What is Modern Monetary Theory? (with Stephanie Kelton) – Pitchfork Economics 2019/4/23

ケルトンは政府予算についての循環型フローのイメージは危険だと言う。

https://video.twimg.com/ext_tw_video/1133002891201933313/pu/vid/1280x720/WhePUmi_ZpvaVkpH.mp4

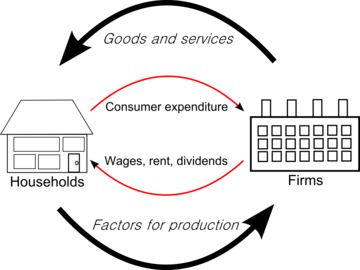

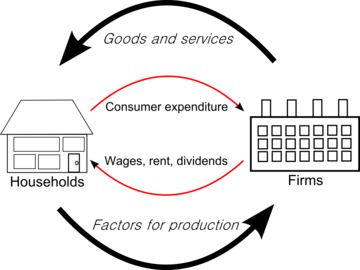

フロー循環図

http://nam-students.blogspot.com/2015/08/blog-post_38.html

参考:

サミュエル・テイラー・コールリッジ(Samuel Taylor Coleridge, 1772~1834)

https://nam-students.blogspot.com/2019/07/samuel-taylor-coleridge-17721834.html

the gardens of southern Europe Coleridge

http://nam-students.blogspot.com/2015/08/blog-post_38.html

参考:

サミュエル・テイラー・コールリッジ(Samuel Taylor Coleridge, 1772~1834)

https://nam-students.blogspot.com/2019/07/samuel-taylor-coleridge-17721834.html

the gardens of southern Europe Coleridge

Samuel Taylor Coleridge, William Greenough Thayer Shedd, Henry Nelson Coleridge - 1884 - 読む - 他の版

Samuel Taylor Coleridge, James Marsh William Greenough Thayer Shedd, Henry Nelson Coleridge, Sara Coleridge ... in actual existence, we could not perhaps find an apter illustration than the gardens of southern Europe would supply.

ハドソンの図は循環型だがファイナンスを別の線にしている

参考:

マイケル・ハドソン

バスタブからシンクへ

サミュエルソンは投資=ポンプの比喩を取り、バスタブの比喩を捨てた?

今MMTがこの比喩を使う

The Economy Is Like A Bathtub 2016/9/29 Kelton

5:32

サミュエルソンのバスタブは文字だけで絵はマンキューなどが使いはじめたのかも

These ideas can be better explained through the bathtub analogy that the economist Wynne Godley used to use; Godley being the man who fully formalised this approach to economics in his seminal work, co-authored by Marc Lavoie “Monetary Economics”. Godley asks us to think of economic variables as one would a bathtub. We fill up the bathtub to a certain level – call this level X. If we pull the plug the level of water starts to fall from point X. However, if we turn on the tap and ensure that the rate at which the water is flowing into the tub is the exact same as the amount of water flowing out, the water-level will remain at X. The bathtub can then be said to be in stock-flow equilibrium.

This conception of equilibrium is in no way metaphysical. It implicitly contains a vision of the economy as a collection of interacting stocks and flows. Our job as economists then is not to meditate on the harmony of supply and demand but instead to study how these variables are interacting and advise macroeconomic policy based on this. This is certainly not the economist-as-priest that Nelson, stuck in the neoclassical paradigm, assumes is inevitable in his book.

Today many neoclassical economists insist that their market equilibrium models are indeed stock-flow consistent. This is never the case and simply shows how, stuck as they are in their metaphysical stories about market equilibrium and rational agents, they completely muck up their analysis of the economy and cannot even get things straight in their own minds. There is an interesting history as to why the economics profession side-lined the stock-flow equilibrium approach in favour of the backward market equilibrium approach and we recap it below.

flow" over time of water in and out of the bathtub, the Balance Sheet gives a picture of the "stock" of water now in the tu

ーー

(マンキューマクロ入門篇邦訳旧第二版26頁)

ストック フロー

個人の富 個人の所得や支出

大卒者 新卒者

失業者数 離職者数

資本 投資

政府の負債 財政赤字

(マンキューマクロ入門篇邦訳旧第二版26頁)

ーーー

Savings + Taxes + Imports = Investment + Government Spending + Exports

S + T + M ≠ I + G + X

Total leakages > Total injections

Circular flow of income - Wikipedia

https://en.m.wikipedia.org/wiki/Circular_flow_of_incomeCircular flow of income

Basic diagram of the circular flow of income. The functioning of the free-market economic system is represented with firms and households and interaction back and forth.[2]

The circular flow of income or circular flow is a model of the economy in which the major exchanges are represented as flows of money, goods and services, etc. between economic agents. The flows of money and goods exchanged in a closed circuit correspond in value, but run in the opposite direction. The circular flow analysis is the basis of national accounts and hence of macroeconomics.

The idea of the circular flow was already present in the work of Richard Cantillon.[3] François Quesnay developed and visualized this concept in the so-called Tableau économique.[4] Important developments of Quesnay's tableau were Karl Marx' reproduction schemes in the second volume of Capital: Critique of Political Economy, and John Maynard Keynes' General Theory of Employment, Interest and Money. Richard Stone further developed the concept for the United Nations (UN) and the Organisation for Economic Co-operation and Development to the system, which is now used internationally.

Overview

The circular flow of income is a concept for better understanding of the economy as a whole and for example the National Income and Product Accounts (NIPAs). In its most basic form it considers a simple economy consisting solely of businesses and individuals, and can be represented in a so-called "circular flow diagram." In this simple economy, individuals provide the labour that enables businesses to produce goods and services. These activities are represented by the green lines in the diagram.[5]

Alternatively, one can think of these transactions in terms of the monetary flows that occur. Businesses provide individuals with income (in the form of compensation) in exchange for their labor. That income is spent on the goods and services businesses produce. These activities are represented by the blue lines in the diagram above.[5]

The circular flow diagram illustrates the interdependence of the “flows,” or activities, that occur in the economy, such as the production of goods and services (or the “output” of the economy) and the income generated from that production. The circular flow also illustrates the equality between the income earned from production and the value of goods and services produced.[5]

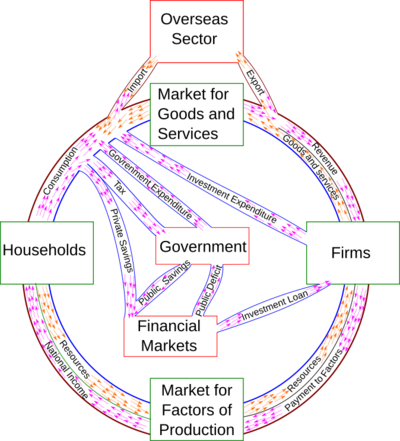

Of course, the total economy is much more complicated than the illustration above. An economy involves interactions between not only individuals and businesses, but also Federal, state, and local governments and residents of the rest of the world. Also not shown in this simple illustration of the economy are other aspects of economic activity such as investment in capital (produced—or fixed—assets such as structures, equipment, research and development, and software), flows of financial capital (such as stocks, bonds, and bank deposits), and the contributions of these flows to the accumulation of fixed assets.[5]

