce and consume. Business had full confidence in the administrations in power in 1929, 1954, 1958, and 1960—but this was not enough to prevent recession when business lacked full confidence in the economy. What matters is the capacity of the Nation as a whole to deal with its economic problems and its opportunities.

The stereotypes I have been discussing distract our attention and divide our effort. These stereotypes do our Nation a disservice, not just because they are exhausted and irrelevant, but above all because they are misleading-because they stand in the way of the solution of hard and complicated facts. It is not new that past debates should obscure present realities. But the damage of such a false dialogue is greater today than ever before simply because today the safety of all the world—the very future of freedom-depends as never before upon the sensible and clearheaded management of the domestic affairs of the United States.

The real issues of our time are rarely as dramatic as the issues of Calhoun. The differences today are usually matters of degree. And we cannot understand and attack our contemporary problems in 1962 if we are bound by traditional labels and worn-out slogans of an earlier era. But the unfortunate fact of the matter is that our rhetoric has not kept pace with the speed of social and economic change. Our political debates, our public discourse—on current domestic and economic issues—too often bear little or no relation to the actual problems the United States faces.

What is at stake in our economic decisions today is not some grand warfare of rival ideologies which will sweep the country with passion but the practical management of a modern economy. What we need is not labels and clichés but more basic discussion of the sophisticated and technical questions involved in keeping a great economic machinery moving ahead.

The national interest lies in high employment and steady expansion of output, in stable prices, and a strong dollar. The declaration of such an objective is easy; their attainment in an intricate and interdependent economy and world is a little more difficult. To attain them, we require not some automatic response but hard thought. Let me end by suggesting a few of the real questions on our national agenda.

First, how can our budget and tax policies supply adequate revenues and preserve our balance of payments position without slowing up our economic growth?

Two, how are we to set our interest rates and regulate the flow of money in ways which will stimulate the economy at home, without weakening the dollar abroad? Given the spectrum of our domestic and international responsibilities, what should be the mix between fiscal and monetary policy?

Let me give several examples from my experience of the complexity of these matters and how political labels and ideological approaches are irrelevant to the solution.

Last week, a distinguished graduate of this school, Senator Proxmire, of the class of 1938, who is ordinarily regarded as a liberal Democrat, suggested that we should follow in meeting our economic problems a stiff fiscal policy, with emphasis on budget balance and an easy monetary policy with low interest rates in order to keep our economy going. In the same week, the Bank for International Settlement in Basel, Switzerland, a conservative organization representing the central bankers of Europe suggested that the appropriate economic policy in the United States should be the very opposite; that we should follow a flexible budget policy, as in Europe, with deficits when the economy is down and a high monetary policy on interest rates, as in Europe, in order to control inflation and protect goals. Both may be right or wrong. It will depend on many different factors.

The point is that this is basically an administrative or executive problem in which political labels or clichés do not give us a solution.

A well-known business journal this morning, as I journeyed to New Haven, raised the prospects that a further budget deficit would bring inflation and encourage the flow of gold. We have had several budget deficits beginning with a $12 1/2 billion deficit in 1958, and it is true that in the fall of 1960 we had a gold dollar loss running at $5 billion annually. This would seem to prove the case that a deficit produces inflation and that we lose gold, yet there was no inflation following the deficit of 1958 nor has there been inflation since then.

Our wholesale price index since 1958 has remained completely level in spite of several deficits, because the loss of gold has been due to other reasons: price instability, relative interest rates, relative export-import balances, national security expenditures—all the rest.

Let me give you a third and final example. At the World Bank meeting in September, a number of American bankers attending predicted to their European colleagues that because of the fiscal 1962 budget deficit, there would be a strong inflationary pressure on the dollar and a loss of gold. Their predictions of inflation were shared by many in business and helped push the market up. The recent reality of non-inflation helped bring it down. We have had no inflation because we have had other factors in our economy that have contributed to price stability.

I do not suggest that the Government is right and they are wrong. The fact of the matter is in the Federal Reserve Board and in the administration this fall, a similar view was held by many well-informed and disinterested men that inflation was the major problem that we would face in the winter of 1962. But it was not. What I do suggest is that these problems are endlessly complicated and yet they go to the future of this country and its ability to prove to the world what we believe it must prove.

I am suggesting that the problems of fiscal and monetary policies in the sixties as opposed to the kinds of problems we faced in the thirties demand subtle challenges for which technical answers, not political answers, must be provided. These are matters upon which government and business may and in many cases will disagree. They are certainly matters that government and business should be discussing in the most dispassionate, and careful way if we to maintain the kind of vigorous upon which our country depends.

How can we develop and sustain strong and stable world markets for basic commodities without unfairness to the consumer and without undue stimulus to the producer? How can we generate the buying power which can consume what we produce on our farms and in our factories? How can we take advantage of the miracles of automation with the great demand that it will put upon highly skilled labor and yet offer employment to the half million of unskilled school dropouts each year who enter the labor market, eight million of them in the 1960's?

How do we eradicate the barriers which separate substantial minorities of our citizens from access to education and employment on equal terms with the rest?

How, in sum, can we make our free economy work at full capacity—that is, provide adequate profits for enterprise, adequate wages for labor, adequate utilization of plant, and opportunity for all?

These are the problems that we should be talking about—that the political parties and the various groups in our country should be discussing. They cannot be solved by incantations from the forgotten past. But the example of Western Europe shows that they are capable of solution—that governments, and many of them are conservative governments, prepared to face technical problems without ideological preconceptions, can coordinate the elements of a national economy and bring about growth and prosperity—a decade of it.

Some conversations I have heard in our own country sound like old records, long-playing, left over from the middle thirties. The debate of the thirties had its great significance and produced great results, but it took place in a different world with different needs and different tasks. It is our responsibility today to live in our own world, and to identify the needs and discharge the tasks of the 1960's.

If there is any current trend toward meeting present problems with old clichés, this is the moment to stop it—before it lands us all in a bog of sterile acrimony.

Discussion is essential; and I am hopeful that the debate of recent weeks, though up to now somewhat barren, may represent the start of a serious dialog of the kind which has led in Europe to such fruitful collaboration among all the elements of economic society and to a decade of unrivaled economic progress. But let us not engage in the wrong argument at the wrong time between the wrong people in the wrong country-while the real problems of our own time grow and multiply, fertilized by our neglect.

