ブイター(ゲゼル関連)

consolidated government

integrated? the treasury and central bank

統合政府が膾炙されたのはブイター1984?,2001,2007,2014以降だろう

レイ3.6はそれより早いが

《マイケル・エリオット ウィレム・ブイターは、(イングランド銀行金融政策委員会のメンバー、ロンドン・スクール・オブエコノミクスの欧州研究所所長を経て)、2010年1月からシティ・グループのチーフ・エコノミストを務めている。誰もが知る、世界的に著名なマクロエコノミストだ。》出典後述

《マイケル・エリオット ウィレム・ブイターは、(イングランド銀行金融政策委員会のメンバー、ロンドン・スクール・オブエコノミクスの欧州研究所所長を経て)、2010年1月からシティ・グループのチーフ・エコノミストを務めている。誰もが知る、世界的に著名なマクロエコノミストだ。》出典後述

1984:

https://www.researchgate.net/publication/5184732_The_Proper_Measurement_of_Government_Budget_Deficits_

Comprehensive_Wealth_Accounting_or_Permanent_Income_Accounting_for_the_Public_Sector

Comprehensive_Wealth_Accounting_or_Permanent_Income_Accounting_for_the_Public_Sector

The Proper Measurement of Government Budget Deficits: Comprehensive Wealth Accounting or Permanent Income Accounting for the Public Sector

Article (PDF Available) · February 1984 with 20 ReadsSource: RePEcCite this publication

Willem H. Buiter

34.87

Citigroup Global Markets Inc.

2001:

Notes on'a code for fiscal stability' 2001

WH Buiter - Oxford Economic Papers, 2001 - academic.oup.com

… refer to the consolidated general government and central bank, or to the consolidated generalgovernment … Unless the share of government investment in GDP happens to equal the prod- uct …While it will inevitably influence and constrain current and future gov- ernment actions, it

2007:

Buiter, Willem H. Article Seigniorage 2007

The government’s period budget constraint and its intertemporal budget constraint are familiar components of dynamic macroeconomic models at least since the late 1960s (see e.g. Christ (1968), Blinder and Solow (1973) and Tobin and Buiter (1976)). The ‘government’ in question is invariably the consolidated general government (central, state and local, henceforth the ‘Treasury’) and Central Bank. When the Central Bank has operational independence, it is useful, and at times even essential, to disaggregate the general government accounts into separate Treasury and Central Bank accounts. Section III of the paper presents an example of such a decomposition, adding to the work of Walsh (2003). In

2014:

2014,p.2

Willem H. Buiter (2014). ... Economics Discussion Papers, No 2014-24, Kiel Institute for the World ...

Helicopter money focuses on the fiscal dimension of an increase in the monetary base: that any increase in the monetary base that is not completely reversed in PDV terms relaxes the intertemporal budget constraint of the consolidated Central Bank and Treasury, that is, it increases the fiscal space of the State. The up-front fiscal stimulus that is the other half of the combined monetary and fiscal stimulus known as helicopter money, ensures that the increase in the fiscal space is actually utilized.

以下のヘリマネ関連論考2016でもブイター2014が参照される

A Primer on Helicopter Money — Money, Banking and Financial Markets

John Muellbauer???

https://www.moneyandbanking.com/commentary/2016/6/27/a-primer-on-helicopter-money ★

多分著者は以下、

フリードマンが統合政府バランスシートを想定していたとしている

A primer on helicopter money

Stephen Cecchetti, Kim Schoenholtz 19 August 2016

以下が参照されている

^

Baldwin, R. (2016), “Helicopter money: Views of leading economists”, VoxEU.org, 13 April.

Bernanke, B S. (2016), “What tools does the Fed have left? Part 3: Helicopter money”, Brookings Institution, 11 April.

Buiter, W. H. (2014), “The simple analytics of Helicopter money: Why it works – always”, Economics, Discussion Paper No. 2014-24,

Cecchetti, S. G. and K. L. Schoenholtz (2015), “How the Fed will tighten”, www.moneyandbanking.com, 10 August.

Friedman, M. (1969), “The Optimum Quantity of Money”, in Milton Friedman, The Optimum Quantity of Money and Other Essays, Chicago: Adline Publishing Company, pp. 1-50.

ウィレム・ヘンドリク・ブイター (Willem Hendrik Buiter), 1949-

http://www.hetwebsite.net/het/profiles/buiter.htm

https://cruel.org/econthought/profiles/buiter.html

ウィレム・H・ブイターの主要著作

- "Long-Run Effects of Fiscal and Monetary Policy", with J. Tobin, 1976, in Stein, editor, Monetarism.

- ."On Two Specifications of Asset Equilibrium in Macroeconomic Models: A Note," with G. Woglom, 1977, JPE

- "'Crowding out' and the Effectiveness of Fiscal Policy,", 1977, JPubE

- "Some Unfamiliar Properties of a Familiar Macroeconomic Model," with H. Lorie, 1977, EJ

- "Short-Run and Long-Run Disequilibrium in Dynamic Macromodels," 1977, Southern EJ

- "Short-Run and Long-Run Effects of External Disturbances Under a Floating Exchange Rate," 1978, Economica

- "Debt Neutrality: A Brief Review of Doctrine and Evidence." with J. Tobin, 1979, in Fursternberg, editor, Social Security Versus Private Saving

- "Government Finance in an Overlapping Generations Model with Gifts and Bequests,"1979, in Fursternberg, editor, Social Security Versus Private Saving

- "Optimal Foreign Exchange Market Intervention with Rational Expectations," 1979, in Martin and Smith, editors, Trade and Payments Adjustment Under Flexible Exchange Rates

- "Unemployment-Inflation Trade-Offs with Rational Expectations in an Open Economy," 1979, JEDC

- "Walras' Law and All That", 1980, IER

- "Fiscal and Monetary Policies, Capital Formation, and Economic Activity" with J. Tobin, 1980, in Government and Capital Formation