History

Cantillon

One of the earliest ideas on the circular flow was explained in the work of 18th century Irish-French economist Richard Cantillon,[3] who was influenced by prior economists, especially William Petty.[7] Cantillon described the concept in his 1730 Essay on the Nature of Trade in General, in chapter 11, entitled "The Par or Relation between the Value of Land and Labor" to chapter 13, entitled "The Circulation and Exchange of Goods and Merchandise, as well as their Production, are Carried On in Europe by Entrepreneurs, and at a Risk." Thornton eds. (2010) further explained:

- Cantillon develops a circular-flow model of the economy that shows the distribution of farm production between property owners, farmers, and workers. Farm production is exchanged for the goods and services produced in the cities by entrepreneurs and artisans. While the property owners are “independent,” the model demonstrates the mutual interdependence between all the classes of people that Adam Smith dubbed the “invisible hand” in The Theory of Moral Sentiments (1759).[8]

Cantillon distinguished at least five types of economic agents: property owners, farmers, entrepreneurs, labors and artisans, as expressed in the contemporary diagram of the Cantillon's Circular Flow Economy.[6]

Quesnay

François Quesnay further developed these concepts, and was the first to visualize these interactions over time in the so-called Tableau économique.[4] Quesnay believed that trade and industry were not sources of wealth, and instead in his 1758 book Tableau économique (Economic Table) argued that agricultural surpluses, by flowing through the economy in the form of rent, wages, and purchases were the real economic movers, for two reasons.

- First, regulation impedes the flow of income throughout all social classes and therefore economic development.

- Second, taxes on the productive classes such as farmers should be reduced in favor of higher taxes for unproductive classes such as landowners, since their luxurious way of life distorts the income flow.

The model Quesnay created consisted of three economic agents: The "Proprietary" class consisted of only landowners. The "Productive" class consisted of all agricultural laborers. The "Sterile" class is made up of artisans and merchants. The flow of production and/or cash between the three classes started with the Proprietary class because they own the land and they buy from both of the other classes. Quesnay visualised the steps in the process in the Tableau économique.

Marx

In Marxian economics, economic reproduction refers to recurrent (or cyclical) processes[9] by which the initial conditions necessary for economic activity to occur are constantly re-created.[10]

Economic reproduction involves the physical production and distribution of goods and services, the trade (the circulation via exchanges and transactions) of goods and services, and the consumption of goods and services (both productive or intermediate consumption and final consumption).

Karl Marx developed the original insights of Quesnay to model the circulation of capital, money, and commodities in the second volume of Das Kapital to show how the reproduction process that must occur in any type of society can take place in capitalist society by means of the circulation of capital.[11]

Marx distinguishes between "simple reproduction" and "expanded (or enlarged) reproduction".[12] In the former case, no economic growth occurs, while in the latter case, more is produced than is needed to maintain the economy at the given level, making economic growth possible. In the capitalist mode of production, the difference is that in the former case, the new surplus value created by wage-labour is spent by the employer on consumption (or hoarded), whereas in the latter case, part of it is reinvested in production.

Further developments

An important development was John Maynard Keynes' 1933 publication of the General Theory of Employment, Interest and Money. Keynes' assistant Richard Stone further developed the concept for the United Nations (UN) and the Organisation for Economic Co-operation and Development to the systems, which is now used internationally.

The first to visualize the modern circular flow of income model was Frank Knight in 1933 publication of The Economic Organization.[13] Knight (1933) explained:

- [we may view the] economic organization as a system of prize relations. Seen in the large, free enterprise is an organization of production and distribution in which individuals or family units get their real income, their "living," by selling productive power for money to "business units" or "enterprises", and buying with the money income thus obtained the direct goods and services which they consume. This view, it will be remembered, ignores for the sake of simplicity the fact that an appreciable fraction of the productive power in use at any time is not really employed in satisfying current wants but to make provision for increased want-satisfaction in the future; it treats society as it would be, or would tend to become, with progress absent, or in a “static” state.[14]

Knight pictured a circulation of money and circulation of economic value between people (individuals, families) and business enterprises as a group,[15] explaining: "The general character of an enterprise system, reduced to its very simplest terms, can be illustrated by a diagram showing the exchange of productive power for consumption goods between individuals and business units, mediated by the circulation of money, and suggesting the familiar figure of the wheel of wealth."[16]

Types of models

A circular flow of income model is a simplified representation of an economy.[2]

Two-sector model

In the basic two-sector circular flow of income model, the economy consists of two sectors: (1) households and (2) firms.[17][18] (Some sources refer to households as "individuals"[19] or the "public"[20] and to firms as "businesses"[1][2] or the "productive sector."[21]) The model assumes that there is no financial sector, no government sector, and no foreign sector. In addition, the model assumes that (a) through their expenditures, households spend all of their income on goods and services or consumption and (b) through their expenditures, households purchase all output produced by firms.[18] This means that all household expenditures become income for firms. The firms then spend this all of this income on factors of production such as labor, capital and raw materials, "transferring" all of their income to the factor owners (which are households). The factor owners (households), in turn, spend all of their income on goods, which leads to a circular flow of income.[20][18][22]

Three-sector model

The three-sector model adds the government sector to the two-sector model.[17][18] Thus, the three-sector model includes (1) households, (2) firms, and (3) government. It excludes the financial sector and the foreign sector. The government sector consists of the economic activities of local, state and federal governments. Flows from households and firms to government are in the form of taxes. The income the government receives flows to firms and households in the form of subsidies, transfers, and purchases of goods and services.[17][18] Every payment has a corresponding receipt; that is, every flow of money has a corresponding flow of goods in the opposite direction.[17][18] As a result, the aggregate expenditure of the economy is identical to its aggregate income, making a circular flow.

Four-sector model

The four-sector model adds the foreign sector to the three-sector model.[17][18][23] (The foreign sector is also known as the "external sector," the "overseas sector,"[19] or the "rest of the world.") Thus, the four-sector model includes (1) households, (2) firms, (3) government, and (4) the rest of the world. It excludes the financial sector. The foreign sector comprises (a) foreign trade (imports and exports of goods and services) and (b) inflow and outflow of capital (foreign exchange).[18] Again, each flow of money has a corresponding flow of goods (or services) in the opposite direction.[18] Each of the four sectors receives some payments from the other in lieu of goods and services which makes a regular flow of goods and physical services. The addition of the foreign sector transforms the model from a closed economy to an open economy!

Five-sector model

The five-sector model adds the financial sector to the four-sector model.[19] Thus, the five-sector model includes (1) households, (2) firms, (3) government, (4) the rest of the world, and (5) the financial sector. The financial sector includes banks and non-bank intermediaries that engage in borrowing (savings from households) and lending (investments in firms).[19] Money facilitates such an exchange smoothly. Residuals from each market enter the capital market as savings, which in turn are invested in firms and the government sector. Technically speaking, so long as lending is equal to borrowing (i.e., leakages are equal to injections), the circular flow will continue indefinitely. However, this job is done by financial institutions in the economy.