Nearly 150 years ago Thomas Jefferson wrote, "The new circumstances under which we are placed call for new words, new phrases, and for the transfer of old words to new objects." New words, new phrases, the transfer of old words to new objects-that is truer today than it was in the time of Jefferson, because the role of this country is so vastly more significant. There is a show in England called "Stop the World, I Want to Get Off." You have not chosen to exercise that option. You are part of the world and you must participate in these days of our years in the solution of the problems that pour upon us, requiring the most sophisticated and technical judgment; and as we work in consonance to meet the authentic problems of our times, we will generate a vision and an energy which will demonstrate anew to the world the superior vitality and the strength of the free society.

Note: The President spoke at 11:30 a.m. on the Old Campus after being awarded an honorary degree of Doctor of Laws. His opening words referred to A. Whitney Griswold, President of the University.

John F. Kennedy, Commencement Address at Yale University. Online by Gerhard Peters and John T. Woolley, The American Presidency Project https://www.presidency.ucsb.edu/node/237153

https://translate.google.com/translate?sl=en&tl=ja&u=https%3A%2F%2Fwww.jfklibrary.org%2Farchives%2Fother-resources%2Fjohn-f-kennedy-speeches%2Fyale-university-19620611

1962年6月11日

____

Tobin on JFK

https://nam-students.blogspot.com/2019/11/tobin-on-jfk.html@

ケネディ大統領はMMTerだった

(1962年のトービンとの会話より)

| Stephanie Kelton (@StephanieKelton) |

|

@boes_ So, JFK asked Nobel laureate James Tobin, “Is there any economic limit to the size of the deficit?”, and Tobin responded, “the only limit really is inflation.

| |

| Matthew B (@boes_) |

|

@PureGuesswork Judith Russell's Economics, Bureaucracy, and Race. She cites this: jfklibrary.org/sites/default/…

| |

https://www.amazon.co.jp/gp/product/0231112521/

https://www.amazon.com/gp/product/023111253X/

Economics, Bureaucracy, and Race: How Keynesians Misguided the War on Poverty

Council of Economic Advisers Oral History Interview –JFK#1, 08/1/1964

Administrative Information

Creator: Walter Heller, Kermit Gordon, James Tobin, Gardner Ackley, Paul Samuelson Interviewer: Joseph Pechman Date of Interview: August 1, 1964 Place of Interview: Fort Ritchie, Maryland Length: 452 pages, one addendum* *Please note: There is no page 83, 84, or 210. Mr. Tobin revised the original transcript before it was proofread by the Kennedy Library staff. He elaborated on specific entries in the transcript. His additions have been included in the transcript where appropriate; his other notes appear in Appendix A and are footnoted in the text.

https://www.jfklibrary.org/sites/default/files/archives/JFKOH/Council%20of%20Economic%20Advisers/JFKOH-CEA-01/JFKOH-CEA-01-TR.pdf

p.276

p.276

APPENDIX A

NOTE 1

I had left the Council of Economic Advisors to return to Yale as of August 1, 1962. Later, in the fall, I was in Washington consulting for the Council. Walter Heller was kind enough to ask for an appointment for me to see JFK, and the president was kind enough to grant it. I guess it was only the second or third time I had an interview with the president by myself. This was a memorable one. The president was extremely cordial, informal, and friendly, calling me “Jim”, a practice he had acquired only late in my service on the CEA. After joshing me about the leisure and high income of the academic life to which I had returned, he wanted to talk about economics, economic theory indeed. He wanted to ask me some questions, but it turned out he wanted to give his own answers to them too and see if I agreed, almost as if he were showing how well he had learned his lessons. So he did most of the talking, and my own interventions were largely to confirm that his own answers to his questions were right. There were two subjects; the budget deficit and gold. On the first, he said, “Is there any economic limit to the deficit? I know of course about the political limits. People say you can‟t increase the national debt too fast or too much. We‟re always answering that the debt isn‟t growing relative to national income. But is there any economic limit on the size of the debt in relation to national income? There isn‟t, is there? That‟s just a political answer, isn‟t it? Well, what is the limit?” I said the only limit is really inflation. He grabbed at that. “That‟s right, isn‟t it? The deficit can be any size, the debt can be any size, provided they don‟t cause inflation.

Everything else is just talk.” We had a similar conversation about gold and the balance of payments: “Why do we worry about a deficit in the balance of payments? It‟s only because we might lose gold, that so? And what do we care about gold? It isn‟t worth anything, in itself, is it?” I assured him it was not, that its value derived wholly from the willingness of nations, especially the U.S., to transform gold into their currencies. “We could, if we wanted to, run the world without gold? And wouldn‟t that be more sensible? Wasn‟t it just the irrational prejudices of bankers that kept us tied to gold? We don‟t have any real national, or international, interest in it, do we?”

I don‟t claim these to be exact quotations, but this was the gist of the conversation. He spent more than half an hour from a busy day on this conversation, and he was obviously having a good time. Obviously too, he and I both recognized that the talk was an academic one, divorced from the day to day policy decisions where he realized so keenly that the political and ideological myths from which he was showing his intellectual liberation were so constraining and compelling. I was extremely gratified, of course, because there were points he had certainly not understood in 1961 and points I had tried persistently to make orally and in writing for almost two years. Maybe he was just showing that he understood my points, without indicating that he agreed with them. But that was definitely not the tone of the conversation. Rather it was that he understood them and accepted them but that he was, as I well knew, hemmed in. His next appointment was kept waiting, and when Ken O‟Donnell finally made him break our interview off, he said good-bye in a most cordial and friendly way.