- "Crowding Out of Private Capital Formation by Government Borrowing in the Presence of Intergenerational Gifts and Bequests," 1980, Greek ER

- "The Macroeconomics of Dr. Pangloss: A Critical Survey of the New Classical Macroeconomics", 1980, EJ

- "Issues in Controllability and the Theory of Economic Policy," with M. Gersovitz, 1981, JPubE

- "Real Exchange Rate Overshooting and the Output Cost of Bringing Down Inflation," with M. Miller, 1982, European ER

- "Real effects of Anticipated and Unanticipated Money: Some problems of Estimation and Hypothesis Testing", 1983, JME

- "Expectations and Control Theory," 1983, Econ Appl

- "Saddlepoint Problems in Continuous Time Rational Expectations Models: A General Method and Some Macroeconomic

Examples," 1983, Econometrica - "Granger-Causality and Policy Effectiveness," 1984, Economica

- "A Guide to Public Sector Debt and Deficits," 1985, Economic Policy

- "Borrowing to Defend the Exchange Rate and the Timing and Magnitude of Speculative Attacks," 1987, JIntE

- "A Fiscal Theory of Hyperdeflations? Some Surprising Monetarist Arithmetic," 1987, Oxford EP

- "Death, Birth Productivity Growth and Debt Neutrality," 1988, EJ

- ."Structural and Stabilization Aspects of Fiscal and Financial Policy in the Dependent Economy," 1988, Oxford EP

- "Efficient 'Myopic' Asset Pricing in General Equilibrium: A Potential Pitfall in Excess Volatility Tests," 1987, Econ Letters

- "Debt Neutrality, Professor Vickrey and Henry George's `Single Tax'," 1989, Econ Letters

- "Debt Neutrality, Redistribution and Consumer Heterogeneity: A Survey and Some Extensions," 1991, in Brainard et al., editors, Money, Macroeconomics and Economic Policy

- The Welfare Economics of Cooperative and Non-Cooperative Fiscal Policy", with K. M. Kletzer, 1991, JEDC

- "Who's Afraid of the National Debt?", with K. M. Kletzer, 1992, AER

- "Capital mobility, fiscal policy and growth with self-financing of human capital formation", with K. M. Kletzer, 1995, Canadian JE

- "Generational Accounts, Aggregate Saving and Intergenerational Distribution", 1997, Economica

- "Alice in Euroland", 1999 J of Common Market Studies

- "Notes on 'A Code for Fiscal Stability'", 2000, Oxford EP

- "Optimal Currency Areas: Why Does the Exchange Rate Regime Matter? With an Application to UK Membership in EMU", 2000, Scottish JPE

ウィレム・H・ブイターに関するリソース

- HET Pages: the Neo-Keynesian World: The Deficit Debates Again,

- W.H. Buiter's Page at NBER

The Simple Analytics of Helicopter Money: Why It Works – Always ...

Willem H. Buiter (2014). ... Economics Discussion Papers, No 2014-24, Kiel Institute for the World ...

http://www.economics-ejournal.org/economics/journalarticles/2014-28/version-3/at_download/file

ミッチェル492#30

.Economist Willem Buiter(2009),WhO nOw wOrksin the nnancial markets′desc百bed New Keynesian and DSGEmode‖ng as``TheunfortunateuselessnessofmostrstateOftheart'academic monetary economics'l He continued:Mοst ttθ′ηstream macroccO′ο“たι力θοたtical iηttοレatiOrs sin6`ι力θ 79フOs(the Nθ″CIass16θ′`θtiοη洲θイρθCtatiο′sたソοルti04¨αη∂油θ Nθ″Kθノ′`Siθn t力εοrising…力aソθ ιυrηθグουt tο be sθ折燿リセ“ηιiaみ′η″θ〃´わο灯昭dなt″6百ο4s at bθst.Resθar6カιθη∂θd tο bθ“οJレatθグ″tたMιar′冽ゎ」c tttdた`ι′洲s,ηk 6αρi"|ard estわθJ6 ρυzzleSげθS"b″S力θ∂たscar6カρrogm綱“θs″ther t力θη tt θ ρο″θ(ル′∂asiた:οレ′グerstard力ο″訪`θ6ο4ο“ノ″θrks―たιθ′οηθ力ο″t力θ θ6οηο綱ノ″οttS∂υ万4g J“es oFst“ss aηグ′ηθ絆61θl irStab″′ッ・Sο ι力θθ`040“16S prψssiοη″θS Ca“g力:υ4ρκρaたd″わθη ιわθ6risis strυ6k.¨ ιha Dノ′θ“'6 StοC力astたGθηθ″|[9′清bttυ“aρρroθ`力″わたわ/Or a″力〃θ″as tta staρたo/6θ4tm′barks'M:er4θ′“οグθ‖電…adυグθs θレθッι力麟grθ′θソθηt tο ι力θρ′rsυたげ′ra46blStabルty(3りたθぅ200"A Few years before the global輌nancialこo‖apse,central bankers were congratulating themselves on the success oftheNMC approach in not only keepinginla6on down′but also stabilたing growth and inandal markets.!n2004 BeniaminBernanke SOon tO become the Chairman ofthe US Federal Reserve Bankしdeclared the arrival ofthe Gκθιハ

ИOdera“οη―aneweraofstabilityinwhichsuccessfulpolicymanagementbycentralbankshadreducedtheriskofrun´away inlationsor recessions.Central bankers would be able to address macroeconomic problems.丁his turned out to be an unfortunate prognosis,as the GFC began iust three yearslaten Alan Greenspan(PBSNewshouぅ2008),who Was chairman ofthe∪S Federal ROserve Bank und1 2006′later told the US Congress thatthe crisis showed that his entire vvorld vievちdeveloped over halfa century and based On a faith in the efnciency Ofrfree markets:had been endrely wrOng(see BOX 32 1).Central bankers had neither understood how the economyworked′nor had they actua‖y produced a new era ofstab‖ity.ln fact′even as Bernanke wrote his paper7the US、vas living through a period of unprecedented bubbles in real estate markets′commodities markets,and equitymarkets.