- Five Sector Circular Flow of Income Model

- Circular flow diagram - five sectors model

Alternative models

The progression from the two-sector model to the five sector model as documented above (that is, by starting with households and firms, then successively adding the government sector, the foreign sector, and the financial sector) is common. However, some authors group (1) households, (2) firms, and (3) the financial sector together as the "private sector" and subsequently add (4) the government sector, making the "domestic sector," and (5) the foreign sector.[19] Others use the "capital market" rather than the "financial sector" to account for the flows of savings and investments; in these sources, the fully specified model has four sectors (households, firms, government, and foreign) plus the capital market, which is regarded as a market rather than a sector.[18]

Circular flow of income topics

Leakages and injections

In the five sector model, there are leakages and injections

- Leakage means withdrawal from the flow. When households and firms save part of their incomes it constitutes leakage. They may be in form of savings, tax payments, and imports. Leakages reduce the flow of income.

- Injection means introduction of income into the flow. When households and firms borrow the savings, they constitute injections. Injections increase the flow of income. Injections can take the forms of investment, government spending and exports. As long as leakages are equal to injections, the circular flow of income continues indefinitely. Financial institutions or capital market play the role of intermediaries. This means that income individuals receive from businesses and the goods and services that are sold to them do not count as injections or leakages, as no new money is being introduced to the flow and no money is being taken out of the flow.

Leakages and injections can occur in the financial sector, government sector and overseas sector:

- In the financial sector

In terms of the circular flow of income model, the leakage that financial institutions provide in the economy is the option for households to save their money. This is a leakage because the saved money can not be spent in the economy and thus is an idle asset that means not all output will be purchased. The injection that the financial sector provides into the economy is investment (I) into the business/firms sector. An example of a group in the finance sector includes banks such as Westpac or financial institutions such as Suncorp.

- In the government sector

The leakage that the Government sector provides is through the collection of revenue through Taxes (T) that is provided by households and firms to the government. This is a leakage because it is a leakage out of the current income thus reducing the expenditure on current goods and services. The injection provided by the government sector is Government spending (G) that provides collective services and welfare payments to the community. An example of a tax collected by the government as a leakage is income tax and an injection into the economy can be when the government redistributes this income in the form of welfare payments, that is a form of government spending back into the economy.

- In the overseas sector

The main leakage from this sector are imports (M), which represent spending by residents into the rest of the world. The main injection provided by this sector is the exports of goods and services which generate income for the exporters from overseas residents. An example of the use of the overseas sector is Australia exporting wool to China, China pays the exporter of the wool (the farmer) therefore more money enters the economy thus making it an injection. Another example is China processing the wool into items such as coats and Australia importing the product by paying the Chinese exporter; since the money paying for the coat leaves the economy it is a leakage.

- Summary of leakages and injections

-

LEAKAGES INJECTIONS Saving (S) Investment (I) Taxes (T) Government Spending (G) Imports (M) Exports (X)

- Table 1 All leakages and injections in the five sector model

The state of equilibrium

In terms of the five sector circular flow of income model the state of equilibrium occurs when the total leakages are equal to the total injections that occur in the economy. This can be shown as:

OR

S + T + M = I + G + X.

This can be further illustrated through a fictitious economy where:

S + T + M = I + G + X

$100 + $150 + $50 = $50 + $100 + $150

$300 = $300

$100 + $150 + $50 = $50 + $100 + $150

$300 = $300

Therefore, since the leakages are equal to the injections the economy is in a stable state of equilibrium. This state can be contrasted to the state of disequilibrium where unlike that of equilibrium the sum of total leakages does not equal the sum of total injections. By giving values to the leakages and injections the circular flow of income can be used to show the state of disequilibrium. Disequilibrium can be shown as:

Therefore, it can be shown as one of the below equations where:

$150 (S) + $250 (T) + $150 (M) > $75 (I) + $200 (G) + $150 (X)

Or

Total Leakages < Total injections

$50 (S) + $200 (T) + $125 (M) < $75 (I) + $200 (G) + $150 (X)

The effects of disequilibrium vary according to which of the above equations they belong to.

If S + T + M > I + G + X the levels of income, output, expenditure and employment will fall causing a recession or contraction in the overall economic activity. But if S + T + M < I + G + X the levels of income, output, expenditure and employment will rise causing a boom or expansion in economic activity.

To manage this problem, if disequilibrium were to occur in the five sector circular flow of income model, changes in expenditure and output will lead to equilibrium being regained. An example of this is if:

S + T + M > I + G + X the levels of income, expenditure and output will fall causing a contraction or recession in the overall economic activity. As the income falls households will cut down on all leakages such as saving, they will also pay less in taxation and with a lower income they will spend less on imports. This will lead to a fall in the leakages until they equal the injections and a lower level of equilibrium will be the result.

The other equation of disequilibrium, if S + T + M < I + G + X in the five sector model the levels of income, expenditure and output will greatly rise causing a boom in economic activity. As the households income increases there will be a higher opportunity to save therefore saving in the financial sector will increase, taxation for the higher threshold will increase and they will be able to spend more on imports. In this case when the leakages increase the situation will be a higher level of equilibrium.

Significance of study of circular flow of income

The circular flow of income is significant in four areas:[24]

- Measurement of national income

- Knowledge of Interdependence - Circular flow of income signifies the interdependence of each of activity upon one another. If there is no consumption, there will be no demand and expenditure which in fact restricts the amount of production and income.

- Unending Nature of Economic Activities - It signifies that production, income and expenditure are of unending nature, therefore, economic activities in an economy can never come to a halt. National income is also bound to rise in future.

- Injections and Leakages

Circular flow diagram as a subsystem of the environment

See also: Ecological economics

The circular flow diagram is an abstraction of the economy as a whole. The diagram suggests that the economy can reproduce itself. The idea is that as households spend money of goods and services from firms, the firms have the means to purchase labor from the households, which the households to then purchase goods and services. Suggesting that this process can and will continuously go on as a perpetual motion machine. However, according to the Laws of Thermodynamics perpetual motion machines do not exist.[25] The First Laws says matter and energy cannot be created or destroyed, and the Second Laws says that matter and energy move from a low entropy, useful, state towards a less useful higher entropy state.[26] Thus, no system can continue without inputs of new energy that exit as high entropy waste. Just as no animal can live on its own waste, no economy can recycle the waste it produces without the input of new energy to reproduce itself. The economy therefore cannot be the whole. It must be a subsystem of the larger ecosystem.[25]

The abstraction ignores the linear throughput of matter and energy that must power the continuous motion of money, goods and services, and factors of production. Matter and energy enter the economy in the form of low entropy natural capital, such as solar energy, oil wells, fisheries, and mines. These materials and energy are used by households and firms a like to create products and wealth. After the material are used up the energy and matter leaves the economy in the form of high entropy waste that is no longer valuable to the economy. The natural materials that power the motion of the circular flow of the economy come from the environment, and the waste must be absorbed by the larger ecosystem in which the economy exists.[27]

This is not to say that the circular flow diagram isn't useful in understanding the basics of an economy, such as leakages and injections. However, it cannot be ignored that the economy intrinsically requires natural resources and the creation of waste that must be absorbed in some manner. The economy can only continuing churning if it has matter and energy to power it and the ability to absorb the waste it creates. This matter and low entropy energy and the ability to absorb waste exists in a finite amount, and thus there is a finite amount of inputs to the flow and outputs of the flow that the environment can handle, implying there is a sustainable limit to motion, and therefore growth, of the economy.[25]

See also

References

- ^ a b Gwartney, James D.; Stroup, Richard L.; Sobel, Russell S.; Macpherson, David A. (2014). Macroeconomics: Private and Public Choice. Cengage Learning. pp. 173–5. ISBN 978-1-285-45354-5.