付録A注1 1962年8月1日現在、私はイェールに戻るために経済顧問評議会を離れていました。その後、秋にワシントンで評議会のコンサルティングを行いました。ウォルター・ヘラーは私にJFKを見るためのアポイントメントをお願いするのに十分親切でした、そして大統領はそれを与えるのに十分親切でした。私は大統領とのインタビューを自分で行ったのは2回目か3回目だったと思います。これは記憶に残るものでした。大統領は非常に誠実で、非公式で、友好的で、私を「ジム」と呼んでいました。これは、CEAでの私の奉仕の後半で習った練習です。帰国した学業の余暇と高収入について私に冗談を言った後、彼は経済学、経済理論について話をしたかったのです。彼は私にいくつかの質問をしたかったのですが、彼も自分の答えを与えて、私が同意したかどうかを確認したかったのです。だから彼はほとんどの話をしました、そして私自身の介入は主に彼の質問に対する彼自身の答えが正しいことを確認することでした。 2つの科目がありました。財政赤字と金。最初に、彼は言った、「赤字に経済的な制限はありますか?もちろん、政治的な限界について知っています。人々は、国の債務をあまりにも早く、またはあまりにも増やすことはできないと言います。私たちは常に、債務が国民所得に比べて増加していないと答えています。しかし、国民所得に関連して債務の規模に経済的な制限はありますか?ありませんか?それは単なる政治的な答えですね。さて、限界は何ですか?」

私は、唯一の限界は本当にインフレであると言いました。彼はそれをつかみました。 「そうですよね?赤字はあらゆる規模になり得、債務はインフレを引き起こさない限り、あらゆる規模になり得る。金と国際収支についても同様の会話がありました。「なぜ国際収支の赤字を心配するのですか?金を失う可能性があるからです。そして、私たちは金について何を気にしますか?それ自体は何の価値もありませんか?」

私は、その価値は、金を通貨に変換するという国家、特に米国の意欲に完全に由来するものではないと確信しました。 「もし望むなら、金なしで世界を走らせることができるだろうか?そして、それはより賢明ではないでしょうか?金に縛られたのは銀行家の不合理な偏見だけではなかったのでしょうか?私たちはこれらを正確な引用であると主張していませんが、これは会話の要点でした。彼はこの会話に忙しい1日から30分以上を費やし、明らかに楽しい時間を過ごしていました。明らかに、彼も私も、この講演は学術的なものであり、彼が知的解放を示していた政治的およびイデオロギー的神話が非常に制約的で説得力があることを非常に鋭く認識した日々の政策決定から離婚したことを認識しました。もちろん、1961年に彼が確実に理解していなかった点や、ほぼ2年間口頭および書面で頑張っていた点があったため、私は非常に満足していました。たぶん彼は、彼が同意したことを示すことなく、私のポイントを理解していることを示していたのでしょう。しかし、それは間違いなく会話のトーンではありませんでした。むしろ、彼はそれらを理解し、受け入れたが、彼は、私がよく知っているように、縁取られていた。彼の次の任命は待たされ続け、ケン・オドネルがついにインタビューを中断させたとき、彼はさよならを言った最も心のこもったフレンドリーな方法。

イエレン、トービン、ケネディそして… - シェイブテイル日記2

トービンとは - コトバンク

ジェームズ・トービン - Wikipedia

大統領経済諮問委員会 - Wikipedia

トランプ氏、ケネディ大統領暗殺資料の部分公開を承認 - BBC ...

経済学者の(?)トービンがケネディ大統領にスカウト - 質問!ITmedia

故ケネディ元大統領暗殺事件、単独犯説をくつがえす新たな証拠を ...

トランプの政策はレーガノミクスと異なる - 東洋経済オンライン

エール大卒イエレン・浜田両氏、恩師の理論を量的緩和に応用 ...

高まるイエレンFRB副議長の影響力、初の女性議長誕生の観測も ...

イエレン、トービン、ケネディそして…

現代は、故トービン氏が活躍した時代と何が異なっているのでしょうか。

少々古い本ですが、W.カール・ビブン氏の書籍にその答えが書かれていました。

停滞した景気を刺激するためには型破りな措置もいとわないイエレン氏の態度は、故ジェームズ・トービン氏の秘蔵っ子として受け継いだ知的遺産を反映している。トービン氏はノーベル経済学賞を受賞したエール大学教授で、ケネディ大統領やジョンソン大統領にも助言を提供していた。トービン氏の功績は、大恐慌時代の英経済学者ジョン・メイナード・ケインズの考え方を軸にしており、高失業率や貧困などの問題に政府が対処することを支持していた。

イエレン氏は1971年にエール大学で経済学の博士号を取得したが、その際に論文のアドバイザーを務めたのがトービン氏だ。イエレン氏は大学時代は失業のコストと原因を専門に学んだ。政府と特に中央銀行は失業率の低下に貢献できる、という師の信念をイエレン氏は受け入れた。

イエレン氏はトービン氏が02年に死去した際、「高度な知的水準を満たすだけでなく、人類の幸福度を高める仕事」をするようトービン氏が教え子を励ましていた、とエール・デーリー・ニュース紙に語った。次期FRB議長指名のジャネット・イエレン氏とはどんな人物か WSJ 2013年10月9日

ジョン・F・ケネディは「米国を再び活性化させよう」をスローガンに、1960年の大統領選挙キャンペーンを展開した。その経済戦略の最高顧問として、ケネディはミネソタ大学のウォルター・ヘラーを選んだ。

…

ケネディ陣営に加わることになった20余年後、ヘラーは指導的地位のケインズ経済学者となっており、その生涯を通じて、彼はケインズ学派の明白な代表者だった。

…

ケネディは、ヘラーをCEA委員長に指名した。CEAは1946年の雇用法によって設立された、三人のエコノミストから構成される委員会であり、年次経済報告書を準備し、経済政策問題について大統領に一般的なアドバイスを行うという役割をになう。

…

ケネディは、ウォルター・ヘラーをCEA委員長に指名した。委員長を補佐するCEAの他の二人の委員とスタッフは、専門的で、有能なエコノミスト集団から選ばれた。後にノーベル経済学賞を受賞するテル大学のジェームス・トービン、スタンフォード大学のケネス・アローそしてMITのロバート・ソローだ。ヘラー、トービン、ソローそしてミシガン大学のガードナー・アグリーは米国経済学会会長となっている。

CEAの正式なメンバーではなかったが、ポール・サミニルソンも非公式の顧問として参加した。

CEAのメンバーの見方によれば、彼らは教育係だった。大統領自身を教育するだけでなく、経済問題についての新しい考え方を議会や一般国民に広めることが、彼らの役割だった。ジェームス・卜−ビンは「ケネディは、マクロ経済問題についてしっかりした理解も確信もなくオフィスにやってきた。彼は大統領就任時には経済学にまったく無知だったが、その後、CEAのビルでは経済学に関心を持つようになり、教授たちにとってすぐれた生徒となった」と述べている。*1