小栗2018

統合バランスシート

ミッチェル492#30

.Economist Willem Buiter(2009),WhO nOw wOrksin the nnancial markets′desc百bed New Keynesian and DSGEmode‖ng as``TheunfortunateuselessnessofmostrstateOftheart'academic monetary economics'l He continued:Mοst ttθ′ηstream macroccO′ο“たι力θοたtical iηttοレatiOrs sin6`ι力θ 79フOs(the Nθ″CIass16θ′`θtiοη洲θイρθCtatiο′sたソοルti04¨αη∂油θ Nθ″Kθノ′`Siθn t力εοrising…力aソθ ιυrηθグουt tο be sθ折燿リセ“ηιiaみ′η″θ〃´わο灯昭dなt″6百ο4s at bθst.Resθar6カιθη∂θd tο bθ“οJレatθグ″tたMιar′冽ゎ」c tttdた`ι′洲s,ηk 6αρi"|ard estわθJ6 ρυzzleSげθS"b″S力θ∂たscar6カρrogm綱“θs″ther t力θη tt θ ρο″θ(ル′∂asiた:οレ′グerstard力ο″訪`θ6ο4ο“ノ″θrks―たιθ′οηθ力ο″t力θ θ6οηο綱ノ″οttS∂υ万4g J“es oFst“ss aηグ′ηθ絆61θl irStab″′ッ・Sο ι力θθ`040“16S prψssiοη″θS Ca“g力:υ4ρκρaたd″わθη ιわθ6risis strυ6k.¨ ιha Dノ′θ“'6 StοC力astたGθηθ″|[9′清bttυ“aρρroθ`力″わたわ/Or a″力〃θ″as tta staρたo/6θ4tm′barks'M:er4θ′“οグθ‖電…adυグθs θレθッι力麟grθ′θソθηt tο ι力θρ′rsυたげ′ra46blStabルty(3りたθぅ200"A Few years before the global輌nancialこo‖apse,central bankers were congratulating themselves on the success oftheNMC approach in not only keepinginla6on down′but also stabilたing growth and inandal markets.!n2004 BeniaminBernanke SOon tO become the Chairman ofthe US Federal Reserve Bankしdeclared the arrival ofthe Gκθιハ

ИOdera“οη―aneweraofstabilityinwhichsuccessfulpolicymanagementbycentralbankshadreducedtheriskofrun´away inlationsor recessions.Central bankers would be able to address macroeconomic problems.丁his turned out to be an unfortunate prognosis,as the GFC began iust three yearslaten Alan Greenspan(PBSNewshouぅ2008),who Was chairman ofthe∪S Federal ROserve Bank und1 2006′later told the US Congress thatthe crisis showed that his entire vvorld vievちdeveloped over halfa century and based On a faith in the efnciency Ofrfree markets:had been endrely wrOng(see BOX 32 1).Central bankers had neither understood how the economyworked′nor had they actua‖y produced a new era ofstab‖ity.ln fact′even as Bernanke wrote his paper7the US、vas living through a period of unprecedented bubbles in real estate markets′commodities markets,and equitymarkets.

Buiter, W(2009)″The ∪nfortunate Uselessness of Most State of the Art Academic Monetary Economics':層rar`ia′■″ηes, March. Avallable at: http://ecOnomistsview.typepad.com/econOmistsvievv/2009/03/the´unfortunate″use″lessness‐of‐most´state‐of‐the´art´acadenlic´monetary´economics.himt accessed 25 September 2018.P3S New

http://www.bresserpereira.org.br/terceiros/cursos/Buiter,Willem.pdf

Most mainstream macroeconomic theoretical innovations since the 1970s (the New Classical rational expectations revolution associated with such names as Robert E. Lucas Jr., Edward Prescott, Thomas Sargent, Robert Barro etc, and the New Keynesian theorizing of Michael Woodford and many others) have turned out to be self-referential, inward-looking distractions at best. Research tended to be motivated by the internal logic, intellectual sunk capital and aesthetic puzzles of established research programmes rather than by a powerful desire to understand how the economy works - let alone how the economy works during times of stress and financial instability. So the economics profession was caught unprepared when the crisis struck.

1970年代以来のほとんどの主流のマクロ経済理論的革新(ロバートE.ルーカスJr.、エドワードプレスコット、トーマスサージェント、ロバートバロなどの名前に関連する新しい古典的合理的期待革命、およびマイケルウッドフォードなどのニューケインズ理論) せいぜい自己参照的な、内向きの気晴らしであることが判明しました。 研究は、経済がどのように機能するかを理解するという強い欲求ではなく、確立された研究プログラムの内部論理、知的沈下資本、および美的パズルによって動機付けられる傾向がありました。 したがって、経済学の専門家は、危機が起こったときに準備ができていない状態で捕らえられました。

W・ブイター氏の経済教室の寄稿原文 :日本経済新聞

https://www.nikkei.com/article/DGXZZO36237510U1A101C1000000/http://www.bresserpereira.org.br/terceiros/cursos/Buiter,Willem.pdf

Most mainstream macroeconomic theoretical innovations since the 1970s (the New Classical rational expectations revolution associated with such names as Robert E. Lucas Jr., Edward Prescott, Thomas Sargent, Robert Barro etc, and the New Keynesian theorizing of Michael Woodford and many others) have turned out to be self-referential, inward-looking distractions at best. Research tended to be motivated by the internal logic, intellectual sunk capital and aesthetic puzzles of established research programmes rather than by a powerful desire to understand how the economy works - let alone how the economy works during times of stress and financial instability. So the economics profession was caught unprepared when the crisis struck.