- ^ a b c Daraban, Bogdan (2010-06-05). "Introducing the Circular Flow Diagram to Business Students". Journal of Education for Business. 85 (5): 274–279. doi:10.1080/08832320903449527. ISSN 0883-2323. Retrieved 2019-06-16.

- ^ a b Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." Journal of the History of Economic Thought. 1.1 (1993): 47-62.

- ^ a b Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: Famous Figures and Diagrams in Economics (2010): 221-230. Chapter 23.

- ^ a b c d Measuring the Economy : A Primer on GDP and the National Income and Product Accounts, by Bureau of Economic Analysis (BEA), U.S. Department of Commerce, October 2014.

- ^ a b Cantillon 2010, p. 66

- Aspromourgos, Tony. "'Political economy and the social division of labour: the economics of Sir William Petty." Scottish Journal of Political Economy 33.1 (1986): 28-45.

- Cantillon 2010, p. 69: Abstract of chapter 12.

- In a recurrent process, the same event repeats itself on multiple occasions. In a cyclical process, a sequence of events repeats itself on a regular basis.

- Michel Aglietta, introduction to Aglietta, A theory of capitalist regulation. London: NLB, 1979.

- Karl Marx, Capital, Volume II. Penguin Classics, 1992.

- Karl Marx, Capital, Volume I. Penguin Classics, 1990, chapter 23 and Capital, Volume II. Penguin Classics, 1992, chapter 20 and 21.

- Patinkin, Don (December 1973). "In Search of the" Wheel of Wealth": On the Origins of Frank Knight's Circular-Flow Diagram". The American Economic Review. 63 (5): 1037–1046. JSTOR 1813935.

- Frank Knight. The Economic Organization, 1933. p.59-60

- Knight (1933, p. 61)

- Knight (1933, p. 60)

- ^ a b c d e Agarwal, Vanita (2010). Macroeconomics: Theory and Policy. Pearson Education India. ISBN 978-81-317-3149-9.

- ^ a b c d e f g h i j Dwivedi, D. N. (2010). Macroeconomics: Theory and Policy (3rd ed.). Tata McGraw-Hill Education. p. 45. ISBN 978-0-07-009145-0.

- ^ a b c d e Buultjens, Jeremy (2000). Excel Preliminary Economics. Pascal Press. pp. 9–10. ISBN 978-1-74020-088-2.

- ^ a b Samuelson, Paul Anthony (1948). Economics: An Introductory Analysis. McGraw-Hill Book Company. p. 226.

- Jackson, Dudley (1982). Introduction To Economics. Macmillan International Higher Education. ISBN 978-1-349-16933-7.

- Beveridge, Thomas (2013-03-29). A Primer on Macroeconomics. Business Expert Press. ISBN 978-1-60649-424-0.

- Bouman, John. Principles of Macroeconomics.

- Perkins, J. O. N. (1990-06-18). A General Approach to Macroeconomic Policy. Springer. ISBN 978-1-349-10661-5.

- ^ a b c Daly, Herman E., and Joshua C. Farley. Ecological Economics: Principles and Applications. Washington: Island, 2011. Print. p. 29.

- Drake, Gordon W.F. "Thermodynamics." Encyclopædia Britannica. Encyclopædia Britannica, Inc., 03 Apr. 2017. Web. 04 Apr. 2017.

- Daly, Herman E., and Joshua C. Farley. Ecological Economics: Principles and Applications. Washington: Island, 2011. Print. p. 29-34.

- Attribution

This article incorporates text from Bureau of Economic Analysis. Measuring the Economy : A Primer on GDP and the National Income and Product Accounts, 2014, a publication now in the public domain.

Further reading

- Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: Famous Figures and Diagrams in Economics (2010): 221-230. Chapter 23.

- Richard Cantillon, Chantal Saucier (translation) & Mark Thornton (editor) (2010) [1755]. An Essay on Economic Theory. Auburn, Alabama: Ludwig von Mises Institute. ISBN 0-415-07577-7.

- Daraban, Bogdan. "Introducing the Circular Flow Diagram to Business Students." Journal of Education for Business 85.5 (2010): 274-279.

- Mankiw, Gregory (2011). Principles of Economics, 6th edition. Thomson Europe.

- Marks, Melanie, and Gemma Kotula. "Using the circular flow of income model to teach economics in the middle school classroom." The Social Studies 100.5 (2009): 233-242.

- Lloyd A. Metzler. “Three Lags in the Circular Flow of Income”, in: Income, Employment and Public; essays in honor of Alvin H. Hansen, Lloyd A Metzler; New York, W.W. Norton [1948]. pp. 11–32

- Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." Journal of the History of Economic Thought. 1.1 (1993): 47-62.

- Sloman, John (1999). Economics, 3rd edition. Prentice Economics. Europe: Prentice-Hall. ISBN 0-273-65574-4.

External links

- Circular Flow, The Economic Lowdown Video Series at stlouisfed.org/

ーーー

サミュエルソン19th

2010

バスタブの比喩は文字としても消えた

What is Modern Monetary Theory? (with Stephanie Kelton) – Pitchfork Economics 2019/4/23

19:30

Stephanie K.: What I would suggest instead I guess is, to picture a bathroom sink or a bathtub, and to think of the government spending… think of a vertical line rather than a circle. From the very top, the government is spending money into the economy, so maybe that’s the water coming [00:20:00] from the faucet into the sink.

Stephanie K.: Now, the economy is being flooded with some dollars that were spent into it. At the same time, the government is taxing some of that out, and so that’s the drain. That’s just shooting straight down and it’s just gone. It doesn’t go back to government and fund the next round of spending.

Stephanie K.: It’s more like, I don’t like the metaphor of printing money, but if I’m going to use it, I’ll say that spending is like hitting in the print key on the keyboard, and taxing is like hitting [00:20:30] the delete key. It’s just removing some of the money that the government spent into the economy. I think, yeah, a vertical line works better.