一般の人々にとって均衡予算という考え方は、1960年代初期には依然として真実だった。そして赤字予算という考えを推進することは大胆な行為だったのである。その演説の草稿を書いたヘラーは、

「大統領閣下。私はこれまで他の大統領が決していわなかったことをこの草稿で大統領、あなたにいってほしいのです。 それは、ある状況下での赤字予算は善いことだということです。いいかえれば、赤字には建設的なものとそうでないものがあり、それは状況次第なのだということです。 そのようにいうと大統領は、『わかった。もう一度読んでみよう』といい、彼はそれを読んだ」。

へラーはさらに続けて「大統領は一つのセンテンスについて表現をおだやかにし、そして草稿を私に返して『さあ、やろう』といった」と語っている。 *2

ニューエコノミクス成功のシンボルの一人として、1965年の『タイム』誌の最終号のカバーストーリーの主役に、他ならぬジョン・メイナード・ケインズが選ばれたのだ。 タイム誌はケインズ経済学について、次のように謳い上げた。「ケインズの死から約20年を経た現在、彼の理論は世界中の自由世界の経済、なかんずく最も富み、最も活気に満ちた米国の経済に多大の影響を与えている。ワシントンで米国の経済政策を練り上げている人々は、戦後の激しい景気変動を回避するためだけでなく、すばらしい経済成長を実現し、めざましい物価安定を達成するために、ケインズ主義を用いている。いまや、ケインズと彼の考え方は、むろん一部の人々にとっては神経をいら立たせるものだが、広範に受け入れられてきている。そして、ケインズ経済学は大学においては新しい正統派になり、ワシントンでは経済運営の基本になった。ケインズの考えは非常に独創的かつ説得的であり、ケインズはいまや、アダム・スミスおよびカール・マルクスとならぶ、歴史上最も重要な経済学者の一人として位置づけられている」。

ケインズ政策とベトナム戦争とは無関係ではない。戦争が引き起こした不均衡はケインジアンの実験のリズムを狂わせた。つまり、ジョンソン大統領は、すでにはじまっていた力強い経済の拡張と野心的な「偉大な社会」計画に大幅な軍事支出を加え、経済の供給力を上回る過大な需要を発生させたのだった。その結果は、十年以上に及ぶインフレ経済だった。

実のところ、ジョンソンの対外政策が引き起こした緊張は、ケインジアン的な政策によって解決可能だった。例えば、増加した軍事支出に見合う政府支出の削減や追加政府支出に見合う増税を行い、民間から購買力を吸い上げればよい。 ジョンソン政権の経済顧問は大統領にこれら不人気な政策をとるように進言したが、ベトナム戦争に政治生命を賭けていたジョンソン大統領は、それを拒否した。こうして経済的困難が広がるにつれて、学界でのケインズ経済学の評価もしだいに傷ついていった。ケインズの時代は、まさにその絶頂期に歴史の一部となったのだ。現在、経済学者の間で経済の動きを説明する基本モデルをめぐって繰り広げられている論争を目の当たりにすると、元60年代前半に支配的だった経済学者たちのコンセンサスと頑固なまでの信頼感に、ある種の郷愁を禁じえない。それはまさに、キャメロット(円卓の騎士)伝説にもたとえるべき、ほんの短い輝ける瞬間だった。*3

Who Killed John Maynard Keynes?: Conflicts in the Evolution of ...

返信削除https://books.google.co.jp › books

W. Carl Biven - 1989 - スニペット表示

Conflicts in the Evolution of Economic Policy W. Carl Biven. and unemployment. ... to budget policy. In a widely referred to commencement speech that Kennedy delivered at Yale University in 1962, he called for a rethinking of the national ...

返信削除ケネディの1962年演説

https://youtu.be/PznXIiGe9rI?t=5m52s

「真実にとっての最大の敵はしばしば嘘~考えぬかれたり、工夫されたり、不正直な~ではなく、神話~持続的、浸透的、非現実的~である。本日、私は米国経済における神話と現実についてとくと考えてみたい」

『誰がケインズを殺したか?』で引用

ご照会の項目の掲載箇所をお知らせします。

返信削除項目名 13.ユーモアにまぎらす苦衷 エール大学卒業式における演説(1962年6月)

ページ pp.97-103

『ケネディは生きている : 名演説21篇とその背景』

黒田和雄 編. 原書房, 1964 【当館請求記号:Y88-13】

URL:http://id.ndl.go.jp/bib/000001053064

利用案内 当該資料は、著作権法の規定により、著作物の一部分(当館では著作物の半分以下と解釈)に限り、複写サービスのお申込みが可能です。

一項目でひとつの著作物とみなされますので、複写ができるのは当該項目の半分までとなります。

この後、複写のお申し込みが必要です。

国立国会図書館オンライン(https://ndlonline.ndl.go.jp/)から

遠隔複写をお申し込みください。

なお、手順2以降の手続き方法については、

国立国会図書館オンラインヘルプ(https://ndlonline.ndl.go.jp/static/ja/help-1/index.html)

に詳細が記載されています。

1.回答欄記載のURLをクリックし、「所蔵一覧」からお求めの資料の書誌情報を選択してください。

2.「遠隔複写」ボタンをクリックし、複写箇所の入力をしてください。

〇複写申込画面の開き方

※「4-1.書誌情報」から、「4-2. 所蔵情報とカート追加」までをご覧ください。

https://ndlonline.ndl.go.jp/static/ja/help-4/index.html#menu4-1

3.複写申込画面で、回答に記載されている掲載情報を入力し、お申し込みください。

〇複写申込画面の入力方法

※「6A. 申込方法(個人) 6A-4. 遠隔複写」をご覧ください。

https://ndlonline.ndl.go.jp/static/ja/help-6a/index.html#menu6a-4

発送方法や料金など、当館の遠隔複写制度に関する全般的な情報は、以下に掲載されています。

当館ホームページのトップ>複写サービス> 遠隔複写サービス

http://www.ndl.go.jp/jp/service/copy3.html

※(ご注意)URLをクリックしてもエラーになる場合

同一ブラウザで国立国会図書館オンラインを開いていた場合、直前に開いていた画面の検索対象に当該URLの資料が含まれないときは、エラーとなり画面が表示されません。

お手数をおかけしますが、検索設定をご確認いただくか、あるいはご自身で検索をお願いいたします。

https://ndlonline.ndl.go.jp/#!/detail/R300000001-I000001053064-00

返信削除

返信削除https://youtu.be/VQuNuHqKJnM

ケネディ1962/5/20

17:54

"[What] we are now talking about doing, most of the countries of Europe did years ago."