1970年代以来のほとんどの主流のマクロ経済理論的革新(ロバートE.ルーカスJr.、エドワードプレスコット、トーマスサージェント、ロバートバロなどの名前に関連する新しい古典的合理的期待革命、およびマイケルウッドフォードなどのニューケインズ理論) せいぜい自己参照的な、内向きの気晴らしであることが判明しました。 研究は、経済がどのように機能するかを理解するという強い欲求ではなく、確立された研究プログラムの内部論理、知的沈下資本、および美的パズルによって動機付けられる傾向がありました。 したがって、経済学の専門家は、危機が起こったときに準備ができていない状態で捕らえられました。

W・ブイター氏の経済教室の寄稿原文 :日本経済新聞

W・ブイター氏の経済教室の寄稿原文

W・ブイター氏(元イングランド銀行金融政策委員)の寄稿原文は以下の通り

(注)寄稿は編集しており、邦文は逐語訳ではありません。

The euro will survive, but it won't be pretty -

Willem H. Buiter

The excessive indebtedness of most European governments and the excessive leverage and poor asset quality of many European banks - including significant exposures to the over-indebted governments - have produced a triple crisis for the euro area and the European Union (EU). In the ‘outer periphery' (Greece, Ireland, Portugal), we face a sovereign insolvency crisis. In the ‘inner periphery' (Spain and Italy) we face a sovereign liquidity crisis that could become a self-fulfilling sovereign solvency crisis unless market funding at affordable interest rates is restored for the Spanish and Italian Sovereigns. Finally, we face a bank recapitalisation and bank funding crisis throughout the EU.

Lack of political leadership, growing populism and economic nationalism in Europe threaten to turn this crisis into a catastrophe. Without decisive action and some institutional innovation, the euro area could break up in the midst of a European banking crisis and a European periphery sovereign default crisis that could threaten to spread to the ‘soft core' of the euro area - Belgium and France. This European banking and sovereign default crisis would soon become global, dragging the global financial system into a deeper collapse than that following the demise of Lehman brothers and bring a prolonged global downturn or depression.

To prevent this nightmare scenario from materialising, Europe needs to do three things. First, the obviously insolvent sovereigns need to be restructured sufficiently aggressively to restore the prospect of solvency, either later this year or early in 2012. In the case of Greece, we estimate that this will require a write-down in the value of the public debt by between 65 and 80 percent. Private and official creditors (including the ECB) except possibly the IMF would share in this debt forgiveness. Political and market contagion from the Greek sovereign restructuring to Portugal and Ireland are likely. This is likely to result in sovereign debt restructuring for Portugal and haircuts on the senior unsecured debt of (some of) the Irish banks. Sovereign debt restructuring will deplete the capital of the domestic banks but also that of foreign banks and other Systemically Important Financial Institutions (sSIFIs) that hold the sovereign's debt. Adequate sources of new bank capital must therefore be readily available.

Second, a ‘big bazooka' financial facility must be readied to ensure continued access to funding for the Spanish and Italian sovereign. Together, they owe more than EUR2.5 trillion, which makes them too big to fail and too big to save for any entity except the ECB backed by the EFSF. The EFSF could, beyond the commitments it has already made, focus on new issuance of likely solvent but illiquid sovereigns and offer a first loss guarantee for ECB purchases of Spanish and Italian sovereign debt.

Finally, recapitalise the EU banks to the point that they can withstand multiple sovereign debt restructurings, by adding EUR300bn to EUR350bn tangible common equity. Little if any of this will come from the markets, although some sovereign wealth funds may be interested in acquiring cheaply an equity stake in a leading European bank. Most of the capital will therefore come from the national fiscal authorities, possibly funded with a loan from the European Financial Stability Facility (EFSF). It would be useful to create a European version of the TARP, a jointly-funded vehicle with, say, EUR150 bn worth of resources, that can take equity stakes in banks without having to go through the sovereign. Some of the required capital may also come from the mandatory conversion into equity of unsecured bank debt, both subordinate and senior. The outcome of this will be a more resilient but to a large extent state-owned European banking sector.

If we assume, conservatively, that at least EUR50bn of the EFSF's resources be set aside for recapitalising banks in EA member states whose sovereigns may not be able to raise funds for the recapitalisation of domestic banks, around EUR250bn is left in the ECBs kitty to provide such guarantees. If we assume that the guarantees cover a first loss of 20% on new EA sovereign issuance, perhaps EUR1-1.25trn of issuance could benefit from such guarantees. This compares to gross financing requirements for the Italian and Spanish sovereigns (bond and bill redemptions plus budget deficits) of just under EUR900bn until Q2 2013, the original target date for the birth of the successor of the EFSF, the European Stability Mechanism (ESM). Secondary market prices of Italian and Spanish sovereign debt would then be left to be determined by the market.

The ECB could also cap interest rates on the outstanding Spanish and Italian sovereign debt by threatening to purchase up to EUR2.5 trillion of such debt. We have estimated the non-inflationary loss absorption capacity of the ECB to be most likely at least EUR3 trillion, so the ECB could take on the lender of last resort function for Spain and Italy without compromising its price stability objective. In any case, even modest-sized EFSF guarantees for new issuance of the Italian and Spanish sovereign may not be enough to lure private investors back to fund these sovereigns on a sustained basis, so the ECB can never be far from the solution.

In our view, the credibility of the Italian authorities has taken such a blow during the past year that an external commitment device such as a Troika programme, or some equivalent externally verified and enforced programme that includes strict conditionality for fiscal austerity and structural reform, would be required. Spain's failure to control the deficits of the lower-tier authorities and the steady drip of revelations of ever greater capital needs by its banking sector have also undermined its capacity for credible commitment to future enhanced austerity and structural reforms to the point that an external crutch, such as a Troika programme or something equivalent is likely to be necessary for it to be the beneficiary of a sovereign debt (new issues) insurance programme at affordable rates.

It is essential that no country, including Greece, exit from the euro area. Sovereign debt restructuring should take place within the euro area. This means that the Greek sovereign and the Greek banks should, provided they comply with the new conditionality, enjoy continued access to official financing following restructuring.

Exit from the euro area by even one country would destroy the credibility of both the exiting and remaining members. The markets would focus on the next country at risk of an exit. This would suffer a deposit run and a refusal by the markets, that will fear an exit followed by a conversion of all contracts and instruments into the new currency, to fund its banks and other private entities. The banking system and sovereigns in the entire periphery would be at risk of default and collapse.