Stephanie K .:その代わりに私が推薦するのは、浴室の流しや浴槽を描き、政府の支出を考えることです…円ではなく縦線を考えることです。一番上から、政府は経済にお金を使っているので、多分それは蛇口から流しに入ってくる水である[00:20:00]。

Stephanie K。:今、経済はそれに費やされたいくつかのドルであふれています。同時に、政府はそのうちのいくらかを課税しています、そしてそれはそれの流出です。それはただまっすぐに撃っているだけで、それはただ消えてしまったのです。それは政府に戻り、次の回の支出に資金を供給するのではありません。

Stephanie K。:お金を印刷するという比喩はあまり好きではありませんが、使用するのであれば、支出はキーボードの印刷キーを押すようなものであり、課税は次のようなものです。 [00:20:30]削除キーを押してください。政府が経済に費やしたお金の一部を取り除いただけです。ええ、垂直線の方がうまくいくと思います。

Paul Anthony Samuelson、William Samuelson - 1980 - スニペット表示 - 他の版

返信削除ポールアンソニーサミュエルソン、ウィリアムサミュエルソン。 4何が…年末年始です。 (バスタブに出入りする水の時間経過に伴う「流れ」を記録する映画カメラとは異なり、バランスシートは現在浴槽に入っている水の「ストック」の写真を与えます。)...

経済学 - 113ページ

https://books.google.co.jp/books?isbn ...

ポールA.サミュエルソン、アンソニースコット - 1975年 - スニペット表示

ポールA.サミュエルソン、アンソニースコット。 付録:〜の要素(バスタブに出入りする水の時間経過に伴う「流れ」を記録する映画カメラとは異なり、貸借対照表には現在浴槽に入っている水の「在庫」の写真が表示されます)。 ...

返信削除1.3ストック、フロー、バランスシート:バスタブのアナロジー

http://econdays.net/?p=9980

__

[_G_]

━┻┻━┓

━━┓_┃

))) 民間部門

┃~~~~~~~~~┃

┃ S ┃

┃ ┃

┗━━━┓ ┏━━━┛

━━━┛T┃

━━━━━┛

この単純な事例では、政府が赤字支出し、民間部門が貯蓄しており、バスタブの水が増えている。ここから、国民所得・生産勘定の有名な最初の等式が得られる。

S ≡ (G-T)

民間部門の貯蓄(S)というフローは、定義により財政赤字の額(G − T)と等しい。常に等しい(≡は、「定義により等しい」を意味している)。

上は政府部門と世帯部門のような二部門経済の場合だった。ここに企業による投資支出を加味するために企業部門を加えると、蛇口をもう一つの加えるのと同様になる。

__ __

[_G_] [_I_] ①蛇口=政府支出G、国内民間投資I

━┻┻━┓┏━┻┻━

━━┓_┃┃_┏━━

))) (((

┃~~~~~~~~~┃②水=貨幣(水が溢れるとインフレ)

┃ S ┃

┃ ┃

┗━━━┓ ┏━━━┛③シンクストッパー=租税政策

━━━┛T┃

━━━━━┛④配水管=税金T

すると恒等式はこうなる。

S = (G-T) + I

ここでIは国内民間投資だ。

さらに海外部門を加える場合は、さらにもう一組の蛇口と排水口が必要になり、

__

[NX]

┏━┻┻━━━━

┃ ┏━━━━━

__ ┃ ┃ __

[G_] ┃ ┃ [_I_] ①蛇口=政府支出G、国内民間投資I、純輸出NX

━┻┻━┓┃ ┃┏━┻┻━

━━┓_┃┃_┃┃_┏━━

))) ((( (((

┃~~~~~~~~~┃②水=貨幣(水が溢れるとインフレ)

┃ S ┃

┃ ┃

┗━┓ ┏┓ ┏━━┛③シンクストッパー=租税政策

━━━┛T┃┃M┃

━━━━━┛┃ ┃ ④配水管=税金T、輸入M

━━━━━━┛ ┃

━━━━━━━━┛

完全な等式は次のようになる。

S = (G – T) + I + NX (NX は純輸出)

これが総貯蓄の恒等式である。

返信削除1.3ストック、フロー、バランスシート:バスタブのアナロジー http://econdays.net/?p=9980

__

[_G_]

━┻┻━┓

━━┓_┃

))) 民間部門

┃~~~~~~~~~┃

┃ S ┃

┃ ┃

┗━━━┓ ┏━━━┛

┃T┃

この単純な事例では、政府が赤字支出し、民間部門が貯蓄しており、バスタブの水が増えている。ここから、国民所得・生産勘定の有名な最初の等式が得られる。

S ≡ (G-T)

民間部門の貯蓄(S)というフローは、定義により財政赤字の額(G − T)と等しい。常に等しい(≡は、「定義により等しい」を意味している)。

上は政府部門と世帯部門のような二部門経済の場合だった。ここに企業による投資支出を加味するために企業部門を加えると、蛇口をもう一つの加えるのと同様になる。

__ __

[_G_] [_I_] ①蛇口=政府支出G、国内民間投資I

━┻┻━┓┏━┻┻━

━━┓_┃┃_┏━━

))) (((

┃~~~~~~~~~┃②水=貨幣(水が溢れるとインフレ)

┃ S ┃

┃ ┃

┗━━━┓ ┏━━━┛③シンクストッパー=租税政策

┃T┃ ④配水管=税金T

すると恒等式はこうなる。

S = (G-T) + I

ここでIは国内民間投資だ。

さらに海外部門を加える場合は、さらにもう一組の蛇口と排水口が必要になり、

__

[NX]

┏━┻┻━━━━

┃ ┏━━━━━

__ ┃ ┃ __

[G_] ┃ ┃ [_I_] ①蛇口=政府支出G、国内民間投資I、純輸出NX

━┻┻━┓┃ ┃┏━┻┻━

━━┓_┃┃_┃┃_┏━━

))) ((( (((

┃~~~~~~~~~┃②水=貨幣(水が溢れるとインフレ)

┃ S ┃

┃ ┃

┗━┓ ┏┓ ┏━━┛③シンクストッパー=租税政策

┃T┃┃M┃ ④配水管=税金T、輸入M

完全な等式は次のようになる。

S = (G – T) + I + NX (NX は純輸出)

これが総貯蓄の恒等式である。

返信削除さらに海外部門を加える場合は、さらにもう一組の蛇口と排水口が必要になり、

__

[X_]

┏━┻┻━━━━

┃ ┏━━━━━

__ ┃ ┃ __

[G_] ┃ ┃ [_I_] ①蛇口=政府支出G、国内民間投資I、輸入X[純輸出NX(X-M)]

━┻┻━┓┃ ┃┏━┻┻━

━━┓_┃┃_┃┃_┏━━

))) ((( (((

┃~~~~~~~~~┃②水=貨幣(水が溢れるとインフレ)

┃ S ┃

┃ ┃

┗━┓ ┏┓ ┏━━┛③シンクストッパー=租税政策

┃T┃┃M┃ ④配水管=税金T、輸入M

完全な等式は次のようになる。

S = (G – T) + I + NX (NX は純輸出)

これが総貯蓄の恒等式である。

返信削除William Mitchell (著), L. Randall Wray (著), Martin Watts (著)

https://www.amazon.co.jp/Macroeconomics-William-Mitchell/dp/1137610662

https://nam-students.blogspot.com/2019/03/macroeconomics-2019-william-mitchell-l.html

https://nam-students.blogspot.com/2019/04/mmt.html@

https://nam-students.blogspot.com/2019/03/2019225-william-mitchell-l-randall-wray.html