JFK'S HEALTH CARE SPEECH FROM MADISON SQUARE GARDEN (MAY 20, 1962)

返信削除youtu.be/VQuNuHqKJnM?t=…

Transcript of President John F. Kennedy’s address at Medical Care for the Aged rally, New York, 20 May 1962

stellatex.tumblr.com/post/188798403…

13.ユーモアにまぎらす苦衷 エール大学卒業式における演説(1962年6月)

返信削除ページ pp.97-103

https://ndlonline.ndl.go.jp/#!/detail/R300000001-I000001053064-00

返信削除ケネディは生きている : 名演説21篇とその背景

黒田和雄 編 原書房 1964

【Live】れいわ新選組代表山本太郎街頭記者会見 大阪駅 2019年12月5日

返信削除https://youtu.be/b5KN9vRqfqE

ケネディとトービンの会話を紹介

バージョンアップしている

https://1.bp.blogspot.com/-XGBPYYnW8iU/Xejwb47yG5I/AAAAAAABpbU/3mKP_15Cs-UXWRm9e2tUkbFX1_BXH-wiACLcBGAsYHQ/s1600/IMG_6082.PNG

13.ユーモアにまぎらす苦衷 エール大学卒業式における演説(1962年6月)

返信削除ページ pp.97-103

全訳ではなく紹介

https://ndlonline.ndl.go.jp/#!/detail/R300000001-I000001053064-00

ケネディは生きている : 名演説21篇とその背景

黒田和雄 編 原書房 1964

【Live】れいわ新選組代表山本太郎街頭記者会見 大阪駅 2019年12月5日

返信削除https://youtu.be/b5KN9vRqfqE

ケネディとトービンの会話を紹介

バージョンアップしている

https://1.bp.blogspot.com/-XGBPYYnW8iU/Xejwb47yG5I/AAAAAAABpbU/3mKP_15Cs-UXWRm9e2tUkbFX1_BXH-wiACLcBGAsYHQ/s1600/IMG_6082.PNG

https://www.jfklibrary.org/sites/default/files/archives/JFKOH/Council%20of%20Economic%20Advisers/JFKOH-CEA-01/JFKOH-CEA-01-TR.pdf

p.276

これを訳したのだ

優秀なスタッフがついている

【Live】れいわ新選組代表山本太郎街頭記者会見 大阪駅 2019年12月5日

返信削除https://youtu.be/b5KN9vRqfqE

ケネディとトービンの会話を紹介

バージョンアップしている

https://i.gyazo.com/ee1bdd98b34e213b3d175ba587d2d140.png

https://www.jfklibrary.org/sites/default/files/archives/JFKOH/Council%20of%20Economic%20Advisers/JFKOH-CEA-01/JFKOH-CEA-01-TR.pdf

p.276

これを訳したのだ

優秀なスタッフがついている

返信削除Economic Advisers Oral History Interview –JFK#1, 08/1/1964

https://www.jfklibrary.org/sites/default/files/archives/JFKOH/Council%20of%20Economic%20Advisers/JFKOH-CEA-01/JFKOH-CEA-01-TR.pdf

p.276

これを訳したのだ

優秀なスタッフがついている

【Live】れいわ新選組代表山本太郎街頭記者会見 大阪駅 2019年12月5日

返信削除https://youtu.be/b5KN9vRqfqE

ケネディとトービンの会話を紹介

バージョンアップしている

https://i.gyazo.com/ee1bdd98b34e213b3d175ba587d2d140.png

https://www.jfklibrary.org/sites/default/files/archives/JFKOH/Council%20of%20Economic%20Advisers/JFKOH-CEA-01/JFKOH-CEA-01-TR.pdf

p.276

https://1.bp.blogspot.com/-nG7di547cSo/XcswT5wgXEI/AAAAAAABo7w/Du8xyBA5DhUy2nKWEkvNmLwoKGRrpr-ywCLcBGAsYHQ/s1600/IMG_4329.PNG

これを訳したのだ

優秀なスタッフがついている

参照:

イエレン、トービン、ケネディそして… - シェイブテイル日記2

http://shavetail2.hateblo.jp/entry/20150129

上で引用されているように、

「誰がケインズを殺したか」 W・カール・ビブン 斎藤精一郎訳 第4章が参考になる

【Live】れいわ新選組代表山本太郎街頭記者会見 大阪駅 2019年12月5日

返信削除https://youtu.be/b5KN9vRqfqE

ケネディとトービンの会話を紹介

バージョンアップしている

https://i.gyazo.com/ee1bdd98b34e213b3d175ba587d2d140.png

https://www.jfklibrary.org/sites/default/files/archives/JFKOH/Council%20of%20Economic%20Advisers/JFKOH-CEA-01/JFKOH-CEA-01-TR.pdf

p.276

https://1.bp.blogspot.com/-nG7di547cSo/XcswT5wgXEI/AAAAAAABo7w/Du8xyBA5DhUy2nKWEkvNmLwoKGRrpr-ywCLcBGAsYHQ/s1600/IMG_4329.PNG

これを訳したのだ

優秀なスタッフがついている

参照:

イエレン、トービン、ケネディそして… - シェイブテイル日記2

http://shavetail2.hateblo.jp/entry/20150129

ケネディに関しては、上で引用されているように、

「誰がケインズを殺したか」 W・カール・ビブン 斎藤精一郎訳 第4章が参考になる

ケネディはMMTerだった

返信削除JFK'S SPEECH AT YALE UNIVERSITY (JUNE 11, 1962)

https://youtu.be/PznXIiGe9rI?t=14m30s

MMTer(=戦争をしなくても完全雇用は可能と考える人々)であるがゆえにリンドン・ジョンソンに暗殺された。

ケネディはMMTerだった

返信削除JFK'S SPEECH AT YALE UNIVERSITY (JUNE 11, 1962)

https://youtu.be/PznXIiGe9rI?t=14m30s

MMTer(=戦争をしなくても完全雇用は可能と考える人々)であるがゆえにリンドン・ジョンソンに暗殺された。

『誰がケインズを殺したか?』4,参照

返信削除luminous woman

@_luminous_woman

@zaigen_lab ちなみに少なくともれいわ新選組のブレーンはMMTをよく勉強しており、ケルトン教授のツイートから以下の資料を数日で作った。

twitter.com/stephaniekelto… pic.twitter.com/s8QNZn5sWI

2021/01/16 17:40

https://twitter.com/_luminous_woman/status/1350362270082109441?s=21

639 金持ち名無しさん、貧乏名無しさん (ササクッテロラ Sp91-GO4G)[sage] 2021/03/13(土) 15:51:45.84 ID:XEmZ4zSmp

返信削除●Alexander Hamilton 1781

《A national debt, if it is not excessive, will be to us a national blessing.

It will be a powerful cement of our Union. 》

LETTER TO ROBERT MORRIS April 30, 1781.

《国の借金は、それが過剰でなければ、我々にとっては国の恵みとなるでしょう。それは、

我々の連邦の強力なセメントとなるだろう。 》

-アレキサンダー・ハミルトン、ロバート・モリスへの手紙、1781年4月30日

https://pbs.twimg.com/media/EwVeIF5UUAEkSyX.jpg

●Abraham Lincoln 1864

《The great advantage of citizens being creditors as well as debtors with relation to the public

debt is obvious. Men readily perceive that they can not be much oppressed by a debt which they

owe to themselves.》

State of the Union Address: Abraham Lincoln (December 6, 1864)

Abraham Lincoln 1864

(Lewis Kimmel’s Federal Budget and Fiscal Policy, 1789-1958)

《国民が公的債務に関連して債権者であると同時に債務者でもあることの大きな利点は明らかである。人は、

自分たちが自分たち自身に負っている負債によって、あまり抑圧されることがないことを容易に理解している。》

エイブラハム・リンカーン

一般教書演説1864年12月6日

https://pbs.twimg.com/media/EwVeIF4VkAkXDlV.jpg

● Franklin D. Roosevelt 1944

《People who are hungry and out of a job are the stuff of which dictatorships are made.》

Franklin D. Roosevelt,

State of the Union Address on Tuesday, January 11, 1944.

《空腹と失職に喘ぐ人々とは、独裁による産物である。》

ルーズベルトの演説

1944年1月11日のルーズベルトの連邦議会へのメッセージ

https://pbs.twimg.com/media/EwVeIF5VEAIEg-u.jpg

● John F. Kennedy 1962

《The deficit can be

any size, the debt can be any size, provided they don't cause inflation.

Everything else is just talk.》

from James Tobin's testimony

https://www.jfklibrary.org/sites/default/files/archives/JFKOH/Council%20of%20Economic%20Advisers/JFKOH-CEA-01/JFKOH-CEA-01-TR.pdf

p.272

ケネディ「財政赤字も政府債務も、本来はどんな規模でもいい、インフレにならない限りは。それ以外は

タワゴトですよ」

ジェームズ・トービンの証言より

https://pbs.twimg.com/media/EwVeIF3VIAMZVA5.jpg

返信削除https://chiebukuro.yahoo.co.jp/user/107315025

終盤、法廷で主人公ジム・ギャリソン(ケビン・コスナー)が

「ある作家の言葉です。

〝愛国者は自分の国を政府から守るべきだ〟」

という台詞がありますが、この「ある作家」とは誰のことですか?

A patriot must always be ready to defend his country against his government.

Edward Abbeyの言葉のようです。

〇補足について

著書『A voice crying in the wilderness』の中の一文のようです。

参考:http://en.wikiquote.org/wiki/Edward_Abbey

A Voice Crying in the Wilderness: Vox Clamantis in Deserto: Notes from a Secret Journal (English Edition) Kindle Edition

English Edition by Edward Abbey (著) Format: Kindle Edition

返信削除ケビンコスナー主演jfk 1991

https://chiebukuro.yahoo.co.jp/user/107315025

終盤、法廷で主人公ジム・ギャリソン(ケビン・コスナー)が

「ある作家の言葉です。

〝愛国者は自分の国を政府から守るべきだ〟」

という台詞がありますが、この「ある作家」とは誰のことですか?

A patriot must always be ready to defend his country against his government.

Edward Abbeyの言葉のようです。

〇補足について

著書『A voice crying in the wilderness』の中の一文のようです。

参考:http://en.wikiquote.org/wiki/Edward_Abbey

A Voice Crying in the Wilderness: Vox Clamantis in Deserto: Notes from a Secret Journal (English Edition) Kindle Edition

English Edition by Edward Abbey (著) Format: Kindle Edition

返信削除検索結果

ウェブ検索結果

映画『JFK』で南部アメリカ英語マンツーマンレッスン(2)https://etc-eikaiwa.com › jfk_1

ケネディ大統領の暗殺から50年経った今、この言葉は今の私達の大きな共感を呼びます。 ... 「愛国者は常に自分の国を政府から守るべき覚悟がいる」と。

https://etc-eikaiwa.com/78news/68recommend/jfk_1.html

返信削除“A patriot must always be ready to defend his country against its government.”