I expect that all three essential steps will be taken and that the euro area and the EU will survive. There will, however, be an extended period of financial turmoil and fear and uncertainty among enterprises and households. The next two years, will, even in this relatively favourable scenario, be years of very low growth or recession. After that, Europe should begin to reap the rewards for deleveraging and structural reform in individual member states and institutional and regulatory reform in the eurozone as a whole.

ウィレム・ブイターが語る先進国の財政問題とソブリンリスク― アメリカも日本も潜在的リスクにさらされている

2~3年後に、アメリカは財政緊縮路線をとらざるを得なくなる。これが、ブッシュ前政権が導入した高額所得者向けの減税措置の打ち切りとタイミングが重なるとしたらどうなるだろうか。この場合、米国債はAAAの格付けを失い、金利の上昇、ソブリンスプレッドの拡大によって、米経済は市場に試されることになる。・・・(日本はどうだろうか)。人々が巨大な政府債務があっても(大きな金融資産を持っているのだから)問題は起きないと考えているうちは、大きな変化はないだろう。だが、多くの人々が、デフォルトに陥ると考えだしたら、どうなるか。この場合、リスクは限りなく大きくなる。投資家が、状況が持続不可能だと懸念するようになれば、現実に、状況は持続不可能になる。・・・いかなる国にも逃げ場はない。(ウィレム・ブイター)

<イギリスもアメリカも例外ではない>

マイケル・エリオット ウィレム・ブイターは、(イングランド銀行金融政策委員会のメンバー、ロンドン・スクール・オブエコノミクスの欧州研究所所長を経て)、2010年1月からシティ・グループのチーフ・エコノミストを務めている。誰もが知る、世界的に著名なマクロエコノミストだ。

彼はソブリン債務に関するペーパーを最近まとめ、その冒頭で次のように指摘している。「ほとんどの先進諸国の財政は、戦時、あるいは、戦争終結直後の時期を例外とすれば、産業革命以降のいかなる時期と比較しても最悪の状態にある。富裕国の多くの財政は、持続不可能な軌道を描いている」。では、先進国のソブリンリスクについて、ウィレム。

マイケル・エリオット ウィレム・ブイターは、(イングランド銀行金融政策委員会のメンバー、ロンドン・スクール・オブエコノミクスの欧州研究所所長を経て)、2010年1月からシティ・グループのチーフ・エコノミストを務めている。誰もが知る、世界的に著名なマクロエコノミストだ。

彼はソブリン債務に関するペーパーを最近まとめ、その冒頭で次のように指摘している。「ほとんどの先進諸国の財政は、戦時、あるいは、戦争終結直後の時期を例外とすれば、産業革命以降のいかなる時期と比較しても最悪の状態にある。富裕国の多くの財政は、持続不可能な軌道を描いている」。では、先進国のソブリンリスクについて、ウィレム。

ウィレム・ブイター かつて新興諸国を苦しめたソブリン債務危機が、いまでは先進国に襲いかかっている。もちろん、比較的健全な財政を維持している先進国もある。スカンジナビア諸国、ニュージーランド、オーストラリアだ。しかし、例外はこれだけだ。・・・

The Simple Analytics of Helicopter Money: Why It Works — Always ...

2014-28 | August 21, 2014 (Version 3: August 23, 2016). Willem H. Buiter. The Simple Analytics of Helicopter Money: ...

Publications - Willem Buiter

The Economics link includes both the original version of August 2014, a revised version of ...... "MMT: What's right is not new, what's new is not right, and what's left is too simplistic", with Catherine L.

MMT part III - conclusion, and a conversation with Ben Bernanke ...

I have argued (as have many – Willem Buiter, Simon Wren-Lewis, Nick Rowe, and others), that this ...

Modern Monetary Theory – what is new about it? – Bill Mitchell ...

... stock-flow consistent ISLM analysis of Blinder and Solow (1973) and Tobin and Buiter (1976). ..... Palley, T.I. (2014) 'Modern money theory (MMT): the emperor still has no clothes', ...

MMT is just plain good economics – Part 1 – Bill Mitchell – Modern ...

And prominent economist, Willem Buiter, who is hardly a radical economist or an MMT proponent, was ...

★

以下のヘリマネ関連論考2016でもブイターが参照される

A Primer on Helicopter Money — Money, Banking and Financial Markets

https://www.moneyandbanking.com/commentary/2016/6/27/a-primer-on-helicopter-moneyA Primer on Helicopter Money

Helicopter money is not monetary policy. It is a fiscal policy carried out with the cooperation of the central bank. That is, if the Fed were to drop $100 bills out of helicopters, it would be doing the Treasury’s bidding.

We are wary of joining the cacophony of commentators on helicopter money, but our sense is that the discussion could use a bit of structure. So, as textbook authors, we aim to provide some pedagogy. (For the record, here are links to Ben Bernanke’s excellent blog post, to a summary of Vox posts, and to Willem Buiter’s technical paper.)

To understand why helicopter money is not just another version of unconventional monetary policy, we need to describe both a bit of economic theory and some relevant operational practice. We use simple balance sheets of the central bank and the government to explain.

First, some background. In the 1960s, Milton Friedman described what he believed to be a surefire mechanism that central banks could use to generate inflation (were that desired): drop currency straight from helicopters on to the population, while promising never to remove it from circulation. The result would be higher prices (and, if you keep doing this, inflation).

In his thought experiment, Friedman assumed that by altering the monetary base—the sum of currency and commercial bank reserve deposits at the Fed– the central bank could control the supply of transactions money (such as the aggregate M2). Second, he assumed that reserves were not compensated: that is, commercial bank holdings at the central bank had a zero interest rate.