政府-非政府部門間垂直取引の図

Full Employment Abandoned: Shifting sands and policy failuresから

政府部門

財務省と中央銀行

物やサービスを販売\ /中央銀行業務(OMO、決済)

金を販売 / ⬆︎ ⬇︎ │ 外貨、金

\ 政府支出

民間の信用市場 非政府部門 (貯蔵)通貨のストック

レバレッジ活動 ⬅︎➡︎ 銀行、家計、民間企業 ━━━ 準備預金

全取引の合計はゼロ 国債

貸出が預金を創造 非政府のブリキ小屋

⬇︎ 累積財政赤字を貯蔵

銀行信用

社債

未公開株

税

純金融資産を除去 ➡︎ ゴミ箱へ

上で示した図では、ストック累積が、我々が「非政府部門のブリキ小屋」(Non-government Tin Shed)と名付けた不換紙幣・準備預金・政府債券の蓄積によってなされるということを示している。「キャンベラのどこかに備蓄地域があって、国民政府がそこにすべての余剰物資を後の利用のために備蓄しているのだ」という大衆の思い込みを解除するために、「ブリキ小屋」(Tin shed)というアナロジーを用いている――それは過去の政府体制における重大主張だったのだ。実際には、そこに備蓄などない。なぜなら、余剰のある限り、購買力は永久に損なわれているからだ。しかし、非政府部門は確かに金融システムのいたるところで「ブリキ小屋」を所有している。

政府部門から非政府部門へ流れるあらゆる支出は、非政府部門に現金・準備預金・債券の形で残っている税負債(the taxation liabilities)を取り上げるものではない。したがって、「ブリキ小屋」に積み上げられている金融資産の蓄積は、累積財政赤字を反映したものであるということが分かる。

垂直の線の一番下は税で、ごみ箱に繋げることで、何かをファイナンスしているのではないことを強調している。税は民間部門の金融収支を減じるが、何ら政府のプラスになるわけではない――その減少分は請求されるものの、どこかへ流れるわけではないのだ。

2019原書ではp.371

Figure 23.2 Vertical and horizontal macroeconomic relations

ビル・ミッチェル「赤字財政支出 101 – Part 3」(2009年3月2日) — 経済学101

https://econ101.jp/ビル・ミッチェル「赤字財政支出-101-part-3」(2069年3月2日/…

https://nam-students.blogspot.com/2019/05/101-part-3200932-101-httpsecon101.html

Part3の翻訳はこちら

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png 統合政府(財務省、中央銀行)の図

返信削除William Mitchell (著), L. Randall Wray (著), Martin Watts (著)

https://www.amazon.co.jp/Macroeconomics-William-Mitchell/dp/1137610662

https://nam-students.blogspot.com/2019/03/macroeconomics-2019-william-mitchell-l.html

https://nam-students.blogspot.com/2019/04/mmt.html@

https://nam-students.blogspot.com/2019/03/2019225-william-mitchell-l-randall-wray.html

政府-非政府部門間垂直取引の図

Full Employment Abandoned: Shifting sands and policy failuresから

政府部門

財務省と中央銀行

物やサービスを販売\ /中央銀行業務(OMO、決済)

金を販売 / ⬆︎ ⬇︎ │ 外貨、金

\ 政府支出

民間の信用市場 非政府部門 (貯蔵)通貨のストック

レバレッジ活動 ⬅︎➡︎ 銀行、家計、民間企業 ━━━ 準備預金

全取引の合計はゼロ 国債

貸出が預金を創造 非政府のブリキ小屋

⬇︎ 累積財政赤字を貯蔵

銀行信用

社債

未公開株

税

純金融資産を除去 ➡︎ ゴミ箱へ

上で示した図では、ストック累積が、我々が「非政府部門のブリキ小屋」(Non-government Tin Shed)と名付けた不換紙幣・

準備預金・政府債券の蓄積によってなされるということを示している。「キャンベラのどこかに備蓄地域があって、国民政府が

そこにすべての余剰物資を後の利用のために備蓄しているのだ」という大衆の思い込みを解除するために、「ブリキ小屋」

(Tin shed)というアナロジーを用いている――それは過去の政府体制における重大主張だったのだ。実際には、そこに備蓄

などない。なぜなら、余剰のある限り、購買力は永久に損なわれているからだ。しかし、非政府部門は確かに金融システムの

いたるところで「ブリキ小屋」を所有している。

政府部門から非政府部門へ流れるあらゆる支出は、非政府部門に現金・準備預金・債券の形で残っている税負債

(the taxation liabilities)を取り上げるものではない。したがって、「ブリキ小屋」に積み上げられている金融資産の蓄積は、

累積財政赤字を反映したものであるということが分かる。

垂直の線の一番下は税で、ごみ箱に繋げることで、何かをファイナンスしているのではないことを強調している。税は

民間部門の金融収支を減じるが、何ら政府のプラスになるわけではない――その減少分は請求されるものの、どこかへ流れる

わけではないのだ。

2019原書ではp.371

Figure 23.2 Vertical and horizontal macroeconomic relations

ビル・ミッチェル「赤字財政支出 101 – Part 3」(2009年3月2日) — 経済学101

https://econ101.jp/ビル・ミッチェル「赤字財政支出-101-part-3」(2069年3月2日/…

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

こちらは統合政府(財務省、中央銀行)の図

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101-2.png

返信削除William Mitchell (著), L. Randall Wray (著), Martin Watts (著)

https://www.amazon.co.jp/Macroeconomics-William-Mitchell/dp/1137610662

政府-非政府部門間垂直取引の図

Full Employment Abandoned: Shifting sands and policy failuresから

政府部門

財務省と中央銀行

物やサービスを販売\ /中央銀行業務(OMO、決済)

金を販売 / ⬆︎ ⬇︎ │ 外貨、金

\ 政府支出

民間の信用市場 非政府部門 (貯蔵)通貨のストック

レバレッジ活動 ⬅︎➡︎ 銀行、家計、民間企業 ━━━ 準備預金

全取引の合計はゼロ 国債

貸出が預金を創造 非政府のブリキ小屋

⬇︎ 累積財政赤字を貯蔵

銀行信用

社債

未公開株

税

純金融資産を除去 ➡︎ ゴミ箱へ

上で示した図では、ストック累積が、我々が「非政府部門のブリキ小屋」(Non-government Tin Shed)と

名付けた不換紙幣・準備預金・政府債券の蓄積によってなされるということを示している。「キャンベラの

どこかに備蓄地域があって、国民政府がそこにすべての余剰物資を後の利用のために備蓄しているのだ」と

いう大衆の思い込みを解除するために、「ブリキ小屋」(Tin shed)というアナロジーを用いている――

それは過去の政府体制における重大主張だったのだ。実際には、そこに備蓄などない。なぜなら、余剰の

ある限り、購買力は永久に損なわれているからだ。しかし、非政府部門は確かに金融システムの

いたるところで「ブリキ小屋」を所有している。

政府部門から非政府部門へ流れるあらゆる支出は、非政府部門に現金・準備預金・債券の形で残っている

税負債(the taxation liabilities)を取り上げるものではない。したがって、「ブリキ小屋」に積み上げられ

ている金融資産の蓄積は、累積財政赤字を反映したものであるということが分かる。

垂直の線の一番下は税で、ごみ箱に繋げることで、何かをファイナンスしているのではないことを強調して

いる。税は民間部門の金融収支を減じるが、何ら政府のプラスになるわけではない――その減少分は請求さ

れるものの、どこかへ流れるわけではないのだ。

2019原書ではp.371

Figure 23.2 Vertical and horizontal macroeconomic relations

ビル・ミッチェル「赤字財政支出 101 – Part 3」(2009年3月2日) — 経済学101

https://econ101.jp/ビル・ミッチェル「赤字財政支出-101-part-3」(2069年3月2日/…

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

こちらは統合政府(財務省、中央銀行)の図

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101-2.png

返信削除William Mitchell (著), L. Randall Wray (著), Martin Watts (著)