「愛国者は常に自分の国を政府から守るべき覚悟がいる」

『最高の愛国心とは、あなたの国が不名誉で、悪辣で、馬鹿みたいなことをしている時に、それを言ってやることだ』ジュリアン・バーンズ

返信削除

返信削除Ichiro NAKAMURA, Ph.D (Informatics)

@ISEC_NEWS_Jpn

@Simon_Sin @nobutake_Ishii @Serenitypraye12 「愛国者は常に自分の国を政府から守るべき覚悟がいる」

-エドワード・アビー

2021/02/23 20:22

https://twitter.com/isec_news_jpn/status/1364173904105771010?s=21

返信削除Sign In

Edward Abbey: A Voice in the Wilderness

TV Movie

2007

Not Rated

58min

予告編

返信削除https://vimeo.com/ondemand/abbey/66076704?autoplay=1

返信削除Entry from July 29, 2010

“A patriot must always be ready to defend his country against his government”

"A patriot must always be ready to defend his country against his government” was written by environmentalist Edward Abbey (1927-1989) and published in 1989. “His government” was replaced by “its government” in the films JFK (1991): “An American naturalist wrote, ‘a patriot must always be ready to defend his country against its government.’” The JFK film reference is from the 1960s and is probably an anachronism.

Abbey’s quotation has been popular wih people who believe the government has gone wrong. The quotation was popular with tea parties in 2009-2010. “It is the duty of the patriot to protect his country from its government” is a fake Thomas Paine quotation that was probably inspired by Abbey.

https://www.barrypopik.com/index.php/new_york_city/entry/a_patriot_must_always_be_ready_to_defend_his_country_against_his_government

返信削除"Arms discourage and keep the invader and plunderer in awe, and preserve order in the world as well as property... Horrid mischief would ensue were the law-abiding deprived of the use of them." This quote is in Thoughts on Defensive War in Foner's Complte Works of Thomas Paine, however there is a question, at this point, as to whether this is Paine's writing.

It is the duty of the patriot to protect his country from its government.

According to the Thomas Paine National Historical Association, this has been misattributed to Paine and is definitely not his quote. http://thomaspaine.org/aboutpaine/did-paine-write-these-quotes.html

トマスペインではない

返信削除“A patriot must always be ready to defend his country against its government.”

「愛国者は常に自分の国を政府から守るべき覚悟がいる」エドワード・アビー

『最高の愛国心とは、あなたの国が不名誉で、悪辣で、馬鹿みたいなことをしている時に、それを言ってやることだ』ジュリアン・バーンズ

返信削除地域通貨花子1

@TiikituukaHana

An American naturalist wrote:

あるアメリカの自然主義者は次のように書いています。

“A patriot must always be ready to defend his country against its government.”

「愛国者は常に自分の国を政府から守るべき覚悟がいる」と。

etc-eikaiwa.com/78news/68recom…

chiebukuro.yahoo.co.jp/user/107315025 pic.twitter.com/RJMx7SDubP

2021/10/21 17:22

https://twitter.com/tiikituukahana/status/1451101493445083137?s=21

返信削除“A patriot must always be ready to defend his country against its government

Kevin Costner

返信削除『最高の愛国心とは、あなたの国が不名誉で、悪辣で、馬鹿みたいなことをしている時に、それを言ってやることだ』ジュリアン・バーンズ

Julian Barnes

“The greatest patriotism is to tell your country when it is behaving dishonorably, foolishly, viciously.”

― Julian Barnes, Flaubert's Parrot

フロベールの鸚鵡

ジュリアン・バーンズ - Wikipedia

https://ja.wikipedia.org/wiki/%E3%82%B8%E3%83%A5%E3%83%AA%E3%82%A2%E3%83%B3%E3%83%BB%E3%83%90%E3%83%BC%E3%83%B3%E3%82%BA

ジュリアン・バーンズ

ジュリアン・バーンズ

Julian Barnes

Julian Barnes in 2019 02.jpg

ペンネーム ダン・カヴァナ

Dan Kavanagh

誕生 ジュリアン・パトリック・バーンズ

Julian Patrick Barnes

1946年1月19日(75歳)

イギリスの旗 イギリス・レスターシャー州

職業 小説家

国籍 イギリスの旗 イギリス

活動期間

ジャンル ポストモダン文学

代表作 『フロベールの鸚鵡』『ここだけの話』

主な受賞歴 メディシス賞エッセイ部門(1986)

フェミナ賞外国小説部門(1992)

オーストリア国家賞(2004)

ブッカー賞(2011)

エルサレム賞(2021)

親族 ジョナサン・バーンズ (兄弟)

Portal.svg ウィキポータル 文学

テンプレートを表示

ジュリアン・バーンズ(Julian Barnes, 1946年1月19日 - )はイギリス・イングランドの小説家。ポストモダン的と評される作風で、現代イギリスの代表的作家の一人として活躍している。『The Sense of an Ending』で2011年のブッカー賞受賞。

またダン・カヴァナ(キャヴァナーとも。Dan Kavanagh)という筆名でミステリー小説も執筆している。

目次

1 作品

1.1 ジュリアン・バーンズ名義

1.2 ダン・カヴァナ名義

2 箴言

3 外部リンク

作品

ジュリアン・バーンズ名義

Metroland (1980)

Before She Met Me (1982)

Flaubert's Parrot (1984) (『フロベールの鸚鵡』)

Staring at the Sun (1986) (『太陽を見つめて』加藤光也訳. 白水社, 1992)

A History of the World in 101⁄2 Chapters (1989) (『10 1/2章で書かれた世界の歴史』丹治愛, 丹治敏衛訳. 白水社, 1991)

Talking it Over (1991) (『ここだけの話』斎藤兆史訳. 白水社, 1993)

The Porcupine (1992)

Letters from London (1995) (記事)

Cross Channel (1996) (『海峡を越えて』中野康司訳. 白水社, 1998)

England, England (1998) (『イングランド・イングランド』古草秀子訳. 東京創元社, 2006、創元ライブラリ、2021)

Love, Etc. (2000)

Something to Declare (2002) (エッセイ)

The Pedant in the Kitchen (2003) (『文士厨房に入る』堤けいこ 訳. みすず書房, 2010)

The Lemon Table (2004)

Arthur & George (2005)(『アーサーとジョージ』真野泰, 山崎暁子訳. 中央公論新社, 2016.

Nothing to Be Frightened Of (2008) (回想録)

East Wind (2008) —

The Sense of an Ending (2011)(『終わりの感覚』土屋政雄訳. 新潮社, 2012)

Levels of Life (2013)(『人生の段階』土屋政雄訳. 新潮社, 2017)

ダン・カヴァナ名義

Duffy (1980) (『顔役を撃て』ダン・キャヴァナー著, 田村義進訳. 早川書房, 1981)

Fiddle City (1981) (『愚か者の街』ダン・キャヴァナー 著,田村義進 訳 早川書房 1982)

Putting the Boot In (1985)

Going to the Dogs (1987)

箴言

「最高の愛国心とは、あなたの国が不名誉で、馬鹿で、悪辣な事をしている時に、それを言ってやることだ」(The greatest patriotism is to tell your country when it is behaving dishonorably, foolishly, viciously.)