Now, there are three problems with this thought experiment. First, transferring funds to households is what fiscal policymakers do, not central bankers. The latter issue central bank money to acquire assets. Second, except when interest rates are at the effective lower bound (ELB), monetary policymakers today control interest rates, not the monetary base (or another monetary aggregate). The monetary base is determined by the demand of individuals to hold currency and of banks to hold reserves at the central bank’s interest rate target. In practical terms, this means that the central bank cannot credibly promise to permanently increase the monetary base. Third, 21st century central banks pay interest on reserves. And they do so precisely to control the level of interest rates in the economy.

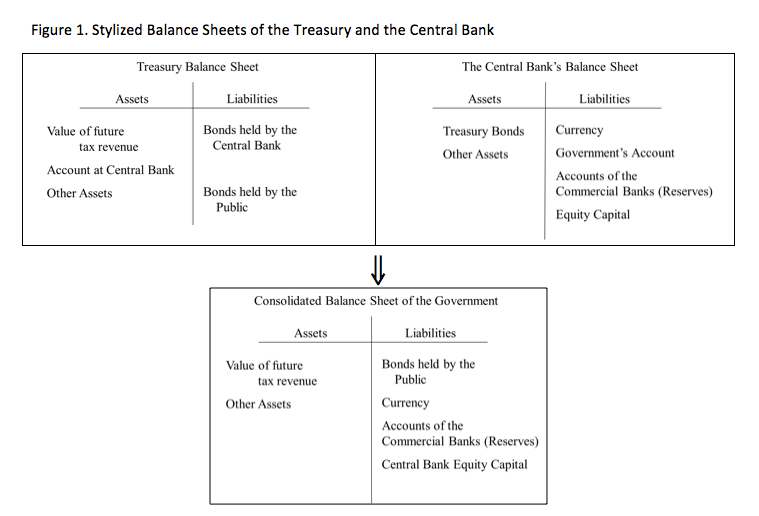

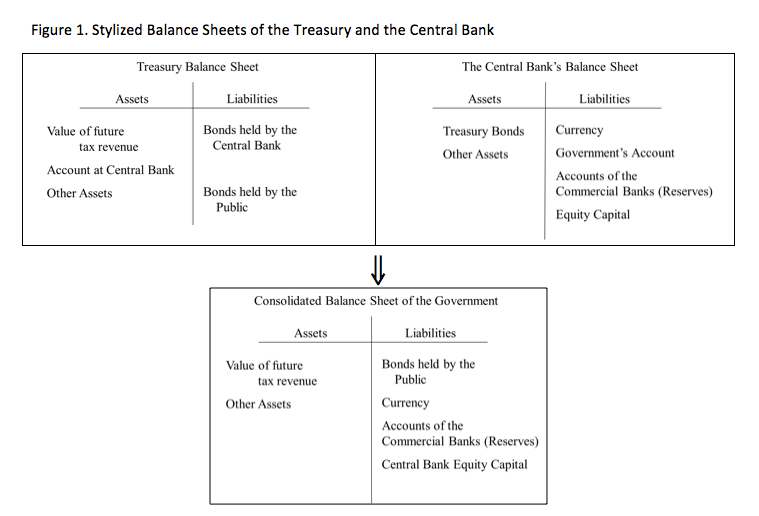

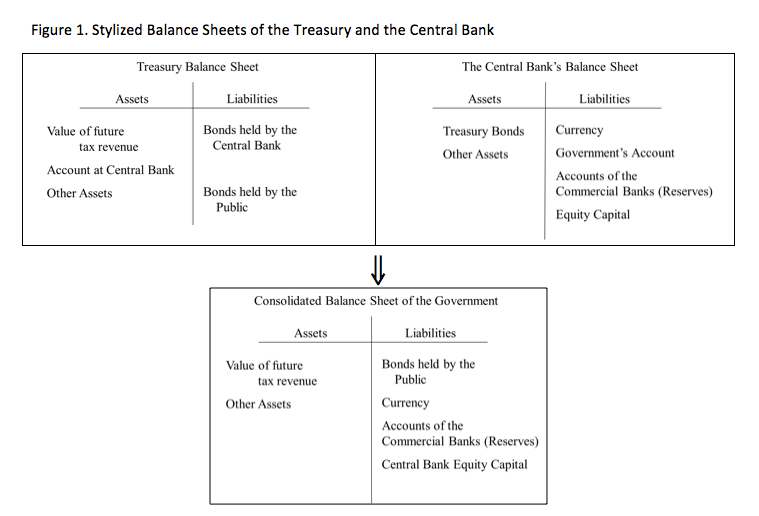

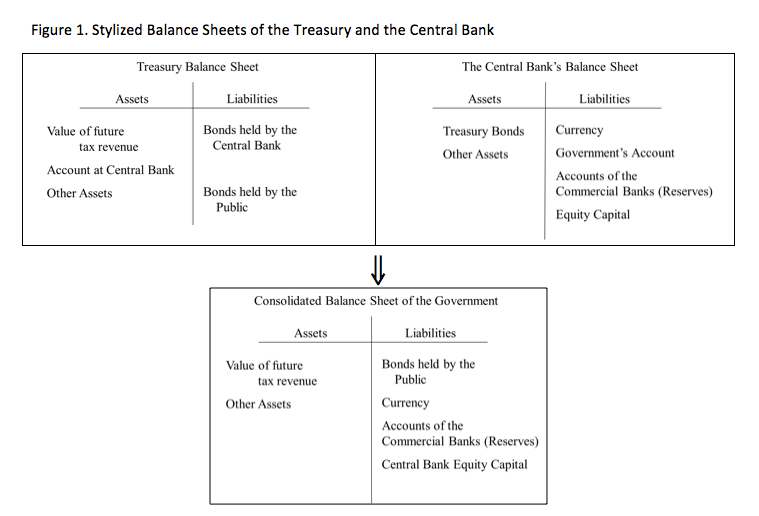

What this means is that the notion of helicopter money today is necessarily different from what Friedman had in mind. To explain the modern concept, we use the balance sheets of the central bank, of the Treasury, and of the consolidated government, which combines the first two. The basics of fiscal and monetary authority balance sheets have the following structure:

We usually think about the central bank as being a part of the government. In an economic sense, this means consolidating the two balance sheets into one. When we do that, the “Bonds held by the Central Bank” on the liabilities side of the Treasury’s balance sheet cancel the central bank’s holdings of “Treasury Bonds” on the asset side of its balance sheet. And the “Account at Central Bank” that appears as a Treasury asset cancels the “Government’s Account” on the liability side of the central bank’s balance sheet. The result is in the bottom part of Figure 1.