https://www.amazon.co.jp/Macroeconomics-William-Mitchell/dp/1137610662

政府-非政府部門間垂直取引の図

Full Employment Abandoned: Shifting sands and policy failuresから

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

政府部門

財務省と中央銀行

物やサービスを販売\ /中央銀行業務(OMO、決済)

金を販売 / ⬆︎ ⬇︎ │ 外貨、金

\ 政府支出

民間の信用市場 非政府部門 (貯蔵)通貨のストック

レバレッジ活動 ⬅︎➡︎ 銀行、家計、民間企業 ━━━ 準備預金

全取引の合計はゼロ 国債

貸出が預金を創造 非政府のブリキ小屋

⬇︎ 累積財政赤字を貯蔵

銀行信用

社債

未公開株

税

純金融資産を除去 ➡︎ ゴミ箱へ

上で示した図では、ストック累積が、我々が「非政府部門のブリキ小屋」(Non-government Tin Shed)と

名付けた不換紙幣・準備預金・政府債券の蓄積によってなされるということを示している。「キャンベラの

どこかに備蓄地域があって、国民政府がそこにすべての余剰物資を後の利用のために備蓄しているのだ」と

いう大衆の思い込みを解除するために、「ブリキ小屋」(Tin shed)というアナロジーを用いている――

それは過去の政府体制における重大主張だったのだ。実際には、そこに備蓄などない。なぜなら、余剰の

ある限り、購買力は永久に損なわれているからだ。しかし、非政府部門は確かに金融システムの

いたるところで「ブリキ小屋」を所有している。

政府部門から非政府部門へ流れるあらゆる支出は、非政府部門に現金・準備預金・債券の形で残っている

税負債(the taxation liabilities)を取り上げるものではない。したがって、「ブリキ小屋」に積み上げられ

ている金融資産の蓄積は、累積財政赤字を反映したものであるということが分かる。

垂直の線の一番下は税で、ごみ箱に繋げることで、何かをファイナンスしているのではないことを強調して

いる。税は民間部門の金融収支を減じるが、何ら政府のプラスになるわけではない――その減少分は請求さ

れるものの、どこかへ流れるわけではないのだ。

2019原書ではp.371

Figure 23.2 Vertical and horizontal macroeconomic relations

ビル・ミッチェル「赤字財政支出 101 – Part 3」(2009年3月2日) — 経済学101

https://econ101.jp/ビル・ミッチェル「赤字財政支出-101-part-3」(2069年3月2日/…

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

こちらは統合政府(財務省、中央銀行)の図

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101-2.png

返信削除ビル・ミッチェル「赤字財政支出 101 – Part 3」(2009年3月2日) — 経済学101

https://econ101.jp/ビル・ミッチェル「赤字財政支出-101-part-3」(2069年3月2日/…

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

政府-非政府部門間垂直取引の図

Full Employment Abandoned: Shifting sands and policy failuresから

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

政府部門

財務省と中央銀行

物やサービスを販売\ /中央銀行業務(OMO、決済)

金を販売 / ⬆︎ ⬇︎ │ 外貨、金

\ 政府支出

民間の信用市場 非政府部門 (貯蔵)通貨のストック

レバレッジ活動 ⬅︎➡︎ 銀行、家計、民間企業 ━━━ 準備預金

全取引の合計はゼロ 国債

貸出が預金を創造 非政府のブリキ小屋

⬇︎ 累積財政赤字を貯蔵

銀行信用

社債

未公開株

税

純金融資産を除去 ➡︎ ゴミ箱へ

上で示した図では、ストック累積が、我々が「非政府部門のブリキ小屋」(Non-government Tin Shed)と

名付けた不換紙幣・準備預金・政府債券の蓄積によってなされるということを示している。「キャンベラの

どこかに備蓄地域があって、国民政府がそこにすべての余剰物資を後の利用のために備蓄しているのだ」と

いう大衆の思い込みを解除するために、「ブリキ小屋」(Tin shed)というアナロジーを用いている――

それは過去の政府体制における重大主張だったのだ。実際には、そこに備蓄などない。なぜなら、余剰の

ある限り、購買力は永久に損なわれているからだ。しかし、非政府部門は確かに金融システムの

いたるところで「ブリキ小屋」を所有している。

政府部門から非政府部門へ流れるあらゆる支出は、非政府部門に現金・準備預金・債券の形で残っている

税負債(the taxation liabilities)を取り上げるものではない。したがって、「ブリキ小屋」に積み上げられ

ている金融資産の蓄積は、累積財政赤字を反映したものであるということが分かる。

垂直の線の一番下は税で、ごみ箱に繋げることで、何かをファイナンスしているのではないことを強調して

いる。税は民間部門の金融収支を減じるが、何ら政府のプラスになるわけではない――その減少分は請求さ

れるものの、どこかへ流れるわけではないのだ。

William Mitchell (著), L. Randall Wray (著), Martin Watts (著)

https://www.amazon.co.jp/Macroeconomics-William-Mitchell/dp/1137610662

同様の図が2019原書ではp.371

Figure 23.2 Vertical and horizontal macroeconomic relations

こちらは統合政府(財務省、中央銀行)の図

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101-2.png

返信削除ビル・ミッチェル「赤字財政支出 101 – Part 3」(2009年3月2日) — 経済学101

https://econ101.jp/ビル・ミッチェル「赤字財政支出-101-part-3」(2069年3月2日/…

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

政府-非政府部門間垂直取引の図

Full Employment Abandoned: Shifting sands and policy failuresから

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

政府部門

財務省と中央銀行

物やサービスを販売\ /中央銀行業務(OMO、決済)