外部リンク

ジュリアン・バーンズ公式ウェブサイト

返信削除● ジョン・F・ケネディ John F. Kennedy (1917~1963)

《The deficit can be any size, the debt can be any size, provided they

don't cause inflation. Everything else is just talk.》1962

from James Tobin's testimony

https://www.jfklibrary.org/sites/default/files/archives/JFKOH/Council%20of%20Economic%20Advisers/JFKOH-CEA-01/JFKOH-CEA-01-TR.pdf

p.276

《財政赤字も政府債務も、本来はどんな規模でもいい、インフレにならない限りは。

それ以外はタワゴトですよ》1962

ジェームズ・トービンの証言より

jfk

返信削除mmt?

1962

#MMT SNS

https://www.tiktok.com/@real_progressives?_t=8XbvOnHVAgr&_r=1

burbank

https://vt.tiktok.com/ZS81RSDmM/

https://www.facebook.com/groups/MMTforRP/posts/3241311516182430/

Charles Hayden

@CarlitosMMT

JFK near Deficit Owl?

facebook.com/groups/MMTforR…

2022/11/24 5:13

https://twitter.com/carlitosmmt/status/1595510888278200333?s=61&t=LJKFEcqnzqGKrPKOXGptcw

https://vt.tiktok.com/ZS81RuAag/

@carlitosmmt

♬ A TRAVELLER FROM AN ANTIQUE LAND - Trent Reznor & Atticus Ross

#MMT

返信削除JFK near Deficit Owl?

John Fitzgerald Kennedy

Yale University Commencement (June 11, 1962)

In New Haven, Connecticut, President Kennedy focuses

on three economic issues: the size and distribution of

government, public fiscal policy, and public confidence in

business and America. [Excerpts]

http://millercenter.org/president/speeches/detail/3370

But does it follow from this that big government is growing

relatively bigger? It does not for the fact is for the last 15

years, the Federal Government - and also the

RealProgressives.Org

返信削除#MMT SNS

#MMT JFK赤字のフクロウに近い?

ジョン・フィッツジェラルド・ケネディ エール大学卒業式(1962年6月11日) コネチカット州ニューヘイブンで、ケネディ大統領は、政府の規模と分配、公的財政政策、ビジネスとアメリカへの国民の信頼という3つの経済問題に焦点を当てた。[抜粋】 http://millercenter.org/president/speeches/detail/3370 しかし、このことから、大きな政府が相対的に大きくなっていると言えるのだろうか。過去15年間、連邦政府とRealProgressives.Orgは、そのようなことはしていないのです。

#MMT JFK near Deficit Owl?

John Fitzgerald Kennedy Yale University Commencement (June 11, 1962) In New Haven, Connecticut, President Kennedy focuses on three economic issues: the size and distribution of government, public fiscal policy, and public confidence in business and America. [Excerpts] http://millercenter.org/president/speeches/detail/3370 But does it follow from this that big government is growing relatively bigger? It does not for the fact is for the last 15 years, the Federal Government and also the RealProgressives.Org

https://millercenter.org/the-presidency/presidential-speeches/december-6-1961-address-national-association-manufacturers

https://www.tiktok.com/@real_progressives?_t=8XbvOnHVAgr&_r=1

burbank

https://vt.tiktok.com/ZS81RSDmM/

https://www.facebook.com/groups/MMTforRP/posts/3241311516182430/

Charles Hayden

@CarlitosMMT

JFK near Deficit Owl?

facebook.com/groups/MMTforR…

2022/11/24 5:13

https://twitter.com/carlitosmmt/status/1595510888278200333?s=61&t=LJKFEcqnzqGKrPKOXGptcw

https://vt.tiktok.com/ZS81RuAag/

https://love-and-theft-2014.blogspot.com/2022/11/httpswww_24.html

返信削除#MMT JFK赤字のフクロウに近い?

返信削除ジョン・フィッツジェラルド・ケネディ エール大学卒業式(1962年6月11日) コネチカット州ニューヘイブンで、ケネディ大統領は、政府の規模と分配、公的財政政策、ビジネスとアメリカへの国民の信頼という3つの経済問題に焦点を当てた。[抜粋】 http://millercenter.org/president/speeches/detail/3370 しかし、このことから、大きな政府が相対的に大きくなっていると言えるのだろうか。過去15年間、連邦政府とRealProgressives.Orgは、そのようなことはしていないのです。

#MMT JFK near Deficit Owl?

John Fitzgerald Kennedy Yale University Commencement (June 11, 1962) In New Haven, Connecticut, President Kennedy focuses on three economic issues: the size and distribution of government, public fiscal policy, and public confidence in business and America. [Excerpts] http://millercenter.org/president/speeches/detail/3370 But does it follow from this that big government is growing relatively bigger? It does not for the fact is for the last 15 years, the Federal Government and also the RealProgressives.Org

https://millercenter.org/the-presidency/presidential-speeches/june-11-1962-yale-university-commencement

https://www.tiktok.com/@real_progressives?_t=8XbvOnHVAgr&_r=1

burbank

https://vt.tiktok.com/ZS81RSDmM/

https://www.facebook.com/groups/MMTforRP/posts/3241311516182430/

Charles Hayden

@CarlitosMMT

JFK near Deficit Owl?

facebook.com/groups/MMTforR…

2022/11/24 5:13

https://twitter.com/carlitosmmt/status/1595510888278200333?s=61&t=LJKFEcqnzqGKrPKOXGptcw

https://vt.tiktok.com/ZS81RuAag/

@carlitosmmt

♬ A TRAVELLER FROM AN ANTIQUE LAND - Trent Reznor & Atticus Ross

ーーー

June 11, 1962: Yale University Commencement | Miller Center

https://millercenter.org/the-presidency/presidential-speeches/june-11-1962-yale-university-commencement