This consolidation reveals that when the central bank purchases a Treasury bond in the open market in exchange for commercial bank reserves, all it does is substitute a very short-term liability (reserves have zero maturity) for a longer-term liability. That is, a central bank purchase of government bonds simply alters the maturity structure of the consolidated government’s liabilities. (The purchase of private bonds is a different matter as it increases the size of the consolidated government balance sheet.)

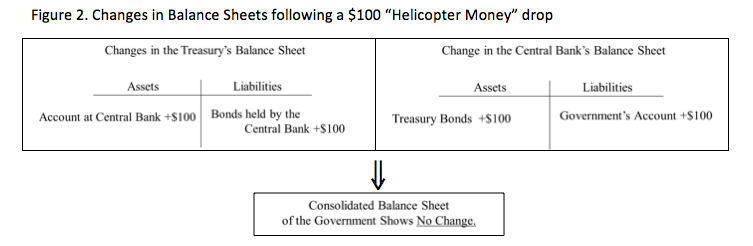

So, in operational terms, what is helicopter money today? As we understand it, helicopter money is a fiscal expansion that is financed by central bank money rather than by bonds. This means that it is not about $100 bills dropping from the sky, à la Friedman. Nor is it either quantitative easing (QE) per se, which can occur when fiscal policy tightens, eases, or remains unchanged; or an intergovernmental transfer, like the remittance of interest income from the central bank to the Treasury.

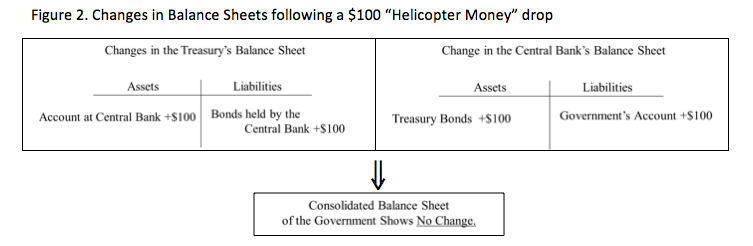

Instead, helicopter money is a multi-stage process that we can imagine starting with the central bank crediting the Treasury’s account. This increase in one central bank liability must be balanced either by a decrease in another liability or by an increase in an asset. In the first case, the only liability that could fall at the central bank’s discretion is its equity – for ease of exposition, we ignore this in what follows. The other alternative, and the one that is more commonly discussed, is that the Treasury issues a bond to the central bank in exchange for an increase in their account balance. (For simplicity, assume there are ways around the legal constraint that prevents many central banks from purchasing bonds directly from the fiscal authority.) For an amount of $100, the changes in the balance sheet look like this:

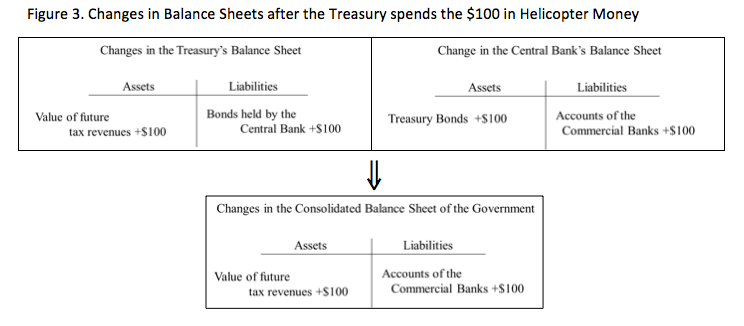

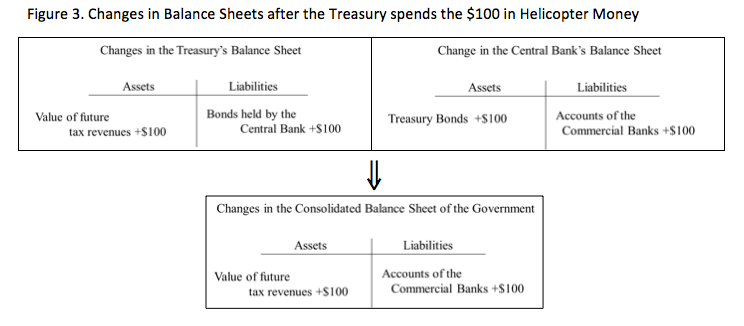

Figure 2 shows that, in exchange for $100 of Treasury Bonds, the central bank has credited the Treasury’s account with $100. In each case, one entity’s asset is the other’s liability, so the consolidated balance sheet shows no change—at least, not yet.

The next step in this description of helicopter money is that the Treasury distributes the $100. For example, it could transfer money to individuals, depositing it in their bank account, or it could use the funds to build a new bridge or renovate a rundown airport. (The government also could reduce taxes, but this functions like a transfer to the taxpayer when the tax is due.) In each case, the $100 is given to someone who deposits it in their commercial bank. When the payment clears, this shifts the liability on the central bank’s balance sheet from the Government Account to the Accounts of the Commercial Banks, as shown in Figure 3:

(Note that since the Treasury has spent its deposit at the central bank, something has to balance the bond that it issued. Assuming that the government operates within its long-term budget constraint—which it must do to remain solvent—the natural candidate is the present value of future tax revenues.)