金を販売 / ⬆︎ ⬇︎ │ 外貨、金

\ 政府支出

民間の信用市場 非政府部門 (貯蔵)通貨のストック

レバレッジ活動 ⬅︎➡︎ 銀行、家計、民間企業 ━━━ 準備預金

全取引の合計はゼロ 国債

貸出が預金を創造 非政府のブリキ小屋

⬇︎ 累積財政赤字を貯蔵

銀行信用

社債

未公開株

税

純金融資産を除去 ➡︎ ゴミ箱へ

上で示した図では、ストック累積が、我々が「非政府部門のブリキ小屋」(Non-government Tin Shed)と

名付けた不換紙幣・準備預金・政府債券の蓄積によってなされるということを示している。「キャンベラの

どこかに備蓄地域があって、国民政府がそこにすべての余剰物資を後の利用のために備蓄しているのだ」と

いう大衆の思い込みを解除するために、「ブリキ小屋」(Tin shed)というアナロジーを用いている――

それは過去の政府体制における重大主張だったのだ。実際には、そこに備蓄などない。なぜなら、余剰の

ある限り、購買力は永久に損なわれているからだ。しかし、非政府部門は確かに金融システムの

いたるところで「ブリキ小屋」を所有している。

政府部門から非政府部門へ流れるあらゆる支出は、非政府部門に現金・準備預金・債券の形で残っている

税負債(the taxation liabilities)を取り上げるものではない。したがって、「ブリキ小屋」に積み上げられ

ている金融資産の蓄積は、累積財政赤字を反映したものであるということが分かる。

垂直の線の一番下は税で、ごみ箱に繋げることで、何かをファイナンスしているのではないことを強調して

いる。税は民間部門の金融収支を減じるが、何ら政府のプラスになるわけではない――その減少分は請求さ

れるものの、どこかへ流れるわけではないのだ。

Macroeconomics 2019

William Mitchell (著), L. Randall Wray (著), Martin Watts (著)

https://www.amazon.co.jp/Macroeconomics-William-Mitchell/dp/1137610662

同様の図が2019原書ではp.371

Figure 23.2 Vertical and horizontal macroeconomic relations

https://1.bp.blogspot.com/-awwmzbCsaJg/XPDpG5My6_I/AAAAAAABjzk/QVRlFDKti1wh1v3PL6S4_YYBDOgAut-kQCLcBGAs/s1600/IMG_9141.JPG

こちらは統合政府(財務省、中央銀行)の図

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101-2.png

返信削除https://econ101.jp/ビル・ミッチェル「赤字財政支出-101-part-3」(2009年3月2日/…

政府-非政府部門間垂直取引の図、Full Employment Abandoned: Shifting sands and policy failures 2008 から

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

政府部門

財務省と中央銀行

物やサービスを販売\ /中央銀行業務(OMO、決済)

金を販売 / ⬆︎ ⬇︎ │ 外貨、金

\ 政府支出

民間の信用市場 非政府部門 (貯蔵)通貨のストック

レバレッジ活動 ⬅︎➡︎ 銀行、家計、民間企業 ━━━ 準備預金

全取引の合計はゼロ 国債

貸出が預金を創造 非政府のブリキ小屋

⬇︎ 累積財政赤字を貯蔵

/銀行信用

│社債 税

\未公開株 純金融資産を除去 ➡︎ ゴミ箱へ

(OMO - Online Merges with Offline、オンラインとオフラインの融合)

上で示した図では、ストック累積が、我々が「非政府部門のブリキ小屋」(Non-government Tin Shed)と

名付けた不換紙幣・準備預金・政府債券の蓄積によってなされるということを示している。「キャンベラの

どこかに備蓄地域があって、国民政府がそこにすべての余剰物資を後の利用のために備蓄しているのだ」と

いう大衆の思い込みを解除するために、「ブリキ小屋」(Tin shed)というアナロジーを用いている――

それは過去の政府体制における重大主張だったのだ。実際には、そこに備蓄などない。なぜなら、余剰の

ある限り、購買力は永久に損なわれているからだ。…

…

垂直の線の一番下は税で、ごみ箱に繋げることで、何かをファイナンスしているのではないことを強調して

いる。税は民間部門の金融収支を減じるが、何ら政府のプラスになるわけではない――その減少分は請求さ

れるものの、どこかへ流れるわけではないのだ。

Macroeconomics 2019 William Mitchell 他 同様の図が2019原書ではp.371、Figure 23.2 Vertical and horizontal macroeconomic relations

https://1.bp.blogspot.com/-awwmzbCsaJg/XPDpG5My6_I/AAAAAAABjzk/QVRlFDKti1wh1v3PL6S4_YYBDOgAut-kQCLcBGAs/s1600/IMG_9141.JPG

統合政府(財務省、中央銀行)の図 https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101-2.png

三橋貴明による同種の図

https://1.bp.blogspot.com/-SlP-0Sz0kKU/XOsjmPmtGsI/AAAAAAABjmI/AE6y9SKpF6szl06XorSUmFd9TMdKHROswCEwYBhgL/s1600/IMG_8464.PNG

返信削除https://econ101.jp/ビル・ミッチェル「赤字財政支出-101-part-3」(2009年3月2日/…

政府-非政府部門間垂直取引の図、Full Employment Abandoned: Shifting sands and policy failures 2008 から

https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101.png

政府部門

財務省と中央銀行

物やサービスを販売\ /中央銀行業務(OMO、決済)

金を販売 / ⬆︎ ⬇︎ │ 外貨、金

\ 政府支出

民間の信用市場 非政府部門 (貯蔵)通貨のストック

レバレッジ活動 ⬅︎➡︎ 銀行、家計、民間企業 ━━━ 準備預金

全取引の合計はゼロ 国債

貸出が預金を創造 非政府のブリキ小屋

⬇︎ 累積財政赤字を貯蔵

/銀行信用

│社債 税

\未公開株 純金融資産を除去 ➡︎ ゴミ箱へ

(OMO - Online Merges with Offline、オンラインとオフラインの融合)

上で示した図では、ストック累積が、我々が「非政府部門のブリキ小屋」(Non-government Tin Shed)と

名付けた不換紙幣・準備預金・政府債券の蓄積によってなされるということを示している。「キャンベラの

どこかに備蓄地域があって、国民政府がそこにすべての余剰物資を後の利用のために備蓄しているのだ」と

いう大衆の思い込みを解除するために、「ブリキ小屋」(Tin shed)というアナロジーを用いている――

それは過去の政府体制における重大主張だったのだ。実際には、そこに備蓄などない。なぜなら、余剰の

ある限り、購買力は永久に損なわれているからだ。…

垂直の線の一番下は税で、ごみ箱に繋げることで、何かをファイナンスしているのではないことを強調して

いる。税は民間部門の金融収支を減じるが、何ら政府のプラスになるわけではない――その減少分は請求さ

れるものの、どこかへ流れるわけではないのだ。

Macroeconomics 2019 William Mitchell 他 同様の図が2019原書ではp.371、Figure 23.2 Vertical and horizontal macroeconomic relations

https://1.bp.blogspot.com/-awwmzbCsaJg/XPDpG5My6_I/AAAAAAABjzk/QVRlFDKti1wh1v3PL6S4_YYBDOgAut-kQCLcBGAs/s1600/IMG_9141.JPG

統合政府(財務省、中央銀行)の図 https://econ101.jp/wp-content/uploads/2018/02/Deficit-spending-101-2.png

三橋貴明による同種の図

https://1.bp.blogspot.com/-SlP-0Sz0kKU/XOsjmPmtGsI/AAAAAAABjmI/AE6y9SKpF6szl06XorSUmFd9TMdKHROswCEwYBhgL/s1600/IMG_8464.PNG

a vertical line works better.

返信削除