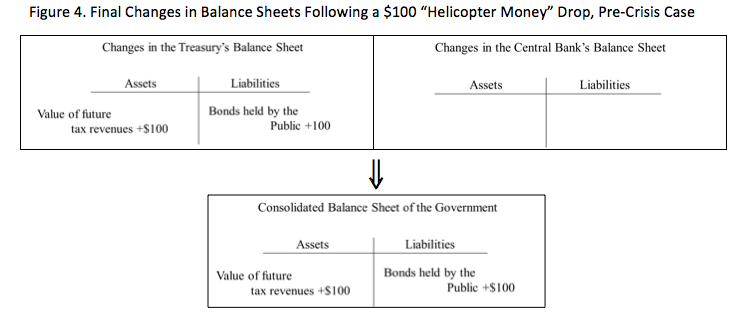

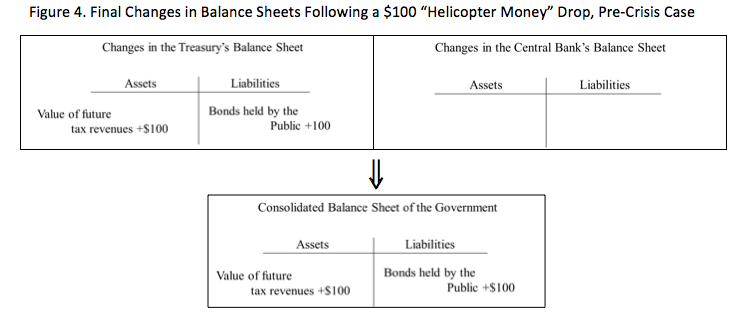

But, what happens to these commercial bank reserves? Prior to the crisis, when central banks like the Federal Reserve targeted a market interest rate, the quantity of reserves in the banking system was determined by commercial bank demand. That is, the central bank would elastically supply whatever reserves the banks wished to hold at the central bank’s interest rate target. In that setting, the only way to get banks to increase their reserve holdings would be to lower market interest rates. This has the extremely important implication that in the absence of a change in the target rate, commercial banks would exchange the additional reserves for Treasury Bonds, so that the balance sheets look like this:

Figure 4 shows the final balance sheet position following a $100 “helicopter money” drop for the pre-crisis case of interest rate targeting away from the ELB. That is, since reserves are demand determined, unless the central bank alters the interest rate target, its balance sheet is unchanged and the Treasury has engaged in conventional debt financed fiscal policy. Put differently, the helicopter money disappears.

To recap, in the pre-crisis world, the multi-stage process goes like this:

- The Treasury issues a bond to the central bank in exchange for a deposit balance.

- The Treasury spends the funds in its central bank deposit, shifting the central bank’s liability to commercial bank reserves and leading to an increase in expected future tax revenues (a Treasury asset).

- Commercial banks, not wanting the additional reserves, exchange them for a government bond, reducing central bank assets and liabilities. The central bank accommodates this exchange unless it wishes to alter the interest rate target.

- The result is an increase in the Treasury’s issue of publicly held bonds, rather than an increase in central bank money.

Admittedly, no one has suggested the use of helicopter money during normal times when bank demand for reserves is downward-sloping and the central bank accommodates that demand to hit its rate target. (For a description of Fed operating procedures in this setting, see Figure 1 here.) Instead, the recommendation is that it be used as a last resort—one that comes after quantitative easing (QE) has been exhausted and interest rates have plunged to the ELB. At that stage, reserves have been supplied massively in excess of the volume needed to hit any interest rate target and banks’ demand for reserves is fully elastic so that they will be indifferent between holding billions more or less (see Figure 2 here). Put differently, once QE drives interest rates to zero or lower, the level of reserves is supply determined. That means that when a commercial bank goes to the central bank to try to exchange the additional reserves for bonds (in Step 3 above), the central bank will refuse. As a result, Figure 3 describes the final position of the balance sheets.

Does this make any difference? Is helicopter money in this setting any different from standard QE when the Fed purchased long-term bonds in exchange for reserves in an effort to flatten the yield curve? Since the alternative is for the fiscal authorities to sell long-term bonds, the answer is no. To see why, note first that, following steps 1) and 2), the consolidated government bank balance sheet shows a $100 increase in both reserve liabilities and the present value of future tax revenue assets. Recall that, in contrast to Friedman’s world, central banks now pay interest on excess reserves. So, banks are compensated for the additional $100 they hold in their account at the central bank at the zero-maturity government rate.

If the yield curve still has any upward slope, issuing reserves rather than long-term bonds to finance fiscal expenditure will appear cheaper in terms of current debt service. However, this apparent saving is an illusion because it ignores interest rate risk. If the government chooses to issue long-term debt, it must compensate investors to take this risk; if it issues short, the government itself assumes the risk.

So, is there really no difference between conventional bond-financed fiscal expansion and helicopter money? There are a few. First, at the ELB, you might think of helicopter money as a combination of: (1) bond-financed fiscal expansion, and; (2) QE in which the monetary authority creates central bank money to acquire the bonds. Second, as several commentators have pointed out, helicopter money may strain the relationship between the fiscal and monetary authority. Forcing the central bank to engage in this practice undermines its independence, creating a situation commonly known as “fiscal dominance.” Third, so long as its currency has value, a central bank does not face rollover risk, so a fiscal expansion financed by central bank money is more stable than one financed by bond issuance. Put slightly differently, we can think of reserves as floating rate consols or perpetuities. But is rollover risk really a concern for the government of most advanced economies? We doubt it.

We are left with a simple conclusion. Helicopter money today is different from what Milton Friedman imagined; it is expansionary fiscal policy financed by central bank money. And, if interest rates have fallen to the ELB, it is neither more nor less powerful than any bond-financed cut in taxes or increase in government spending in combination with QE.

ウィレム・ブイターの

返信削除「アイスランドの銀行危機と最適通貨圏の最後の貸し手理論」

2008年10月の論文ですが、下記からDLできるようになってますね。

(99+) (PDF) The Icelandic banking crisis and what to do about it: The lender of last resort theory of optimal currency areas | Willem H Buiter - Academia.edu https://www.academia.edu/8092545/The_Icelandic_banking_crisis_and_what_to_do_about_it_The_lender_of_last_resort_theory_of_optimal_currency_areas?email_work_card=title